The CPI rates for May 2022 topped all expectations, setting new high’s.

On June 10, the U.S. Bureau of Labour Statistics updated the Consumer Price Index (CPI) figures for May 2022. The rate rose 8.6% on a year-on-year basis in May, surpassing the predicted value of 8.2%. It is the highest increase since December 1981, and it seems it may not stop there.

The main contributors to the increase are surging housing, food, and gasoline prices, which rose 5.5%, 10.1%, and 34.6% respectively. Housing costs, comprising of one-third of the CPI, rose at the fastest rate in 12 months over a 31 year period.

Core inflation, which excludes volatile energy and food costs, rose 0.6% for the month and 6% over the year. The monthly increase was unchanged from April but the yearly increase was slightly below the rate in April.

Markets had anticipated another 0.5–0.75 basis points rate hike by the Fed after such awful numbers in the CPI report. Just on June 15 officials agreed to a 0.75% rate rise, meeting expectations and approving the biggest increase since 1994. The Fed is widely expected to continue tightening policy through the year and possibly into 2023.

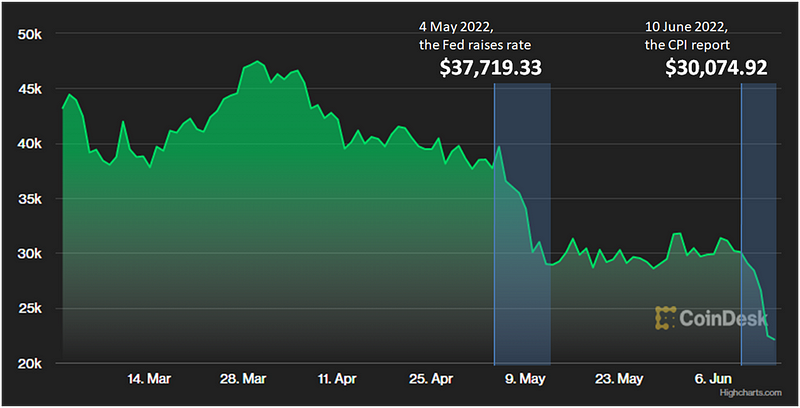

Coindesk U.S. markets reporter Helene Braun writes that this report influenced Bitcoin, along with other traditional assets, impacting cryptocurrency by $500 within minutes after the report. She also suggests that the ongoing downturn of Bitcoin is triggered by the tightening monetary policy of western central banks over the past few months.

There are indeed some patterns to observe: a previous major hit followed the Fed’s raising rates to 1% which took place on May 4. Bitcoin fell by $7,000 that week. Moreover, we already wrote about the connection between CPI and Bitcoin price in March, when the cryptocurrency also performed poorly after CPI updates. Now, as of the fifth day after the report, the price of Bitcoin has dropped yet again by $8,000.

It is a pity that we cannot run an A/B test to see if Bitcoin and other cryptocurrencies actually began to respond to macroeconomic news and changes, but this trend deserves more attention. All in all, you can presume that the first is an incident, and the second is a coincidence. Let’s wait to see if the third change will produce a pattern.