Most of those who are interested in finance are familiar with stock indices (or at least have heard of them). Investors and traders around the world carefully monitor S&P 500, DJIA, and NASDAQ. Their fluctuations allows one to assess the state of the market, and serve as a guideline for the completion of an investment portfolio. Index futures are useful for trading and risk hedging.

Such convenient tools exist not only in the stock markets. We have already written about cryptocurrency indices in the article "Digital-Assets Index by CoinDesk: First out of Nine". The largest crypto exchange, Binance, calculates its indices and allows you to trade them as perpetual futures in the derivatives section.

The BTCDOM Index reflects the dominance of bitcoin over altcoins. All in all it represents the price of bitcoin relative to a basket of other coins. 20 cryptocurrencies with the maximum capitalization are used for calculation, except for bitcoin. Each coin has its own weighting coefficient, depending on its capitalization. For example, Ethereum currently has a weight of 51.90%, while Solana only has a weight of 1.70%.

Futures with the BTCDOMUSDT ticker allow you to invest in the index or develop trading strategies related to the correlation between the index and other assets. For example, if the whole market is growing, then the direction of the BTCDOM trend may show whether it is more profitable to buy bitcoin or altcoins when trading with the trend. If the index also rises strongly in a growing market, it means that bitcoin dominates other coins. In a falling market, rising BTCDOM may indicate that Bitcoin is losing less in price than altcoins.

On the charts, you can see that the correlation between the price of bitcoin and the value of the index can be both direct and inverse. The index itself does not give clear “buy” or “sell” signals, but can be a useful tool for assessing the strength of a trend. The inverse correlation with bitcoin prevails, probably due to the greater volatility of altcoins, which can both give more profit and cause more losses than bitcoin. However, the fastest uptrend in bitcoin price over the past couple of years (in October 2021) was accompanied by an increase in BTCDOM. Such events can be regarded as a signal to buy bitcoin along the trend. If the trend continues, bitcoin on average will yield more profits than other coins.

DEFI Composite is an index which reflects the price of a basket of DeFi tokens listed on Binance. It currently includes 28 tokens. The index is calculated on the basis of weighted average prices, the weighting coefficients depend on the market capitalization and trading volume of the coin. The maximum share in DEFI Composite (11.01%) now belongs to Chainlink (LINK). TIt also includes following coins: UNI (9.00%), ALGO (5.81%), CRV (4.96%), BAND (4.70%), AAVE (4.62%), YFI (3.69%), RUNE (3.68%), 1INCH (3.47%), MKR (3.44%), SFP (3.20%), KAVA (3.20%), KNC (3.20%), REN (3.18%), BAL (3.14%), COMP (2.79%), RSR (2.55%), ZRX (2.33%), UNFI (2.24%), TRB (2.24%) and others.

The index chart significantly correlates with the BTC/USDT rate, but you can notice major differences in local highs and lows. DEFIUSDT futures make it easy to diversify your investments by adding DeFi tokens to your portfolio without directly purchasing different coins.

The Football Fan Token Index is based on the prices of football clubs’ fan tokens traded on Binance. At the moment it consists of 10 components. The calculations also use weighting factors related to the market capitalization of the tokens. Now the maximum weight (20%) takes the club token S.S. Lazio (LAZIO).

The influence of the bitcoin rate on the index is clearly visible during significant market falls. At the same time, the index mainly shows itself as an independent trading instrument. This can make the FOOTBALLUSDT futures attractive not only for football fans but also for other traders and investors.

