Binance, the largest crypto exchange in the world, is leaving its 117 million clients without access to the trade of Bitcoin NFTs through its marketplace. The announcement made on Thursday calls the decision part of Binance's “ongoing efforts to streamline product offerings.” Users will stop receiving airdrops of Bitcoin projects by April 10, and on April 18, all support for the chain's NFTs will be discontinued.

The popularity of Bitcoin NFTs following the launch of the 'Ordinal protocol' by developer Casey Rodarmor in January 2023 led Binance to promptly and enthusiastically add support for them on its platform.

“Bitcoin is the OG of crypto. We are super excited to bring Bitcoin Ordinals to Binance NFT,” said Mayur Kamat, Head of Product at Binance at the time. “We believe things are just getting started here and can’t wait to see what the future holds in this space,” he added.

Kamat’s excitement was well-positioned. Ordinals ignited a fire in the NFT ecosystem by leading developers from other protocols to reproduce Bitcoin’s new inscription process and create similar digital tokens for their native chains.

Asset-management firm Franklin Templeton noted that, on a prospectus published last Tuesday, the Ordinal protocol was the epicenter of change within the community, leading to a “renaissance in activity.”

The success hasn’t always been evident - last summer, the sales of Ordinals dropped, sinking as low as $11 million in August. Yet, by the end of the year, their prices had begun to rebound and even reach new all-time highs. Caught up in the hype, Binance launched an Inscription marketplace in February solely for Ordinals and similar inscriptions from other blockchains.

Observing moneytech and cryptoEva Senzaj Pauram

Observing moneytech and cryptoEva Senzaj Pauram

Even though meme-coins have distracted many degen traders and media outlets from the NFT market, it is still booming.

According to the latest report on the DeFi industry by DappRadar, the first quarter of 2024 was the best for NFTs since the start of 2023. During the first three months of the year, the trading volume of digital assets was around $3.9 billion, a 50% increase from October to December 2023. Sales increased by 13% compared with the previous quarter, reaching 11.6 million.

Bitcoin NFTs are no exception. Data from CryptoSlam points to the sales of BRC-20 tokens and inscriptions surpassing $514 million last month - their highest level in 2024 and the second highest since the launch of the Ordinals protocol.

In this context, Binance stepping out of the Bitcoin NFTs appears counterintuitive. The crypto exchange continued its support of the BTC tokens while they were performing quite poorly, and now that BRC-20 is scoring, it has stopped doing so.

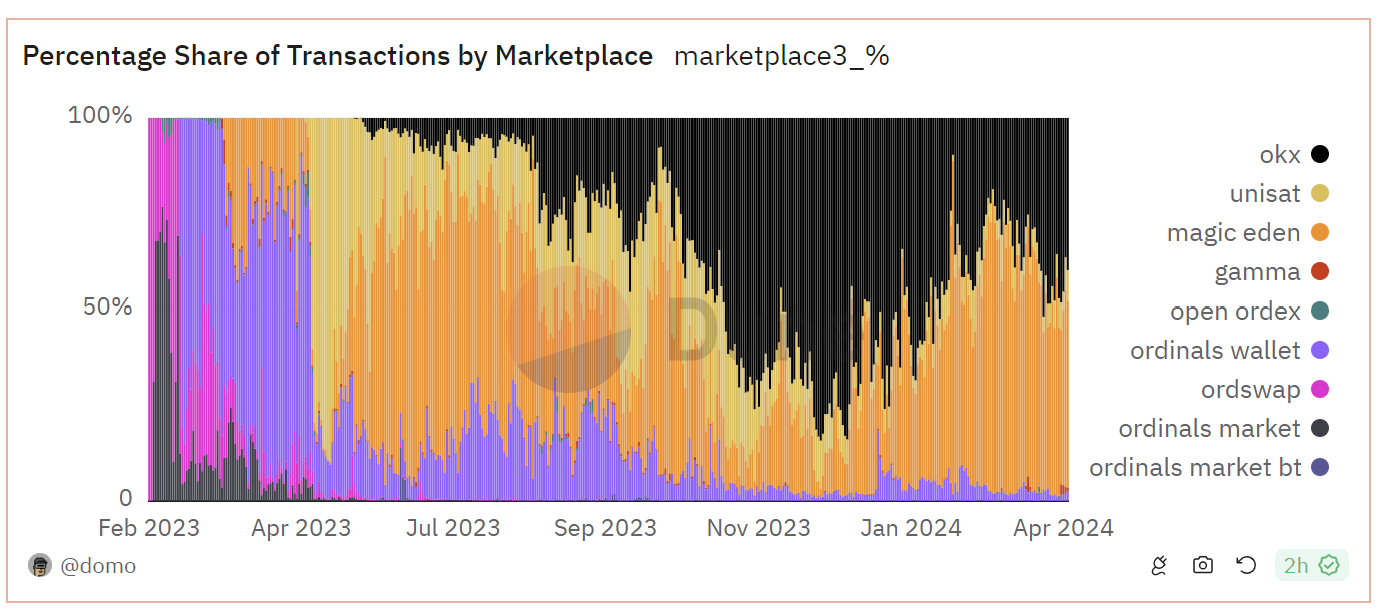

The decision can probably be explained by the low volume of Ordinals trade on Binance. OKX and Magic Eden exchanges, which made a strong effort in developing their ordinals' marketplaces, have streaked ahead of Binance and other specialized platforms that dominated the market initially.

For Binance, this could also be another consolidation measure to offset the increasing costs of ongoing legal challenges in multiple jurisdictions, and in light of the changes in its structure imposed on the firm by the U.S. Securities and Exchange Commission. At the beginning of last month, Binance.US, its U.S. entity designed to service U.S. residents, had to lay off more than two-thirds of its staff after its revenue shrunk by 75% following the SEC’s enforcement action.