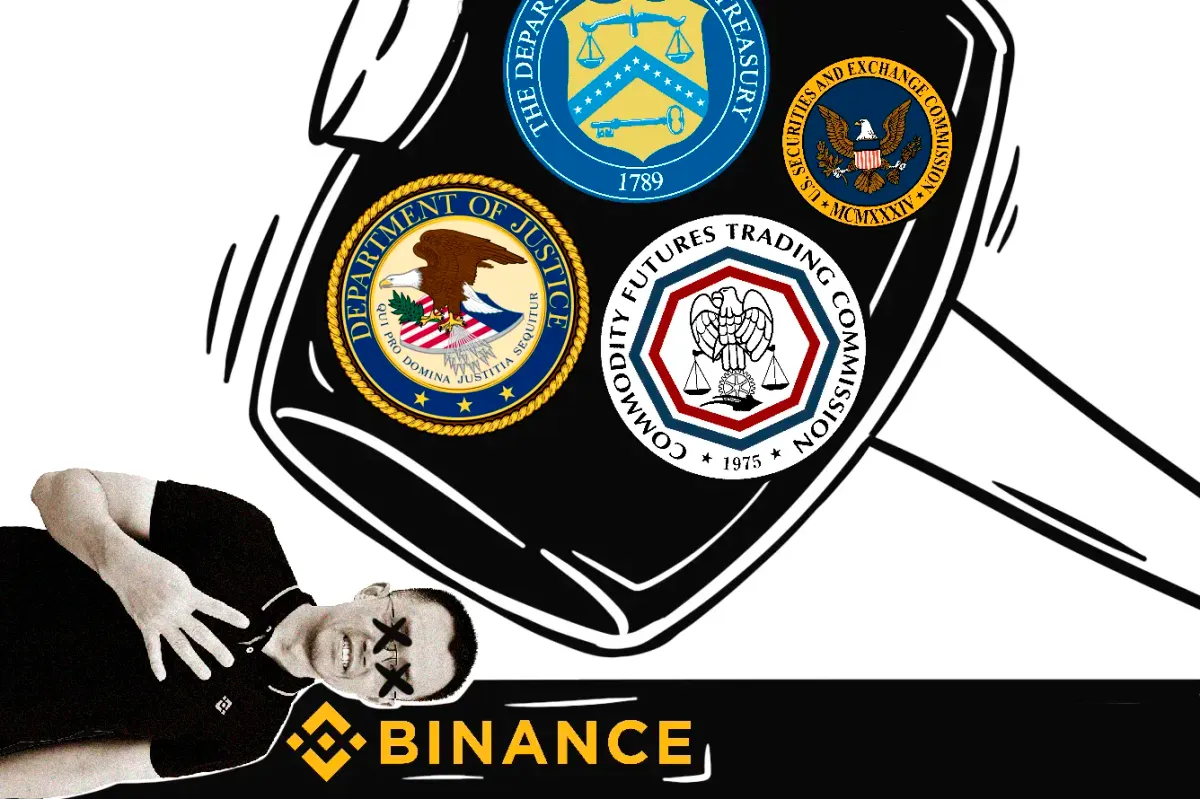

In one of the largest corporate criminal cases in the history of the U.S., the world's largest crypto exchange has agreed to pay $4.3 billion in penalties for failing to comply with money transmission laws and numerous other infringements.

Co-founder and CEO Changpeng Zhao has stepped down from his post after pleading guilty to money laundering charges and has been released on bail until his trial takes place in Seattle on February 23.

Richard Teng, former global head of regional markets with over thirty years of experience in financial services, will be Binance's new CEO.

CZ: This is what forgiveness tastes like

When discussing how to make the U.S. Binance branch profitable in a group chat with colleagues in 2019, CZ allegedly said, "Better to ask for forgiveness than permission." If the exchange were to comply with the country's laws from day one, it would hinder its growth. Instead, the exchange told its high-volume users to hide their U.S. connections.

In under two years, this illicit strategy made the U.S. market the most significant revenue stream for Binance and helped cement Zhao as the wealthiest man in the crypto world with a fortune approaching $65 billion. However, it has now turned against the crypto entrepreneur in a case against money laundering and corporate scheming brought on by the U.S. Department of Justice and other agencies.

To avoid heavy jail time, the Binance co-founder has pleaded guilty to all criminal charges against him and agreed to pay a $50 million fine for his role in letting customers evade U.S. law and not adequately guarding against the exchange of funds for terrorist activities.

Still potentially facing up to 18 months in jail, Zhao paid bail of $175 million to remain free until a hearing scheduled to take place in Seattle on February 23. In a post on X, he stated that leaving the exchange he helped create was emotionally difficult and that from now he will refrain from start-up building, adding "I am content being an [sic] one-shot (lucky) entrepreneur."

Binance: 'Too big to fail'?

According to the DOJ, Binance employees willingly violated U.S. law by facilitating transactions amounting to nearly $900 million between U.S. and Iranian users, as well as transactions with other sanctioned jurisdictions such as Syria and Russia, and companies known for their illicit activities such as Hydra, a Russian dark web market place, and Bestmixer, a criminal favourite crypto mixer.

The company has agreed to pay $4.3 billion in penalties and forfeiture to remain operational. In a statement regarding the case, Attorney General Merrick B. Garland said, "This is one of the largest penalties we have ever obtained from a corporate defendant in a criminal matter."

While the Justice Department says it has "no tolerance for crimes that threaten our economic institutions and undermine public trust in the fairness of those institutions" and congratulates itself on the success of the crackdown on crypto companies over the past month, Binance and CZ, in contrast to FTX and SBF, have been giving a shot to survive.

In a statement after yesterday's capitulation, Binance noted that the company has steered clear of allegations regarding misappropriating user funds and market manipulation.