All crypto eyes are on Seoul this week, where Web3 leaders from around the world are gathering for industry-shaping discussions at Korea Blockchain Week (KBW).

In alignment with its host country's tech-savvy society and culture of enterprise innovation, KBW has, over the course of its seven editions, grown to become the most relevant business-oriented and institutional-solutions crypto event of the year.

Minding Everyone's Business

Building on business-to-business sessions of previous years, this edition features an institutional stage called "IMPACT" tailored to the big money sharks of blockchain: asset managers, financial institutions, and institutional investors.

Jeon Seon-ik, CEO of KBW host company FACTBLOCK, says the stage "will allow KBW to play a leading role in the Web3 industry and grow into a premium brand."

The relevance of this year's edition is such that, even though Coinbase and Binance have virtually no users in the country—national exchanges Bithumb and Upbit control over 95% of the CEX market—Binance's CEO Richard Teng and Coinbase's Director of Product Edward Lee are flying to Seul this week to attend KBW.

Also due to attend, Ethereum co-founder Vitalik Buterin, BitMEX co-founder Arthur Hayes, CEO of Ripple Brad Garlinghouse, executive director of Solana Foundation Dan Albert, and dozens of other industry leaders are speaking at the FACTBLOCK-Hashed organized conference.

Korean Tech Star Quality

The South Korean market is a world leader in technological innovation, having ranked at the top of the Bloomberg Innovation Index for seven of the nine years it has been published. The World Bank describes the Asian nation as a "technology and innovation powerhouse," with tech exports in 2022 hitting $233 billion.

A report by Tiger Research notes that the country has "world-class IT infrastructure, highly skilled technical workforce, abundant IP assets in the gaming and entertainment industries, and widespread public familiarity with virtual assets."

The tech-savvy social and business environment is fertile ground for new and promising technologies.

Like with other tech, South Koreans have welcomed blockchain, with registered local crypto exchanges counting around 6.45 million users, which is about 12.5% of the population.

The regulatory framework, however, has not always facilitated adoption.

Regulatory Challenges in South Korea

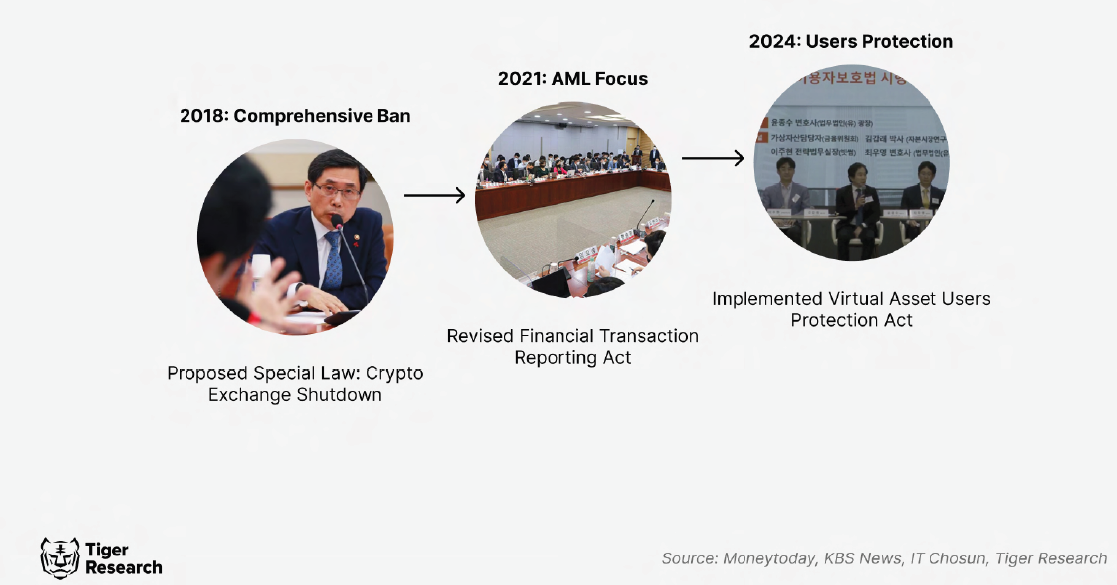

In 2018, KBW's inaugural year, the government introduced a ban on cryptocurrency exchanges, seeing trading digital assets as akin to gambling.

At the time, the Guardian had described South Korea as "one of the key nations driving the demand for bitcoin and other virtual currencies."

The trauma of the severe economic crisis the country endured in the late 1990s still shapes regulators' mindsets to this day, leading them to be extremely careful in crafting legislation that protects investors and discourages bad behavior.

Earlier this year, the Act on the Protection of Users of Virtual Assets began to be enforced, offering users protection from unfair trade practices and market manipulation.

Blockchain games, for example, are still considered illegal and categorized as "highly speculative activities."

However, the national regulatory framework for blockchain-related products and services is evolving, with both conservative and liberal parties fighting to get sector-wide regulation approved.

It helps, then, that KBW hosts one of the most relevant industry conferences every year, showcasing the evolving maturity of the sector and offering a glimpse into its promising future.

Blockchain Landscape of South Korea

Legal challenges sometimes push national countries out of the country borders, where they can conduct business more at ease.

