By building an open ecosystem, the project lowers the barrier to join the AI economy, whether you’re launching new models or curating datasets. Yet it's unclear if token rewards alone can sustain quality, coordination, and long-term innovation in such a decentralized development model

Alexander Mardar

Decentralized exchanges just hit a record high, with DEX-to-CEX spot volumes reaching parity for the first time. The middle-tier altcoin sector, once central to CEX activity, is losing ground. Meanwhile, a new generation of CLOB-based DEXs is preparing to reshape the landscape of crypto trading.

Alexander Mardar

EigenLayer has launched EigenCloud, a decentralized platform combining off-chain compute, verification, and data availability. Built on its restaking model, EigenCloud enables developers to build trust-minimized apps using services like EigenCompute, EigenVerify, and EigenDA.

Alexander Mardar

Etherealize has released “The Bull Case for ETH,” a report that positions Ethereum as the digital oil of the modern economy. Aimed at traders, it argues that ETH is one of the most mispriced assets in the world—and could eventually reach a valuation of $706,000.

Alexander Mardar

Several major crypto projects are winding down their DAOs, citing the need for more effective governance. Once seen as the future of decentralization, DAOs now suffer from low participation and stalled decisions—raising the question: if no one’s steering the DAO, should it still stand?

Alexander Mardar

The platform brings real-world assets (RWAs) on-chain by offering tokenized U.S. Treasury Bills and a stablecoin with a novel yield distribution design. This gives crypto investors access to low-risk returns from T-Bills without leaving the DeFi ecosystem.

Alexander Mardar

The spike in activity is primarily attributed to the rapid growth of Avalanche’s Coqnet subnet, which has seen an unusual surge in volume. However, other subnets, including the main Avalanche C-Chain, have also experienced significant increases in activity.

Alexander Mardar

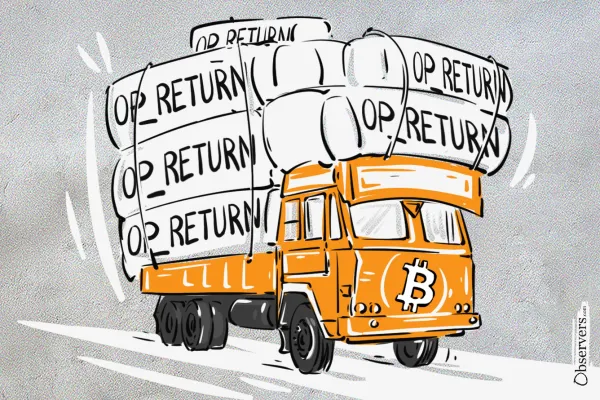

A controversial change in Bitcoin Core will remove relay limits on the OP_RETURN field, allowing larger data payloads to spread across the network. Critics fear spam and bloat; supporters say it's already happening—and making it visible will improve fee markets and mempool consistency.

Alexander Mardar