Better Than CEX. This is what users see first when they enter the website of this decentralized exchange. But, the provocative motto is only a small part of this DEX's user appeal.

DeFi App has been getting a lot of attention in the DeFi world lately, and it is easy to see why—its focus on users is connecting well with traders, leading to some quick growth. The team is working to shift the centralized crypto exchange market by launching an innovative decentralized trading app. They have put in a lot of effort to keep it simple and easy to use, and it’s clearly paying off.

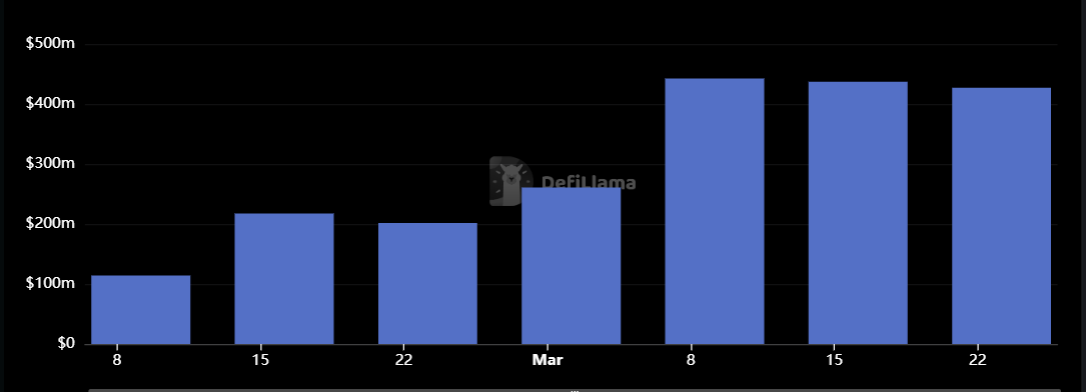

Just a few weeks after starting, the app is managing over $60 million in daily swap volume and bringing in plenty of new users, between 750 and 2,000 signups each day.

The goal was to create a platform that feels fast and straightforward like a centralized exchange, but stays fully decentralized. This suits traders who want to keep control of their funds and appreciate DeFi’s advantages.

With the DeFi App, users sign in using their social accounts—no need to bother with private keys. Everything is kept in one place, so users don’t have to switch tools or move assets between chains. The app takes care of gas fees, meaning users don’t have to buy gas tokens (ETH or SOL) just to make a trade. Token swaps across chains go off without a hitch—no need for bridges, no slippage, and no extra steps.

The app is built to handle swaps on EVM and Solana right now, so users can work with assets on both blockchains without flipping between wallets.

The project uses two distinct technological approaches to manage EVM and Solana wallets.

For EVM, the app is using Smart Accounts (sometimes called “account abstraction” or EIP-4337) to make things both safe and easy. This includes perks like covering gas fees, letting users pay fees with any ERC20 tokens, and offering a few ways to verify transactions. DeFi App covers the gas costs for now, which are funded by transaction fees.

With account abstraction, users’ funds stay in the EIP-4337 contract, not a separate wallet, so exporting a key won’t show balances in wallets like Metamask or Fantom.

Solana is different since it doesn’t have account abstraction. Here, the team built their own system to handle users' wallets. Again, gas fees are covered, so Solana users get the same deal.

For trading, DeFi App uses a feature called Intent-Based Swaps & Execution. Users say what they want—like “Swap 1 ETH for USDC at the best rate”—and the system makes a trade. Users don’t need to pick bridges or pools. Instead of using on-chain liquidity directly, it passes trades to solvers (or relayers) who find the best path based on liquidity, gas costs, and success chances. This keeps trading fast and effective, offering the best rates and low costs.

Right now, the app offers basic swaps between blockchains. However, the team has plans to add more features later, like perpetual trading, yield farming, and even AI-powered trading tools.

DeFi App users can also earn XP points, which might lead to an airdrop in the future.