For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

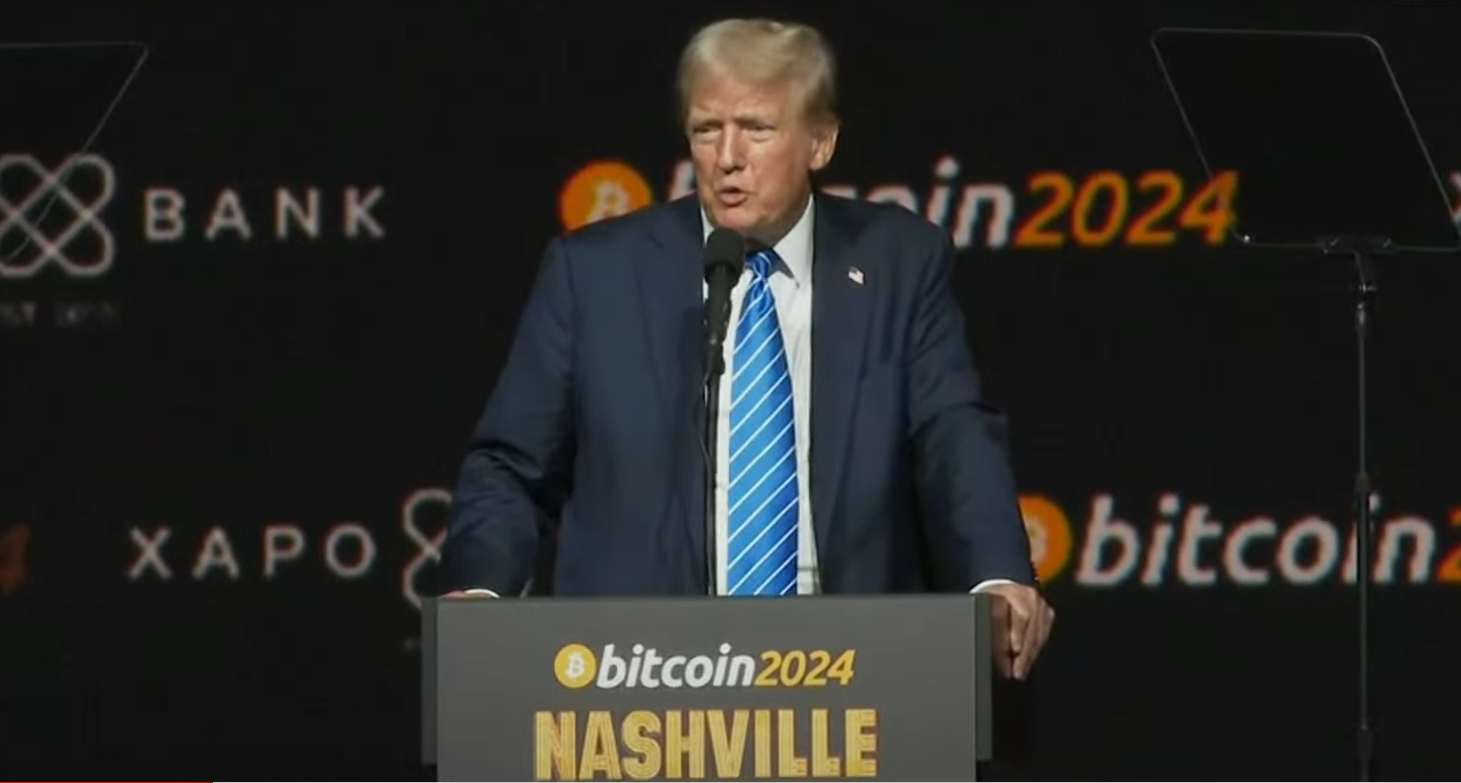

“Forget it. There will never be CBDC while I am president of the United States,” - Donald Trump declared during a long-awaited address at the Bitcoin conference in Nashville today. Among other things, he promised to fire the current U.S. SEC chairman, Gary Gensler, protect the right to self-custody, nurture the development of USD-denominated stablecoins with proper regulation, and never sell the bitcoin owned by the U.S. government.

It was easy prey to pick for a populist speech since the idea of Central Bank Digital Currency has found little support in the modern capitalistic system. People are concerned about surveillance and control, merchants don’t see any additional value from it, and the strongest opposition, commercial bankers, see digital cash as a threat to their monopoly of keeping digital money accounts. The latter gave birth to a new economic parameter, never heard before the CBDC papers – maximum holding limits for digital cash.

Now, monetary authorities in Europe are ‘calibrating’ the maximum holding limits for the planned digital euro to find a balance that will keep bankers happy and provide at least some usability to the digital euro for ordinary users. During the 12th technical session on the digital euro, members of the European Retail Payment Board (ERPB) discussed the possible threshold levels.

The banking side of ERPB weighed in on the risks of deposits and general liquidity outflow from the banking segment, in case CBDC is too good. Members of the consumers and merchants sector argued it is healthy competition and that banks could prevent outflows towards the digital euro by offering attractive interest rates.

The maximum holding limit currently proposed by the European Central Bank is between 3,000 and 4,000 euro. For comparison, the verified e-CNY (digital renminbi) wallets in China can hold up to 500,000 renminbi ($63,000).

We have not observed any reports of complaints about surveillance and control reported in China. Instead, local sources post stories about the advantages of the CBDC wallets’ programmability function. Citizens of Qingdao were able to get back the prepaid subscription to a bankrupt fitness center due to the RMB “smart contract reservation” function enabled by the Postal Savings Bank.

In other positive CBDC news, the Central Bank of Peru (BCRP) awarded its first CBDC pilot contract this week. Unusually, a local telecom company was selected to implement the project.

In other developments, the Israeli Central Bank (BOI) selected 14 teams, including companies like Fireblocks and PayPal, to participate in developing use cases for the digital shekel. Among common use cases, the announcement mentioned “sub wallets”—special sections of the main wallet that users can set up to manage funds for different purposes and better privacy protection.

Tokenization News

As part of the Eurosystem’s wholesale CBDC trials, Slovenia issued 30 million euro digital bonds on the BNP Paribas's Neobonds platform. BNP Paribas is an active player in the tokenization sphere and it currently experiments on two platforms: Neobonds using Canton Blockchain and AssetFoundry based on public Ethereum blockchain.