For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

Kicking off with the digital euro — and a whitepaper was released this week that explores the steps needed to ensure a CBDC doesn't jeopardize stability and liquidity in the banking sector.

The European Central Bank says a CBDC could become a safe haven "during periods of market uncertainty," but this could have consequences:

"A CBDC could in theory crowd out bank deposits, adversely affecting the intermediation role of banks and their capacity to lend to the real economy. Thus, a CBDC without adequate safeguards could decrease demand for bank deposits, thereby impairing banks’ liquidity, profitability and overall resilience."

Holding limits are being touted as a solution here — but exact limits would only be set closer to the digital euro's launch.

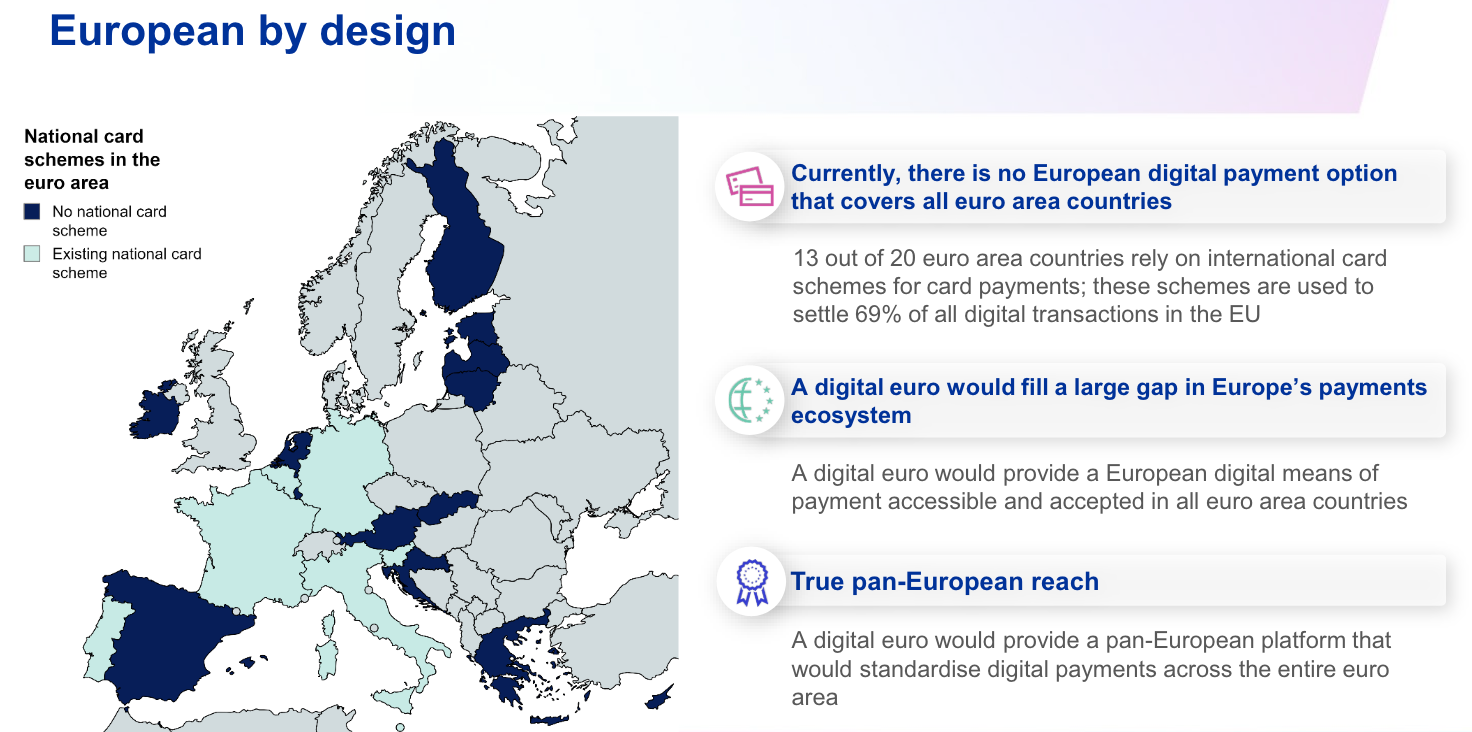

Meanwhile, ECB executive board member Piero Cipollone set out how this CBDC could represent "the future of money" during talks with the Italian Banking Association on April 17:

