For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

We kick off with some pretty significant news from The Bahamas.

With adoption of the Sand Dollar remaining disappointingly low—four years after launch—officials have told Reuters that new regulations are in the works that will require commercial banks to offer this CBDC to their customers.

Central bank governor John Rolle said the rules will be enforced within two years, adding:

"We foresee a process where all of the commercial banks will eventually be in that space and they will be required to provide their clients with access to the central bank digital currency."

The Bahamas isn't the only country that's struggling to encourage uptake of its retail CBDC, with use of the e-rupee in India also plummeting.

Research earlier this year by the Kansas City Fed shows that the Sand Dollar represents a tiny percentage of the Bahamian currency in circulation, and the latest figures put this at less than 1%.

News of the tightened rules will likely put the central bank on a collision course with financial institutions. Not only will they likely have to embark on expensive upgrades to their IT infrastructure, but they may fear this will undermine their business model.

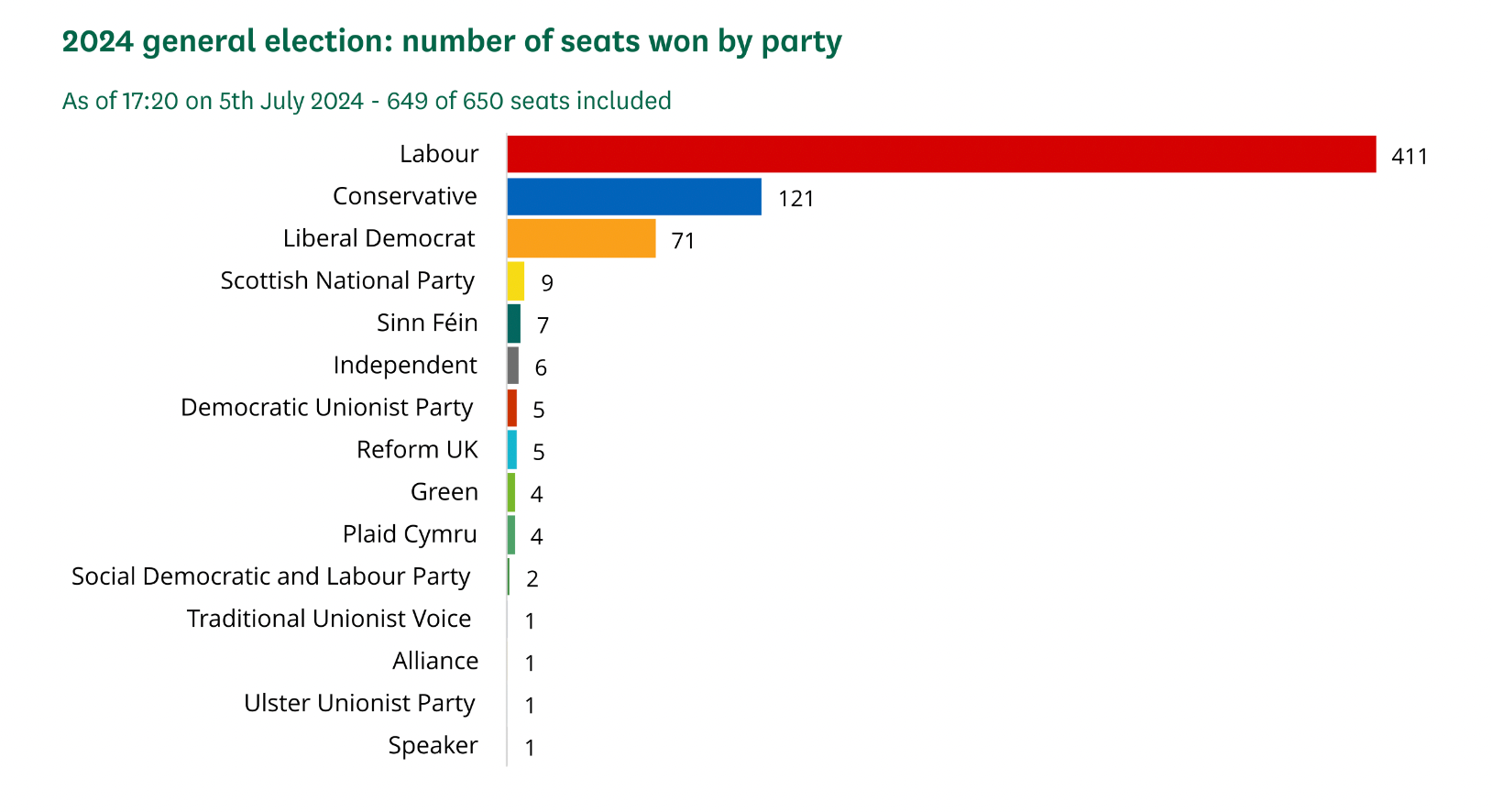

Over in Britain, and there's been a political landslide this week.

The Conservatives, a pro-crypto administration, were ousted from power after 14 years—suffering their worst result in history.

Labour take over in their place, and policy documents earlier this year made clear that they envisage the launch of a digital pound a priority.

On the continent, a new report by the European Commission has warned that the EU is likely to miss ambitious targets related to connectivity and digital skills by the end of the decade. A particularly staggering figure is this: just 55.6% of those aged 16 to 74 possess even basic digital skills.

While not specifically related to the digital euro, the research raises searing questions about whether many European citizens would have the technical wherewithal to use such a CBDC—that is, if it launches.

In slightly cheerier news, the Swiss National Bank has revealed that it's willing to broaden its test program on wholesale CBDCs. Speaking at the Point Zero Forum in Munich, Antoine Martin said:

"We would like to see a pilot which develops, with more banks joining and a higher volume of transactions."

In China, reports of fraud cases involving e-CNY digital wallets dissonate with critics of the country's CBDC surveillance features. In a precautionary instruction the local police reminded that "due to its short launch time and simple transfer operation, it is difficult to track down [transactions in e-CNY digital wallets].

