The recent launch of DeepSeek, a Chinese artificial intelligence model, has stunned the U.S. stock market. It particularly impacted tech-heavy indices like the Nasdaq, which closed down 3.1% on Monday.

Why were markets left reeling? This new AI assistant boasts lower operational costs compared to American counterparts such as ChatGPT and has topped Apple Store downloads. Analysts are concerned that the open-source, free-to-use Deep Seek will further delay the profitability of massive American investments in AI.

“The larger question has suddenly become whether the hundreds of billions of dollar investment in AI needs re-evaluation," Richard Hunter, the head of markets at the platform Interactive Investor, told the Guardian. Donald Trump said the launch should be a “wake-up call” for American companies.

Silicon Valley Venture Capitalist, Marc Andreessen was more alturistic, saying, “DeepSeek R1 is one of the most amazing and impressive breakthroughs I've ever seen — and as open source, a profound gift to the world."

Deepseek R1 is AI's Sputnik moment.

— Marc Andreessen 🇺🇸 (@pmarca) January 26, 2025

Despite the fears, some see the market's reaction as an overreaction, emphasizing that U.S. companies still lead in AI innovation and infrastructure development.

Crypto: An Early Barometer of the Equity Markets?

Even before the U.S. markets began their steep slide, the cryptocurrency markets were already in freefall. Bitcoin, often considered a bellwether for digital assets, saw one of its largest single-day drops in recent months. Ethereum and other major tokens followed, amplifying the sense of Fear Uncertainty and Doubt (FUD).

Arthur Hayes, who is known for his pro-crypto, optimistic posts, has even predicted a correction in the range of of 70,000 for Bitcoin.

What stood out most in this sequence of events was the timing. Crypto markets, operating without pause due to their 24/7 nature, appeared to act as an early barometer for the turmoil that later unfolded in traditional markets.

This was not the first instance of such synchronicity, but the starkness of the correlation reinforced a pattern that has been quietly taking shape. Traders in the cryptocurrency space, perpetually scanning for signals, seemed to digest the implications of DeepSeek’s launch faster than their counterparts in equity markets. As the news broke and uncertainty mounted, the crypto sell-off foreshadowed the tech-heavy Nasdaq’s decline when the U.S. markets opened hours later.

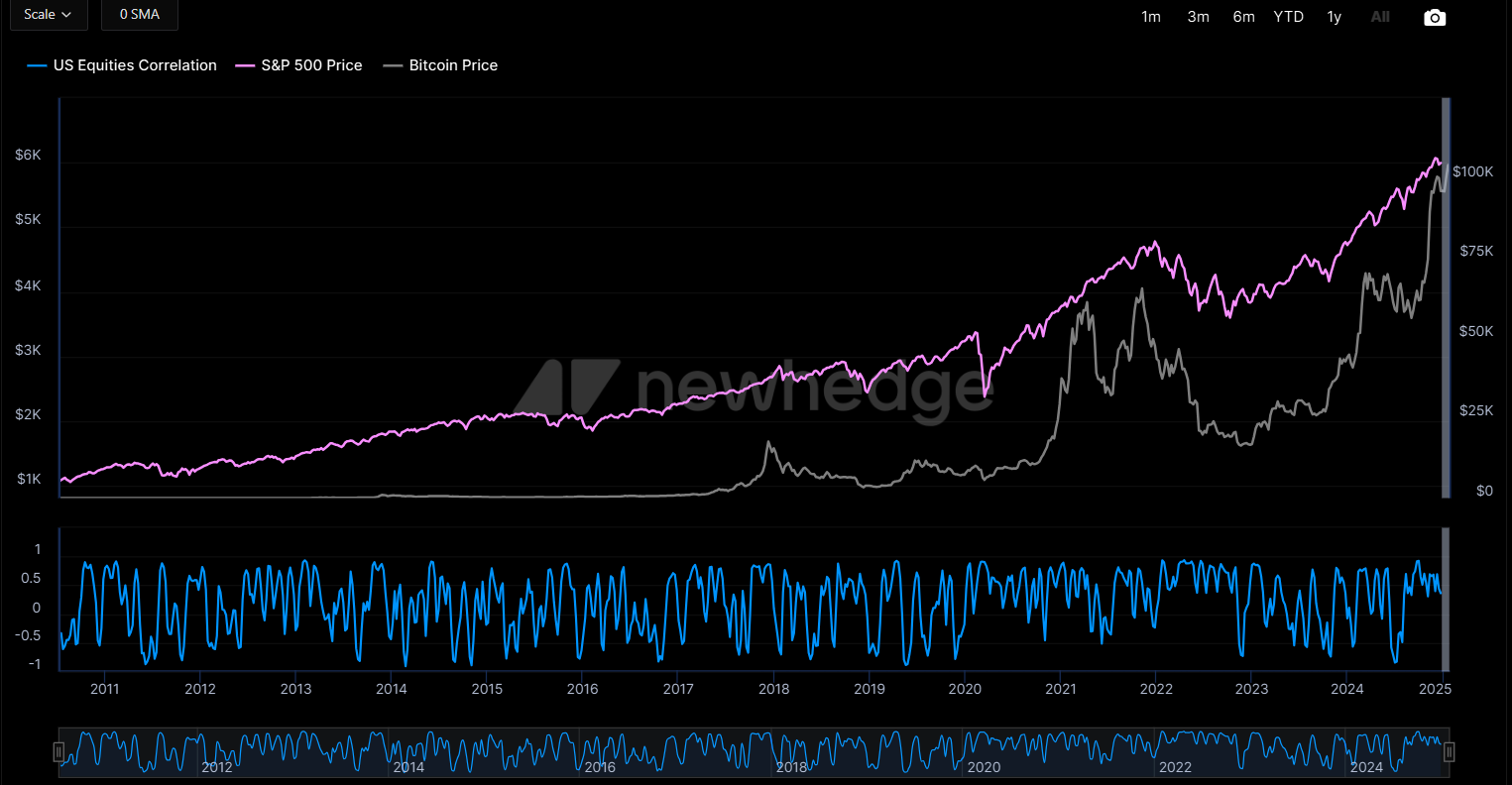

This unfolding dynamic further illustrates a growing alignment between cryptocurrency markets and the stock market. Bitcoin, in particular, has increasingly mirrored the movements of major indices like the Nasdaq.

This is a relatively new phenomenon, marking a departure from Bitcoin's earlier reputation as an uncorrelated asset class.

For years, cryptocurrency was touted as a hedge against traditional financial systems, immune to the forces driving equities. Yet, as institutional investors poured into the crypto space and trading strategies evolved, the walls separating these markets have thinned.

The launch of DeepSeek may have sent shockwaves across industries, but the cryptocurrency market’s reaction underscores its evolving role in global financial systems. No longer a separate entity, it has become a faster-moving, always-on extension of the traditional markets—one that continues to redefine the strategies of those who seek to navigate its volatile waters.