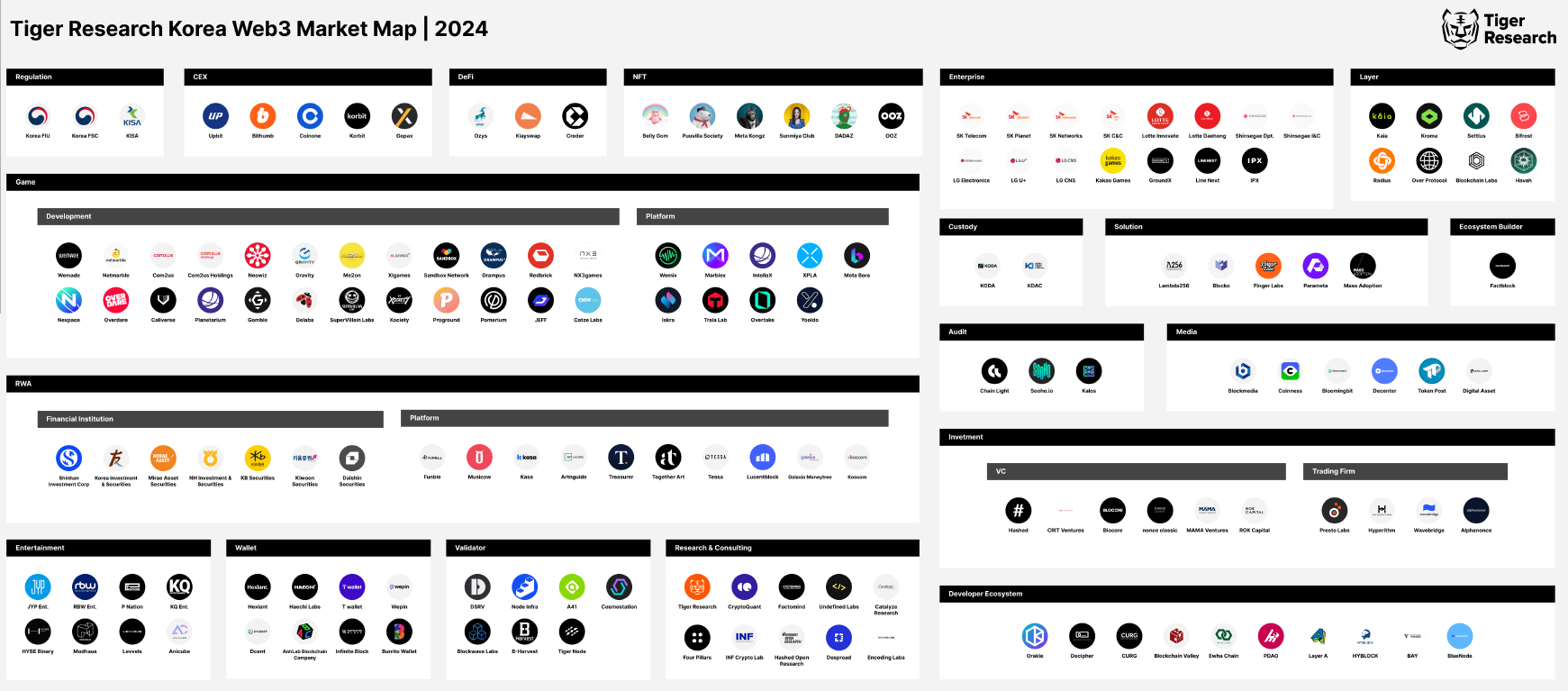

Still, as shown by the map below created by Tiger Research, the local blockchain ecosystem is vast and includes companies working in all major fields of the ecosystem.

Trading

Due to tough regulations on crypto exchanges, international players do not have a hold on the market. 97% of crypto is held in local centralized crypto exchanges Upbit (78%) and Bithumb (19%). DeFi levels are low, with several sub-sector enterprises trying to enter the national market while stationed abroad.

Contrasting with usual trading patterns where Bitcoin dominates, in South Korea, altcoins make up 70 to 80% of the Asian nation's total trading volume.

This phenomenon is due to a preference for volatility, which users in the country try to leverage despite the risks associated with it.

Entertainment

Entertainment is a multi-billion dollar industry in South Korea—the birthplace of K-pop—and the national blockchain industry reflects that, despite the challenges brought on by tight regulatory control.

The country's NFT market is dominated by large conglomerates that have catered collections specifically to Korean speakers and their unique cultural tastes.

South Korea hosts the fourth-largest gaming sector in the world, resulting in several active Web3 gaming projects. While blockchain games are forbidden in the country, companies have launched them internationally.

Interest in wallets is growing, and several local projects have developed their own specific-purpose versions, especially for games. While they strive to reach a broad audience, Metamask leads.

Custody And Validators

The approval of the Virtual Asset User Protection Act earlier this year set in motion the growth of the custody business by anticipating spot ETFs would be legal soon. Financial authorities are cautious about foreign players and restrict legal entities from investing in cryptocurrencies, which confines most custodian clients to crypto issuers.

The validator industry is among the most competitive in the world, with the average active staking rate of Korean validators having surpassed the global average, and companies in the country deploying several creative tactics to attract mainnet.