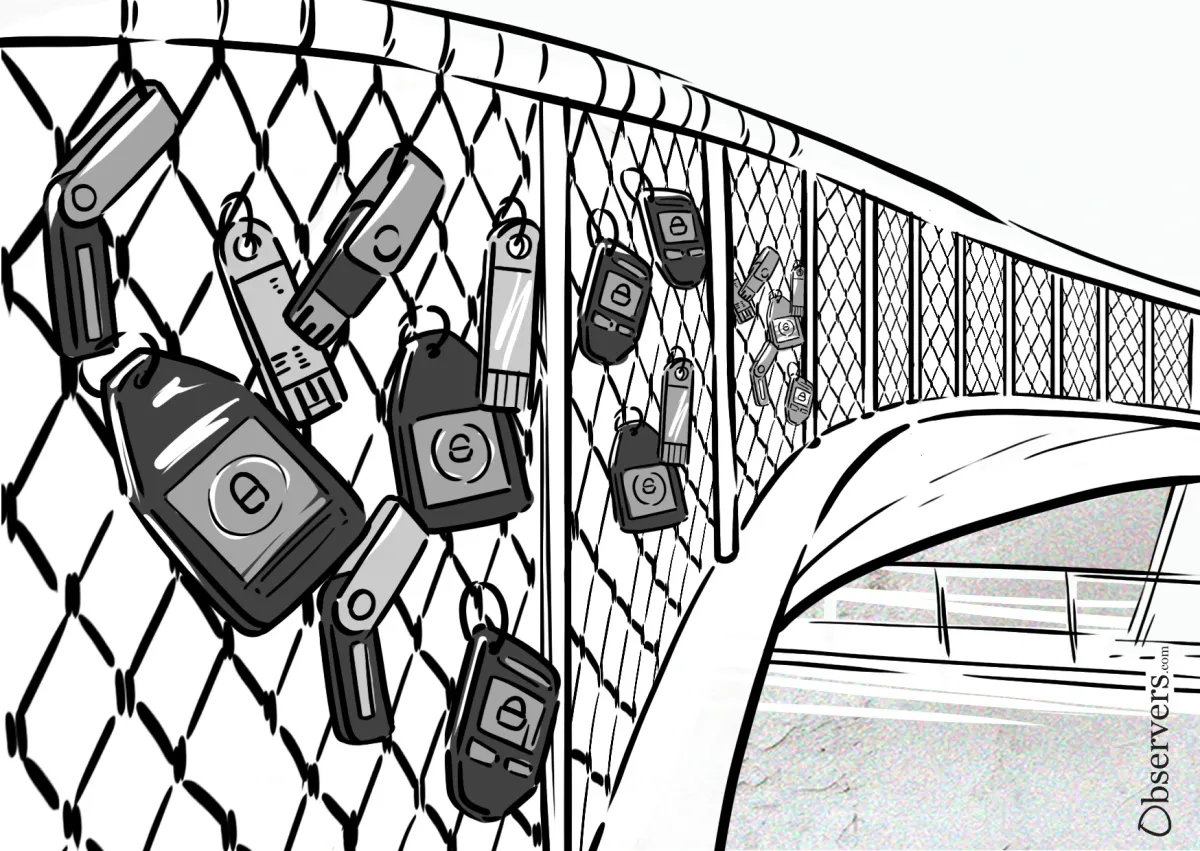

What's better than discovering some forgotten cash in a dusty coat pocket? Applying the same delightful surprise to the world of Web3: finding tokens in a wallet you hadn't thought about for ages. It’s quite common for people to overlook cash in their pockets, and similarly, assets in their Web3 wallets and smart contracts can be forgotten. This happens especially among those managing multiple wallets and large sums of money.

The blockchain analytics platform Arkham has highlighted several instances where major crypto stakeholders may have neglected funds in various bridge contracts.

According to Arkham, dozens of accounts, including those of prominent DeFi players and one linked to Vitalik Buterin, have millions of dollars stuck in bridge contracts.

Users who use native bridges sometimes encounter issues where their tokens become stuck, requiring them to claim these tokens manually. If forgotten, there are no reminders from the smart contracts, leading to potentially overlooked funds.

For instance, a wallet associated with Vitalik Buterin reportedly has $1.05 million stuck on the Optimism bridge for about seven months.

Coinbase experienced a similar issue when it tried to bridge 75k USDT to Ethereum L1. The transaction failed, leaving the funds idle on the bridge contract for around six months.

Arkham has also identified several lesser-known users with unclaimed assets. For example, @thomasg_eth apparently forgot about $800k on the Arbitrum bridge, while @Mike_Macdonald might have overlooked $117k (proceeds from his Cryptopunks sales) on the same bridge.

One of the most striking examples involves Bofur Capital, which left 27 WBTC on the Optimism bridge for about two years, now worth nearly $2 million.

It is unclear whether these funds were intentionally left unclaimed or simply forgotten. However, considering the portfolio sizes of some users, it’s plausible that they might have simply overlooked the need to claim their tokens.

Holding large sums in bridge smart contracts is generally risky due to security concerns; bridges can be susceptible to hacks, and leaving substantial amounts unclaimed does not seem reasonable.

To date, none of the identified wallet owners have commented on the situation. We continue to Observe.