For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

This week HSBC pushed the adoption of tokenized RWA forward by opening its gold tokens for retail investors in Hong Kong. The bank launched gold tokens on its Orion digital asset platform in November last year, but the trading was available only to its institutional clients.

Gold tokens are one of the most advanced segments of the RWA tokenization industry, with market capitalization exceeding $1 billion. The two largest players in the segment are Tether and Paxos with $550 and $405 million worth of gold tokens issued, respectively. Last year Bank of America named the tokenization of gold a 'key driver in the adoption of digital assets'.

Meanwhile, Japan's Nomura Group was featured in the staking business news. This week, the group's digital arm, Laser Digital, opened Polygon's MATIC staking service to its institutional clients. On the chain side, the staking will be performed by TruFin for Polygon's Agglayer security.

Since the launch of its operations, Laser Digital has been actively investing in Web3, staking, tokenization, metaverse, smart contract automation, and a host of other projects. Talking at the Digital Dollar event panel, the Head of Ventures at Laser Digital highlighted the "incredible" pace of transformation in Asia's payment and money systems.

In Australia, the public is concerned about the decline of traditional cash infrastructure, such as ATMs and cash withdrawal counters, in favor of new technologies. According to statistics from the Australian Prudential Regulation Authority, from the end of June 2017 to the end of June 2023, bank branches declined by 37%, going from 5,694 to 3,588, and ATMs declined by 59%, going from 13,814 to 5,693. It seems the cash cancellation is not driven by customer choices, but rather by private banks and payment system operators. Australians, are not happy with the removal of this essential public service and have even started a petition at Change.org.

The International Monetary Fund (IMF) has a different view, at least regarding payment system operators such as e-money issuers. A recent study that looked into the financial markets of Ghana, Kenya, Nigeria, Tanzania, and Uganda showed positive effects of the money digitalization policies on the monetary policy transmission (measured by the responsiveness of interest rates to the policy rate), and the growth in bank deposits and credit, and efficiency gains in financial intermediation (measured by deposit-to-lending rate spreads).

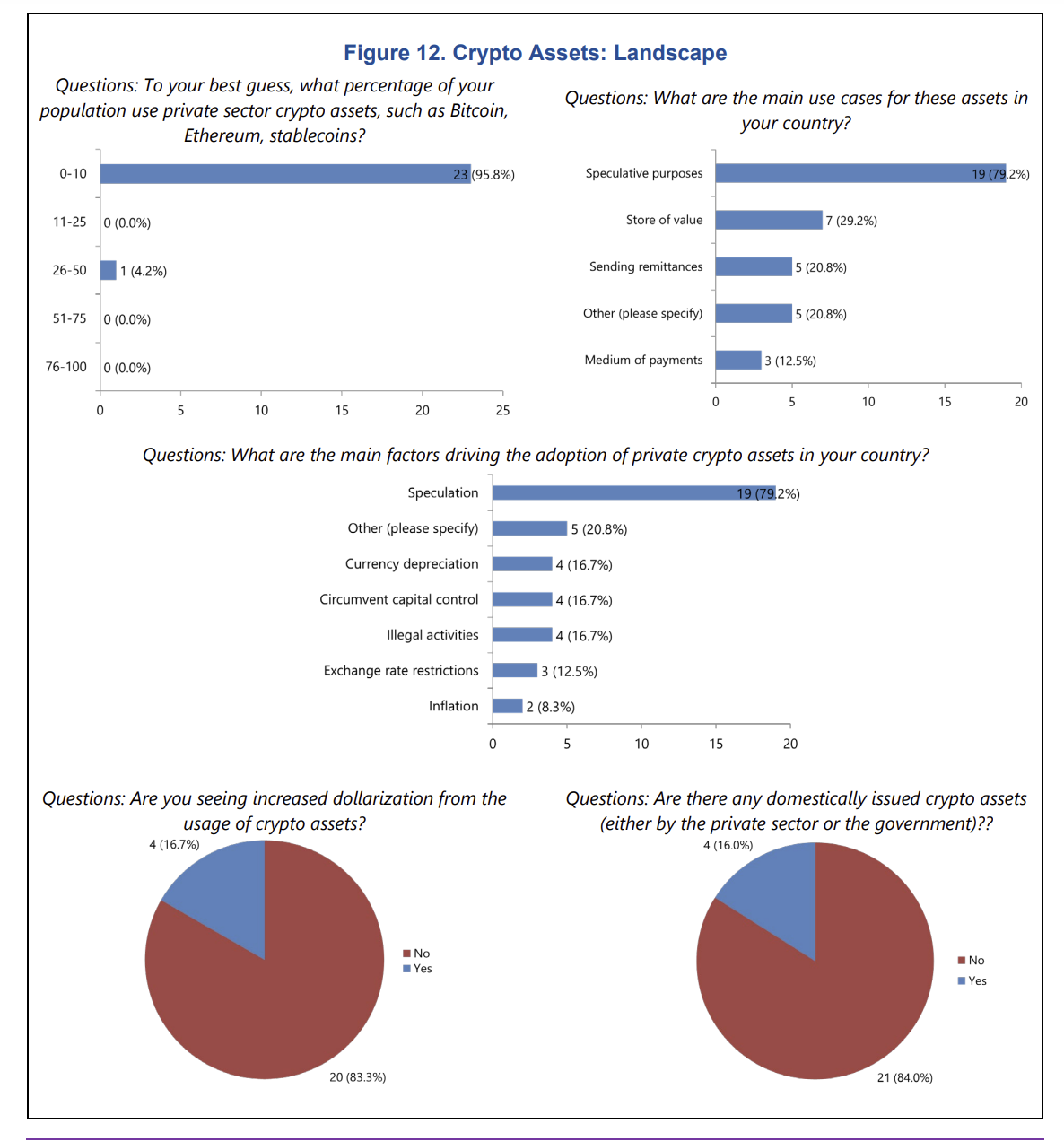

In another report where the IMF summarized the findings of a more comprehensive study into CBDC, e-money, and crypto use in Sub-Saharan Africa, we observed around 75% of central banks planning or already engaged in CBDC development, and more than 80% of the territories covered with some kind of Fast Payment System accessible through mobile phones and internet. Less than 10% of the population uses crypto, and mostly for speculative purposes (according to surveyed central banks).

In other parts of the world, CBDC development is also progressing. Kazakhstan is focusing on the programmability aspect of the digital tenge. The authorities are reportedly testing the controlling of the funds issued for public procurement and government subsidies. While noble in the declared anti-corruption goals, the risks of having such functionality in public money led many leading CBDC projects, such as the digital euro, to prohibit the programmability.