This week, the Polygon PoS network has been in the spotlight as Lido announced it would discontinue operations on Polygon, and Aave threatened to leave the network as well.

Over a month ago, Lido published a “Reevaluation of Lido on Polygon State” proposal on its governance forum. The proposal outlined several challenges Lido faces on Polygon. These include low user adoption, insufficient rewards, limited Polygon growth, and increased competition.

According to Lido, the growing DeFi migration toward zkEVM has diminished the demand for Polygon PoS and liquid staking as foundational components of other protocols. Lido has said it intends to focus on Ethereum and its ecosystem, discontinuing deployments on other chains.

In line with this strategy, Lido has already sunset operations on Solana, Polkadot, and Kusama. Now, Polygon joins this list.

Lido’s decision coincided with ongoing disputes involving Polygon and Aave. Polygon’s governance had been discussing a proposal to collaborate with DeFi protocols Morpho and Yearn. This collaboration aimed to utilize approximately $1.3 billion in stablecoins from the PoS Chain bridge and deploy them into curated lending pools. The proposal sparked controversy, with debates over the ethics of using user funds to generate yield and concerns about security risks.

Aave’s management was particularly incensed by the proposal, as the team had hoped the Polygon bridge funds would be deployed with Aave rather than with competitors like Morpho and Yearn. In response, Marc Zeller, the founder of Aave, drafted a proposal to phase out Aave’s lending protocols on the Polygon PoS chain, citing potential future security risks.

This move led to strong criticism from Sandeep, the co-founder of Polygon, who called Aave’s actions monopolistic and contrary to the ethos of Web3:

“This is extremely monopolistic and anti-competitive behavior from Aave leadership and not at all aligned with the ethos of Web3. This is a prominent example of DAO leadership engaging in anti-competitive tactics and bullying other ecosystems to play to their tune.”

After extensive debates, the Polygon community decided to reject the controversial proposal.

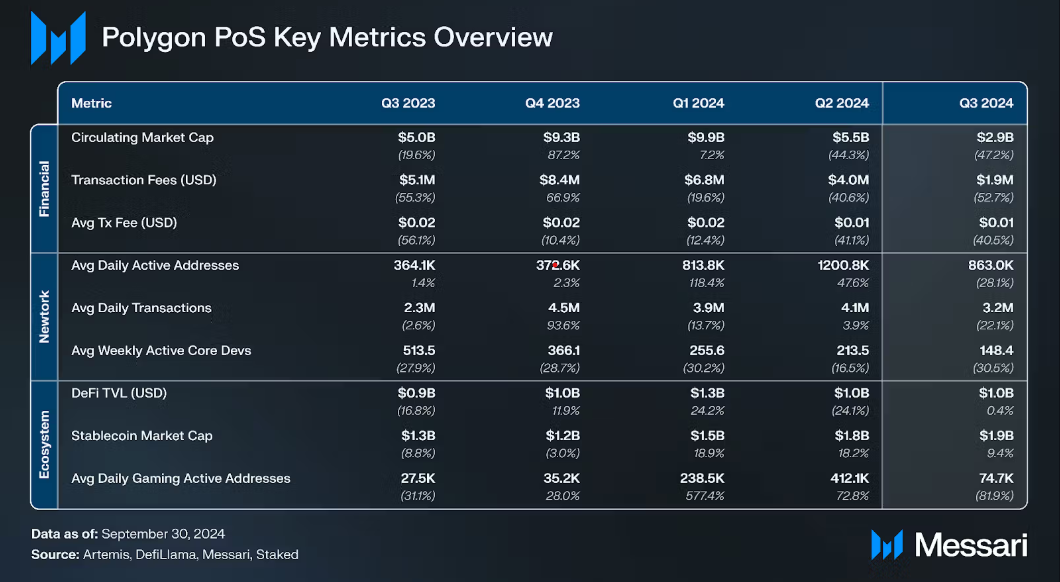

While these controversies do not benefit the Polygon ecosystem, it has shown strong results recently.

Polymarket, built on Polygon PoS, experienced significant growth, surpassing $3 billion in election-related bets and gaining over 140,000 new accounts in October. By the end of Q3 2024, Polygon PoS had a stablecoin market cap of $1.9 billion, with a 30% rise over six months. The USDC supply on Polygon also grew by 42% last quarter, from $618 million to $880 million.

This shows that despite recent setbacks, the Polygon PoS network continues to demonstrate resilience and growth, underscoring its potential to remain a significant player in the blockchain space.