Banking CBDC Roundup, Observers, CBDC, e-CNY, Digital ruble, Digital Tenge, World Bank, State Street, Propy, 21.co

Banking and CBDC Weekend Roundup 20/07/2024

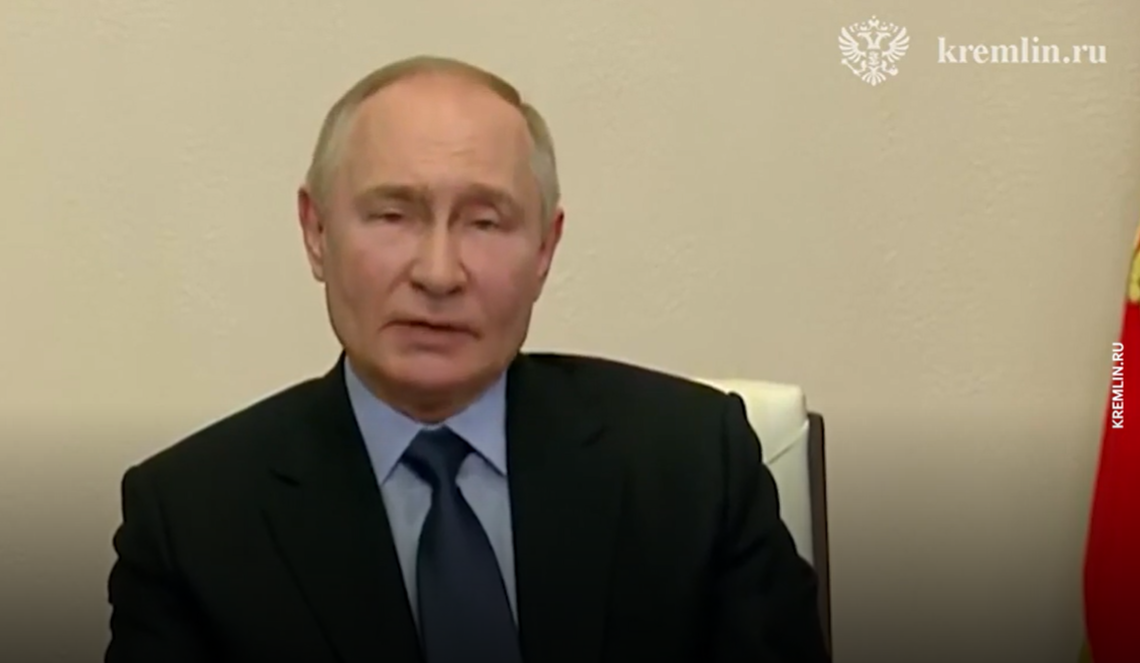

A key figure involved in preparing legislation for the digital euro has been accused of stalling by rival politicians—and over in Russia, Vladimir Putin wants his country to "seize the moment" and embrace the digital ruble.