The European Central Bank chose five entities, including US internet behemoth Amazon, to prototype the frontend of digital euro project. The work will not be remunerated.

CaixaBank in Spain, Worldline SA in France, Nexi SpA in Italy, European Payment Initiative, (a consortium of 30 European banks), and Amazon were selected in the ECB contest for front end development for the digital Euro. The European Central Bank explained in a statement that the five were picked from a pool of 54 front-end service providers because they possessed "particular skills" necessary to test a variety of objectives.

The call for the proposal was issued by ECB’s on 28th of April this year included a questionnaire with more than 20 capabilities required for the work. It also mentioned that preference would be given to providers located in the European Economic Area. Amazon has its European headquarters in Luxemburg, but clearly stands out from other winners by its operational scope and size.

The backend development and the interface between the front and back ends is not outsourced and will be developed by ECB/Eurosystem internally.

According to the ECB statements the roles in the frontend prototyping project are distributed as follows:

- peer-to-peer online payments – CaixaBank, supposedly, also via mobile apps

- peer-to-peer offline payments – Worldline;

- point of sale payments initiated by the payer – EPI;

- point of sale payments initiated by the payee – Nexi;

- e-commerce payments – Amazon.

"We are excited to work with the European Central Bank on their digital euro prototyping exercise," Max Bardon, vice president of Amazon Payments, stated via email to Coindesk. "Amazon believes the future will be built on new technologies that enable modern, fast and inexpensive payments, and we look forward to building these innovations to help improve how customers will pay in the future."

Despite the expectations from the participants, the commercial perspectives of this cooperation is rather limited. The European Central Bank is not funding the exercise - all costs are to be covered by the developers themselves. ECB also stated that "selection at this stage does not mean that a provider will also be selected to provide a front-end prototype, nor does it mean that being selected into the pool or as front-end prototype provider gives automatic rights for future collaboration or joint work in the next phases of the digital project, should there be any."

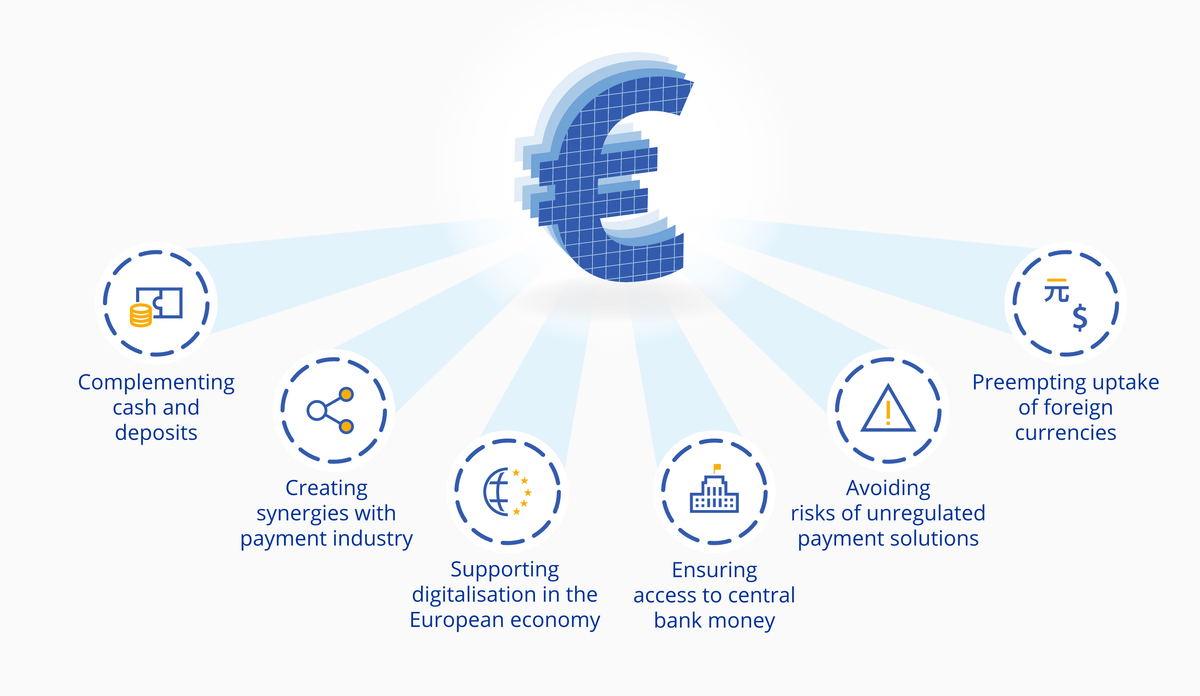

ECB is being vague on the prospects and the final shape of the digital euro too: "it will be like euro banknotes, but digital." The objectives are set, and the digital euro should make it easier for individuals to make payments and provide more alternatives, encouraging inclusion and accessibility.

The ECB anticipates that the Digital Euro Project's frontend prototype stage, which began in July 2021, will be finished by the first quarter of 2023. The ECB will make the final decision on whether to create a digital version of the euro when the project's two-year study phase concludes in October 2023. The implementation phase, if necessary, is projected to last three years. As a result, in the best case, a digital euro might debut in 2026. This definitely goes in our observation list.