Binance began to get rid of BUSD immediately after SEC warned Paxos on BUSD operations.First, there was news that Binance converted its own stablecoin worth $1 billion into other crypto assets. On March 13, Binance announced removing BUSD from the Industry Recovery Initiative (IRI) funds and, less than a week later, on March 17, from SAFU where the BUSD funds are converted into other crypto reserves.

The BUSD in IRI was converted into three crypto assets: Bitcoin, BNB, Ethereum. Binance exchange announced that it was completely replacing BUSD with TrueUSD and USDT in the SAFU fund. With the recent problems of the USDC, it is worth noting that Binance chose Tether and not USDC for BUSD replacement in the SAFU fund.

According to the announcement, Binance is abandoning BUSD in the funds, since Paxos has stopped issuing new tokens. Not clear why the largest crypto group does not want to switch to another issuer and keep working in such a promising niche as global stablecoins.

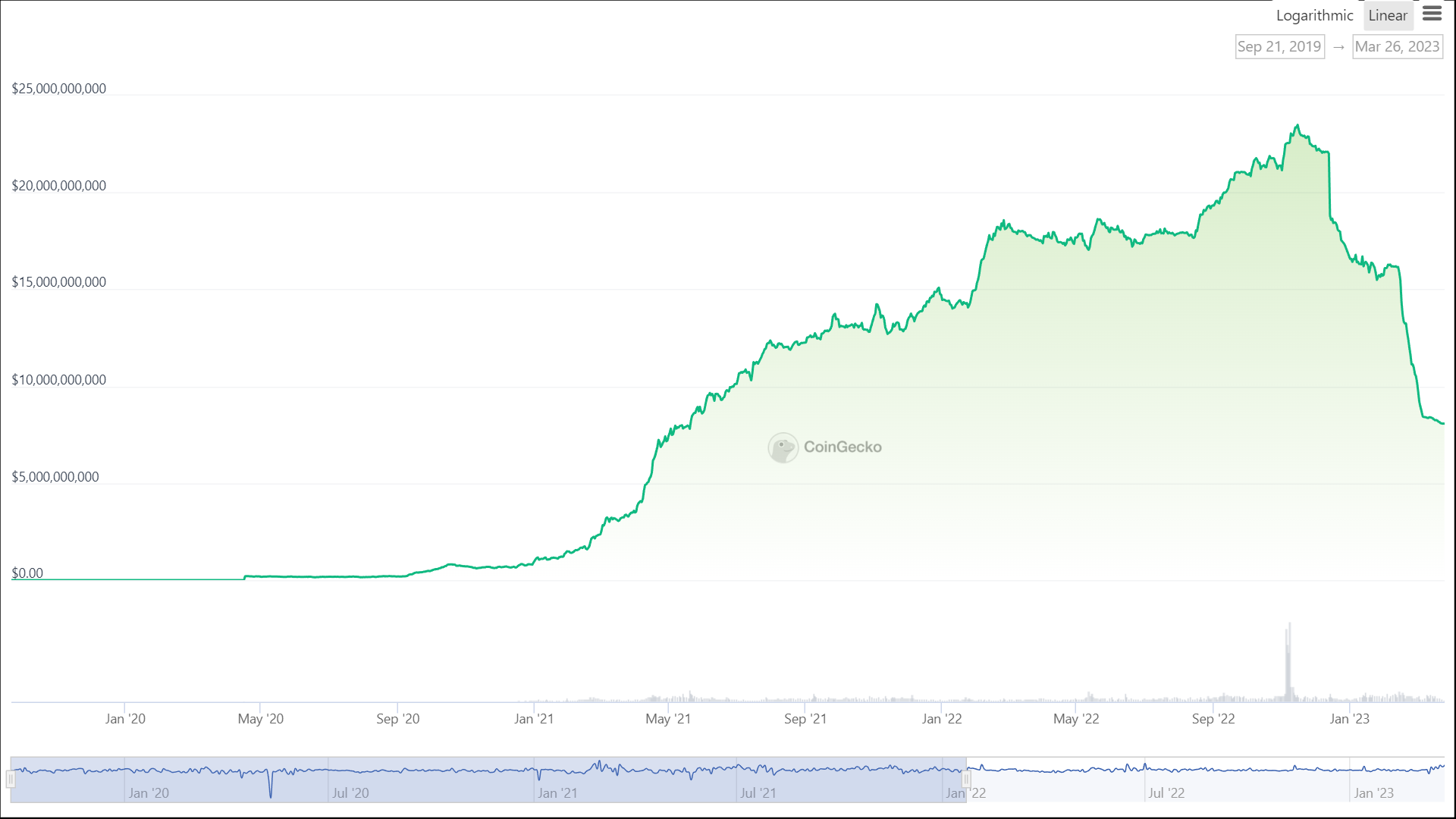

At the time of writing, according to CoinGecko, the market capitalization of the stablecoin is around $8 billion and continues to decline gradually.

However, Binance promises that this change will not affect users in any way, that funds will continue to be stored at publicly verified addresses. Is it not significant that the exchange says that existing issued BUSD will continue to be supported.

“This change will be of no impact *on users, and these funds will continue to be on publicly verifiable addresses. BUSD will continue to be supported on Binance. The SAFU fund will be observed closely to ensure that it is sufficiently capitalized, and topped up periodically, as necessary, using Binance’s own funds,” - it says in the announcement.

The head of Binance, CZ, explained the decision to convert their own stablecoin into native cryptocurrencies due to changes in the market of stablecoins and banks.

Given the changes in stable coins and banks, #Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund movements will occur on-chain. Transparency.

— CZ 🔶 Binance (@cz_binance) March 13, 2023

As CZ noted, the transaction took only 15 seconds and cost $1.29.

The transfer txid. Took 15 seconds and costs $1.29. Imagine moving $980 million through a bank before banking hours on a Monday. https://t.co/ViCppASVFK

— CZ 🔶 Binance (@cz_binance) March 13, 2023

Binance is going through turbulent times for the crypto industry and, being at its forefront, attracts the attention of observers to any unusual activity. On March 24, the exchange experienced technical problems that resulted in halting its spot trading and withdrawals.

CZ took to Twitter to explain the situation and repeat his ‘Funds are SAFU’ mantra.

Initial analysis indicates matching engine encountered a bug on a trailing stop order (a weird one). Recovering. Est 30-120 min ish. Waiting for more precise ETA.

— CZ 🔶 Binance (@cz_binance) March 24, 2023

Deposits & withdrawals are paused as a SOP (standard operating procedure). Funds are #SAFU. 🙏 https://t.co/mvtGQ3JlMA

The problem was solved quickly enough, and trading and withdrawal functions were restored. Yet the panic and FUD that accompany all these “patches” is not going to disappear soon. We continue to observe.