Tokenization Updates

With the tides of innovation slowly turning to tokenization, industry players are battling to make sure they aren't left behind.

Schroders Capital, the private markets arm of Schroders asset manager giant has collaborated with German reinsurance firm Hannover Re on a pilot tokenization of insurance-linked securities (ILS) on a public blockchain. Schroders manages around $5 billion of ILS assets, a type of financial instrument with returns determined by linked to insurance-related, non-financial risks and thus having little correlation with financial markets.

Schroders Capital reported that the tokenized ILS pilot project demonstrated the possibility of an improved client experience, enhancing the accessibility of ILS assets by allowing tokens to be held in investors’ digital wallets alongside their other digital investments.

Schroders Group is actively exploring use cases in digital assets, and since the last year, is a member joined the Project Guardian which is being spearheaded by the Monetary Authority of Singapore.

S&P Global Ratings has also announced this week that it's joined Project Guardian.

The company is set to bring "analytic frameworks, assessments and benchmarks in digital assets and tokenized markets" to the table. Andrew O'Neill, who is the digital assets analytical lead at S&P Global, said:

"Recent innovations in digital bonds and tokenized treasuries have highlighted the potential of digitalization to transform capital markets. We aim to bring our risk perspective and insights to this forum to support robust risk mitigation as this technology is applied in financial markets."

And returning to the UK elections for a moment, it's interesting to see the change of tone from Labour here, which wants to turn the country into a "global hub for securities tokenization." (Their predecessors wanted to create a "global hub for cryptoasset technology.")

The new governing party says that this "presents a significant new opportunity" for the country—in other words, another way for the City of London to gain ground against European rivals including Paris and Frankfurt. In remarks that could prompt tokenization platforms to set up shop in Britain, Labour said:

"Embracing tokenisation could increase liquidity, provide access to new asset classes and fractionalised assets, and strengthen risk management (by reducing counterparty risks and other operational risks)."