For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

We begin in Europe, where the France central bank's governor François Villeroy de Galhau has called on European countries to set aside their differences and work together in developing innovative technologies such as tokenization of deposits, artificial intelligence, and "cutting-edge" payment infrastructure. During a speech, he argued that CBDCs have the potential to be a "partner" and not an "adversary" in a concerted push to make the EU more competitive with the U.S.

The EU Blockchain Observatory has also included the convergence of blockchain with Artificial Intelligence (AI) as an upcoming trend in its industry report. The report contains links to the previous thematic reports of the European blockchain observer body, such as on applications of blockchain in the automotive sector, decentralized social media, and others.

Qatar Central Bank is also leveraging AI in the country's digital currency project. The central bank announced the completion of the infrastructure development part of the project in its X post today.

Much slower is the progress in the U.K. A general election is now in full swing over in the country — with Britons set to go to the polls on July 4. This could delay the prospect of a digital pound even further. Labour, which is expected to win by a landslide, has listed a CBDC as being among its economic policies. However, it's unclear how much of a priority this would be for Sir Keir Starmer if he picks up the keys to 10 Downing Street.

Over in Israel, a "digital shekel challenge" has been launched that encourages organizations to develop "innovative and diverse use cases" for its CBDC. Commercial banks, fintech firms and nonprofits are among those invited to get experimenting. Anyone from around the world can apply.

The Reserve Bank of India (RBI) also released its annual report, which showed a substantial drop in the use of its wholesale CBDC over the past year.

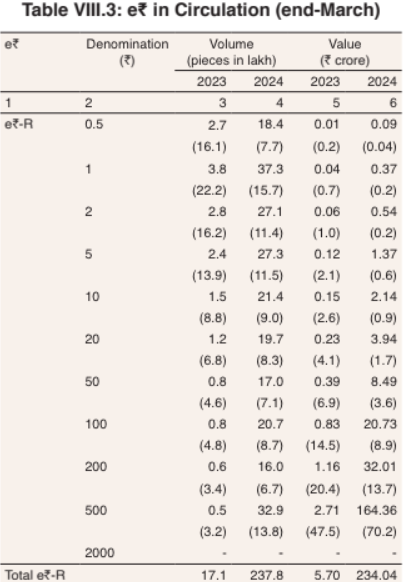

For the retail digital rupee, RBI reported a 39-fold surge over the same period. Still, the total balance of digital rupee outstanding at the end of March was 2.3 billion ($28 million) or around 0.018% of the country's physical notes and coins in circulation (M0). For comparison, the last reported similar figure of China's e-CNY was ten times larger (0.16% of M0). A total of 4.6 million consumers were onboarded, compared to hundreds of millions of e-CNY users in China.

Unexpectedly for a digital currency, the retail facing e-rupee has fixed denominations and the following table shows the distribution of the total value among those digital coins.

Japan's Central Bank held the 9th CBDC expert forum where it shared a detailed presentation (in Japanese) on the status and plans of the digital yen development. Japan FinTech Observer summarized the key points.

Tokenization Updates

Franklin Templeton spoke of its bullishness on tokenization during a crypto conference this week. Speaking at CoinDesk's Consensus 2024, the company's president Jenny Johnson said blockchain technology has the potential to drive down costs — as right now, the firm has hundreds of people tasked with reconciling data between systems.

There's also been some aggressive fundraising going on in the space as tokenization startups start to scale. Fortunafi netted $9.5 million during a recent round that now takes its valuation to $48 million. The company's founder, Nick Garcia, declared:

"We believe the biggest opportunities that exist today in the broader cryptoasset industry fall within the RWA and stablecoin sectors. We have a distinct vision of what both sectors will look like in the years ahead and we’re ready to execute on our mission."