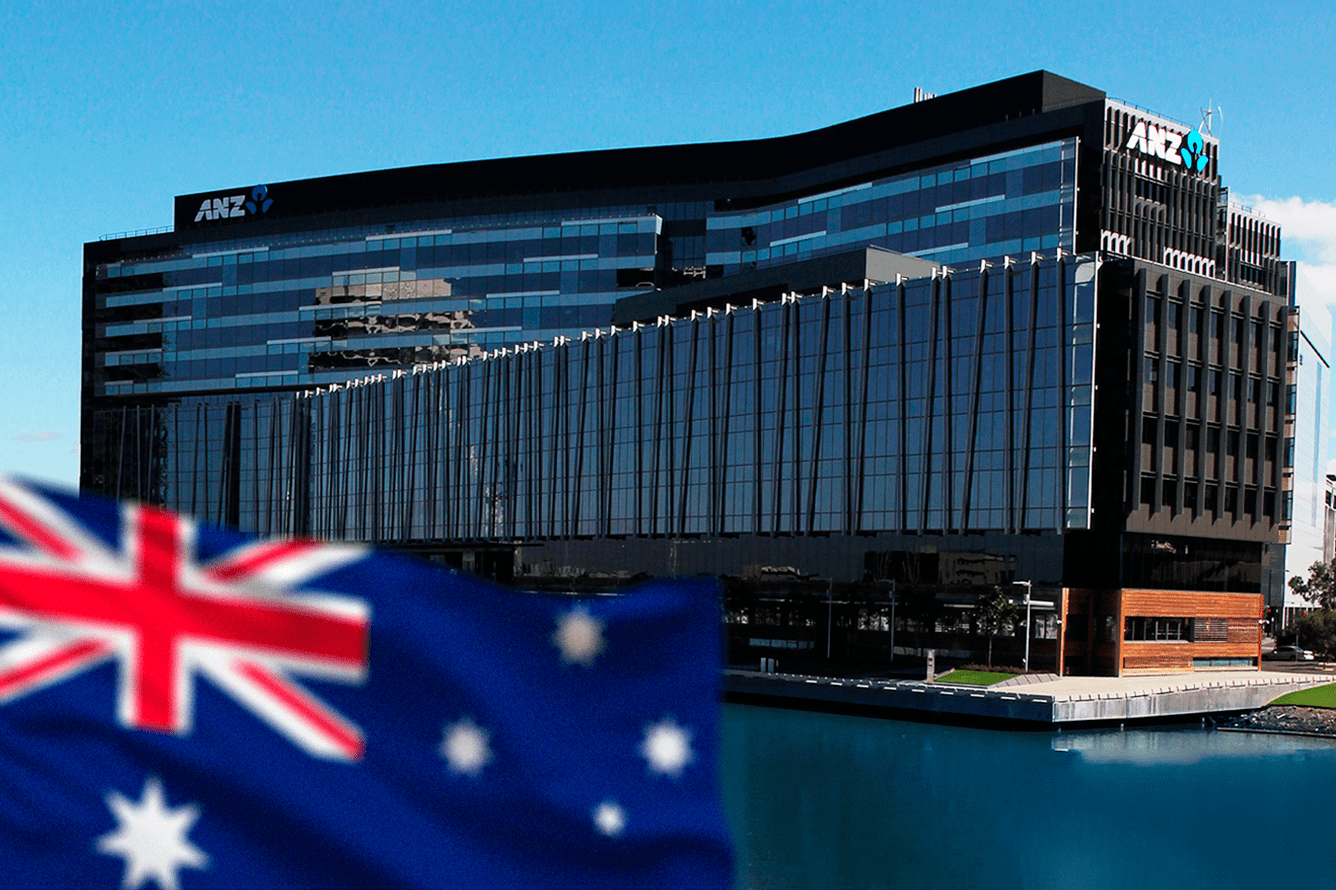

One of Australia’s largest institutional banks, ANZ, has taken the next step in the quest for interoperability between banks and blockchains. Building on a recent initiative by cross-border payments stalwart Swift, the bank has demonstrated a test transaction to simulate a tokenized asset purchase using stablecoins denominated in both Australian and New Zealand dollars.

As we Observed earlier this month, the Society for Worldwide Interbank Financial Telecommunications (Swift) has been investigating a solution leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and its own financial messaging platform. In the future, this could connect the global banking system to multiple blockchains in order to enable cross-border transactions involving tokenized assets.

ANZ, which was one of the banks involved in the experimental Swift solution, has now gone one step further, and performed a simulated transaction involving the purchase of a tokenized asset, using both an Australian dollar stablecoin (A$DC) and a New Zealand dollar stablecoin. Both stablecoins are issued by ANZ.

According to a post about the demo transaction by ANZ Banking Services Lead, Nigel Dobson:

“This transaction involved technical integration of ANZ’s digital asset services technology stack with CCIP to realise cross-chain settlement of tokenised assets securely and efficiently.”

ANZ and Swift are not the only institutional players pushing for a more interconnected future. As we reported in July, the Bank for International Settlements (BIS) is also looking at a more comprehensive digitalization of the financial system, which Dobson also cites in his post.

According to BIS, this could take the form of a ‘unified ledger’, combining central bank money, tokenized deposits and tokenized assets on a programmable platform. This could improve the efficiency of existing banking processes, while also enabling innovative (for the banking world) use cases that are not currently possible within the confines of the current banking system.

The future then, it would appear, is to be tokenized… although many would argue that the present is already there. Just last week we have seen Deutsche bank teaming up with Taurus to provide institutional clients with custody services for crypto assets, and Zodia working to bring custody on the Polkadot blockchain up to ‘banking-grade’ standards in order to attract institutional investors.

And this is just the tip of the iceberg. An increasing number of global banking giants are forging ahead with their own paths towards blockchain integration, putting in place the pieces of the jigsaw required to provide secure access and management of digital assets. This is generally based on the demands of their clients, who wish to enter the crypto market, but lack the technical experience to do so alone.

Would the ‘unified ledger’ of BIS mean that there was less motivation for banks to directly engage with the blockchain space, using a public platform such as Ethereum. And could this ‘unified ledger’ ever be more than a highly limited and sanitized version of the innovative landscape that actually makes crypto so exciting?

As ever, we will be here to Observe as the story continues to develop.