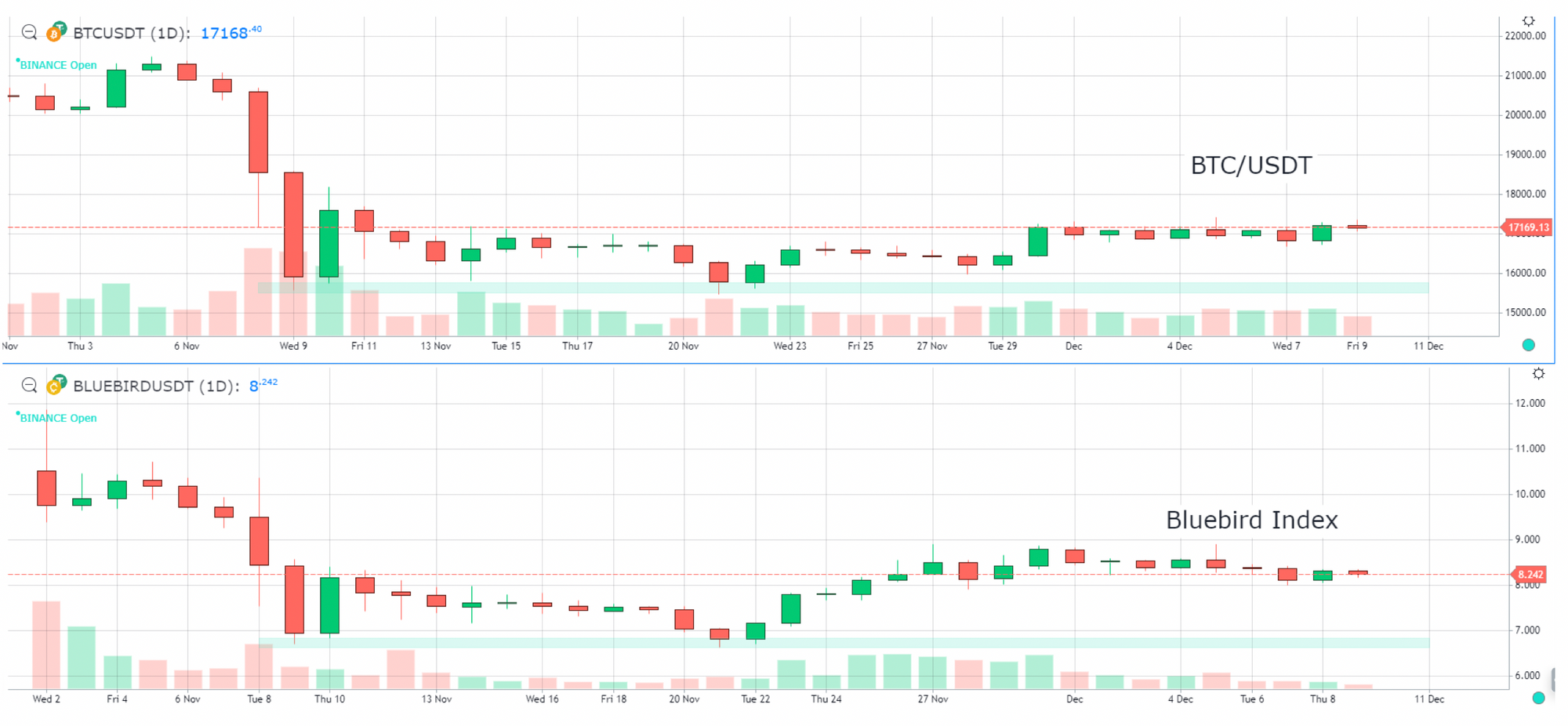

The Binance Bluebird Index consists of just three components: BNB, Binance's native token (58.39%), Dogecoin, the "meme" cryptocurrency favoured by Elon Musk (34.43%), and MASK, the Mask Network protocol that enables users of popular social media platforms to send cryptocurrency, interact with decentralized applications and share encrypted content (7.19%).

The correlation with bitcoin is obvious, however, BLUEBIRDUSDT futures can be a useful tool for those who like to follow Elon Musk's tweets and catch fast trends, but do not want to invest everything in one volatile cryptocurrency.

To sum up, index trading can be a good alternative to trading individual coins. The volatility of indices is more stable, they are less prone to sudden movements and the direction of the index trend is more difficult to change. At the same time, the analysis of the index price is complicated because of a large number of factors affecting its pricing. At the very least, indexes can be useful as auxiliary trend indicators for more accurate trading of their components. The main thing to remember is that not a single indicator can predict future events.