While the EU has expressed concern about the impact a CBDC could have on financial institutions, deputy Bank of Israel governor Andrew Abir says competition is to be embraced. He said:

"In many countries around the world, including Israel, commercial banks do not win public popularity contests. The global financial crisis that erupted in 2008 and its impact on the economic situation of millions around the world was a major source of this anger."

The Reserve Bank of New Zealand has now launched a new consultation as it weighs up whether to issue digital cash.

Key questions for the public include:

- Should interest be paid on CBDC holdings?

- Should there be a cap on how much digital cash a New Zealander can own?

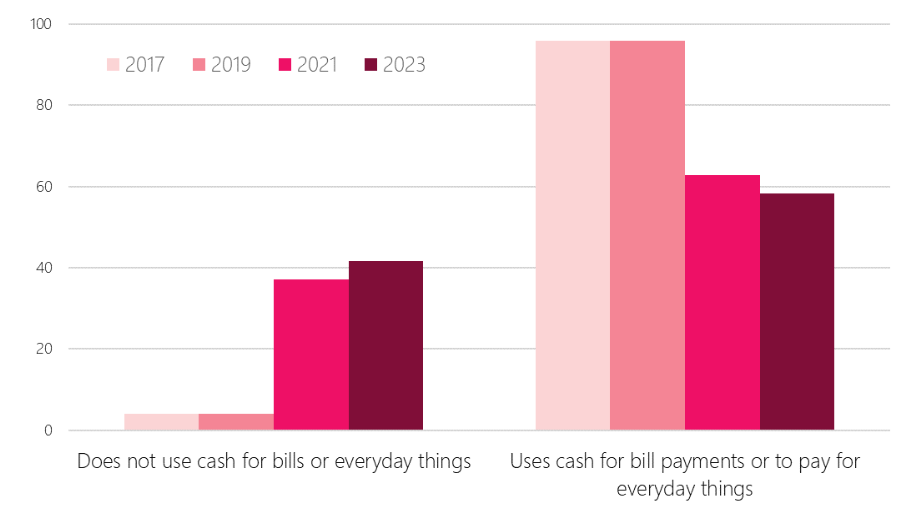

The central bank says innovation is crucial to preserve the country's monetary sovereignty, as the use of other currencies would undermine its ability to set interest rates. In a report, it shared staggering research that shows how cash use has dwindled over the past six years:

As part of the ongoing CBDC pilot, the Central Bank of South Korea reaffirmed its plans to issue and distribute Digital Currency I (deposit tokens) and Digital Currency II (e-money tokens) in the fourth quarter of this year. In particular, the Bank of Korea plans to focus on testing the payment function with deposit tokens.

UK Finance, a trade association for the UK banking and financial services sector, took the lead in coordinating the next phase of Regulated Liability Network (RLN) experiments. R3, Quant and DXC will work on the technical development of the common infrastructure, with all major UK banks and sector specialist firms participating in trials. Prioritized directions at this stage are online purchases, real estate, and bond settlements.

Finally this week — two significant regulatory developments concerning stablecoins: both in the U.S. and U.K.

In Washington, two pro-crypto politicians have proposed a new bill that would compel stablecoin issuers to maintain one-to-one reserves, and ban algorithmic digital assets that use code to stay pegged to the dollar. Advantages for consumers would include FDIC protection on holdings and faster settlement times.

The Conservative government in London also wants to regulate crypto exchanges and stablecoin providers by the summer. But time is of the essence for Rishi Sunak to make Britain a "global hub" for crypto, as a general election is looming that he is widely expected to lose.