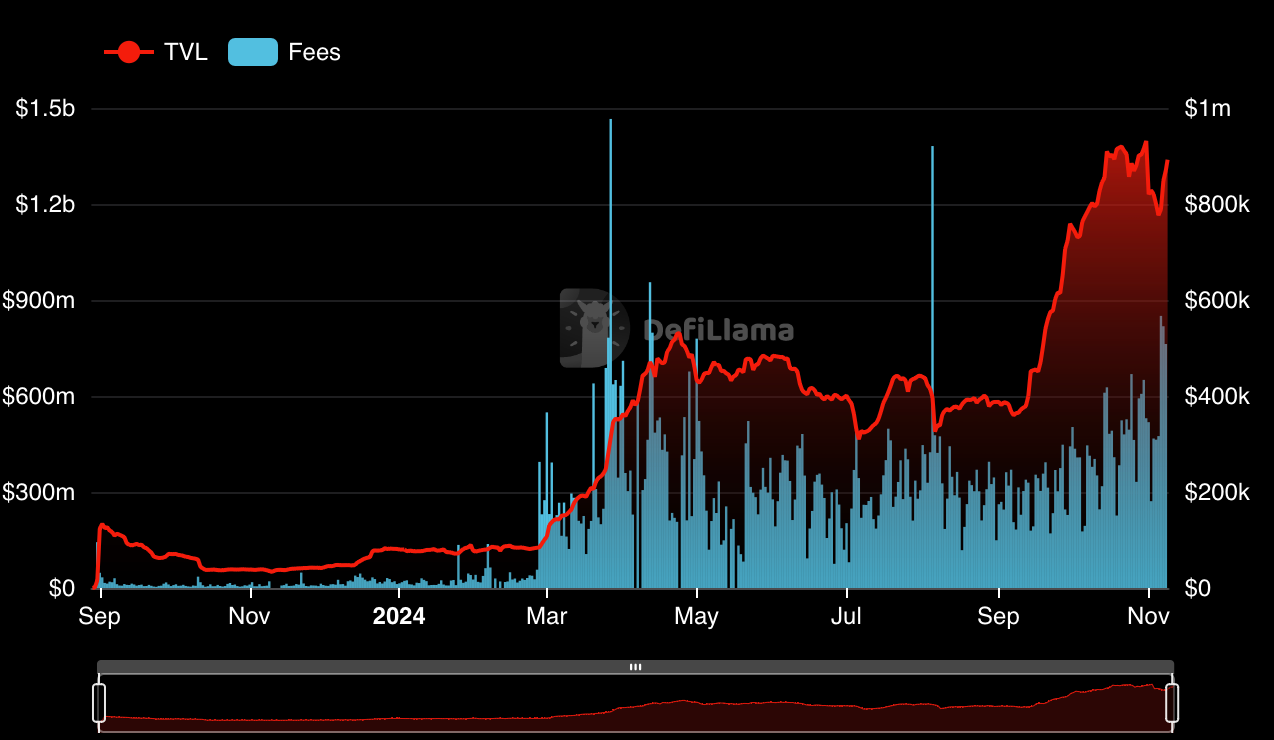

Aerodrome, a DEX positioning itself as “the central trading & liquidity marketplace” on Base network, has quickly ascended to the top of the L2 ecosystem when launched in 2023. It has surpassed Uniswap as the highest fee-generating platform on Base, collecting over $500,000 daily. Since its launch, Aerodrome has attracted substantial liquidity. Its total value locked (TVL) has exceeded $1.3 billion, accounting for roughly half of Base’s TVL.

Aerodrome Finance is a DeFi protocol that helps automate market-making and provides liquidity on the Base network. Aerodrome is a fork of Velodrome, one of the largest DEX on Optimism, and mirrors its successful model, focusing on incentivized liquidity pools.

DEX with Advanced Features

One of the keys to its appeal is its tokenomics model, a CEX-like experience and the combination of several effective mechanics introduced by other DEXs, such as enhanced AMM engine.

The platform design creates a dynamic environment in which pools compete for rewards by adding liquidity and then use the rewards to strengthen their voting positions, bribe other voters, or add even more liquidity.

Aerodrome rewards liquidity providers with its native token, $AERO, which they get in addition to the fees from the trades in their pools. Further, when users lock $AERO tokens, they receive $veAERO NFTs, that grant them voting rights on governance decisions and control over weekly $AERO emission allocations across the pools. In reward, voters receive 100% of the trading fees generated by the platform in the previous epoch (week) in proportion to their voting power. The pools can also “bribe“ voters to receive a bigger emission share. This system creates a direct incentive for active governance participation and increasing liquidity.

Protocols that hold veAERO tokens can use Aerodrome’s automated system to reinvest their voting rewards automatically. Reportedly, about 13% of the total protocol revenue is reinvested for the maximum term (4 years) every week, indicating a high level of commitment to the platform. Continuous locking of $AERO creates structural support for the system and prevents inflation. The team’s allocation of AERO is also max-locked as veAERO for 4 years to ensure that everyone cares about long-term success.

Coinbase, Base, Aerodrome

Apart from its own achievements, the Aerodrome is experiencing positive effects from the rapid expansion of the Base, which, in turn, has direct access to Coinbase’s distribution channels.

Aerodrome supports Liquid Staked Tokens, specifically Coinbase’s cbETH and cbBTC. As cbBTC can be exchanged between Coinbase and Aerodrome, users are incentivized to trade across both platforms to take advantage of arbitrage. This makes Aerodrome the go-to place for cbBTC trading, increasing its volume, liquidity, and fee revenue.

Currently, Aerodrome handles around 80% of trading volumes on cbBTC. Coinbase voting power acquired with $AERO position allows it to send more liquidity to cbBTC pools, reinforcing Aerodrome’s dominance.

As the number of users of transactions on Base grows, the usage of Aerodrome follows. New protocols launched on Base increase the demand for $AERO tokens hunting for voting power to get liquidity.

Bots or Real Trade?

Although all the Aerodrome stats are impressively positive, some critics—especially Uniswap’s advocates—expressed concerns about the platform's quick rise. Their findings suggest that bots artificially inflate Aerodrome’s volumes.

"After looking into its activity, we now determine that this is a programmatic bot, who exclusively trades in the ETH/USDC pool on Aerodrome on their own balance sheet."

Aerodrome LP incentives were used to promote the adoption of native USDC on Base. Before that, Base had acquired Aerodrome's tokens. If wash trading concerns at Aerodrome are valid, the above transactions are just part of the internal fund circulation.

Nevertheless, unlike many VC-backed projects that often end up with piles of useless tokens, the $AERO price remains relatively stable so far. Some experts believe that alongside Base growth, Aerodrome TVL can triple from current levels within a year, with monthly volumes hitting $50b.