OpenSea is terminating 20% of its employees. The job cuts could be the consequences from the issues OpenSea faced, like the Customer.io scandal or the Nate Chastain incident, or — the crypto winter effects. Let’s check out if the rest of the crypto market has been hit by layoffs.

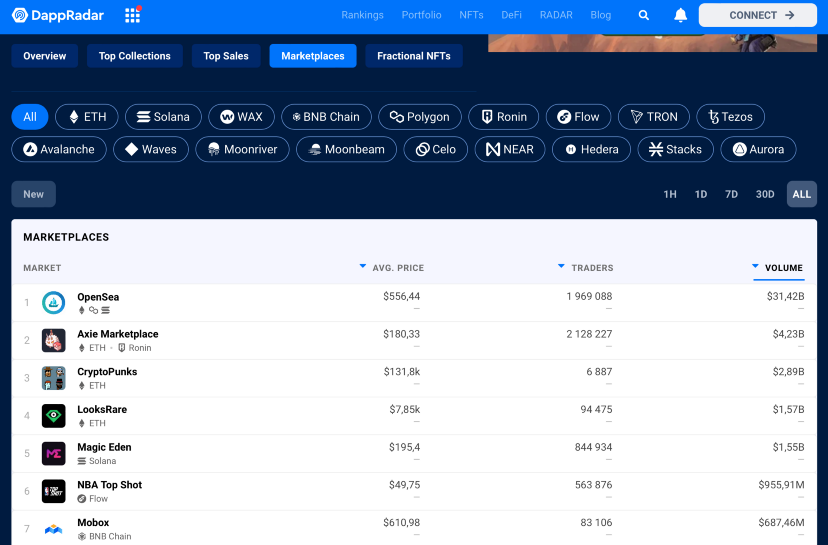

Devin Finzer of OpenSea recently shared a touching goodbye letter he had previously sent to the team as the company had to part with 20% of staff. Still about 230 people will remain with OpenSea. This is a big blow for OpenSea, which was valued at more than $13.3 billion in January during the peak of the venture capital boom in crypto. Yet OpenSea remains the biggest NFT marketplace by trading volume, having done more than $31 billion in all-time sales.

The demand for NFTs has dropped sharply during the most recent downturn. OpenSea has seen its sales cut in half over the past month, with the average price of an NFT on its marketplace dropping by nearly 40%. Even the blue-chip NFT collections, like Bored Ape Yacht Club and CryptoPunks have felt the damage.

OpenSea plans to provide severance and health care coverage into 2023, and accelerate equity vesting for employees who were let go. In his note, Finzer also mentioned that those changes gave the company up to five years’ worth of runway if the crypto winter continues. OpenSea case is a part of a series of layoffs in the crypto industry as digital-asset prices continue to plummet: other crypto companies recently announced major job cuts, like Coinbase Global Inc., Gemini Trust Co., Crypto.com and BlockFi Inc. Companies’ are blaming the downsizing wave on market conditions.

“We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period,” Coinbase’s CEO and cofounder Brian Armstrong said in a June 14 blog post, in which he announced the layoffs.

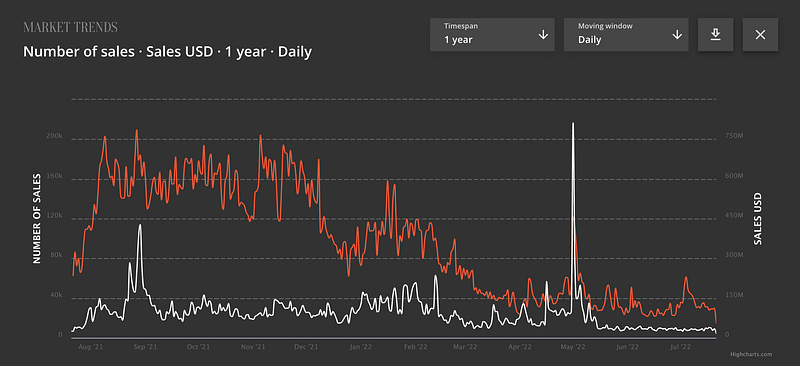

Well, last year was definitely the year of NFTs. That boom resulted from a bullish trend in crypto and investors willing to put up the money. However, this year the crypto winter and general macroeconomic instability has been negatively affecting the crypto ecosystem. And the NFT boom has come to an end with the sales plummeting to one-year lows.

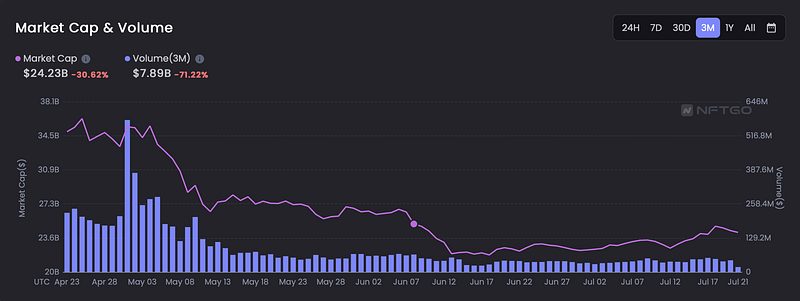

In June 2022 the total number of daily sales was the same as in June 2021, almost 20,000 tokens, however the value of the same amount of tokens has risen four times since summer 2021. Over the last three months, the NFT market capitalisation dropped almost 40% while losing over 66% of its trading volume.

Now fears of an impending recession and soaring inflation are prompting investors to flee cryptocurrencies, and the crypto market is downsizing. Let’s observe the market and see who will survive in the crypto winter, staff included.