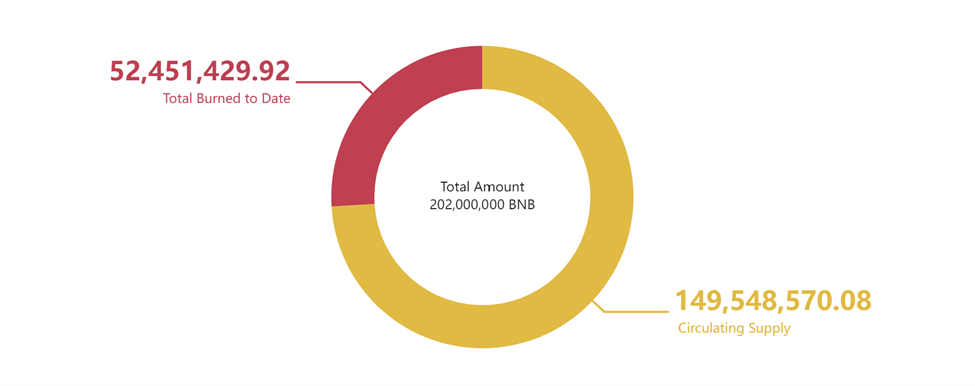

Last week, Binance chain reported another major token burn milestone for its BNB token. The 26th quarterly burn removed 2.1 million tokens (around $636 million in value) from circulation. The BNB project is halfway to reaching its planned supply of 100 million tokens, and if the current pace holds, it will reach the target in another five to seven years.

BNB started as a crowdfunding (ICO) token for the Binance centralized cryptocurrency exchange. It was launched in 2017 with a total supply of 200 million tokens. Later, the exchange developed its own blockchain based on Ethereum’s EVM technology, and the BNB token was migrated there, becoming the utility and governance token for the BNB blockchain. Immediately after the launch, the project committed to decreasing the number of tokens by half.

During the past seven years, nearly 52 million BNB has been burned. For the first five years, the number of tokens to be destroyed was calculated quarterly based on Binance’s trading volumes. Now, the chain is using two main mechanisms for decreasing its supply: an auto-burn mechanism, that destroys tokens based on a formula connected to the token price and a recently introduced real-time burning that is linked to the gas fees.

The auto-burn mechanism has directly linked the token’s volume to its price. The price of the BNB token is supplied on-chain via Chainlink price oracle, and it is included, inversely, in the formula that calculates the number of tokens to be burnt. Theoretically, this should provide for BNB price stability. Once the total circulating supply of BNB falls below 100 million, the BNB auto-burn will stop.

The real-time burning mechanism is less intuitive. It seems like it punishes network activity because it burns a portion of the reward assigned to validators. However, just like in Ethereum's case, the mechanism is intended to decrease inflationary pressure on the token, especially during periods of high network activity and high fees. According to the current rule, the real-time burning mechanism will stay even after the target 100 million supply level is reached.

The token price remains a critical factor in the health of the blockchain ecosystems. Development activity, collaborations, inventions and patents are all ultimately reflected in the token’s price. No wonder the founders pay so much attention to the healthy price dynamics of their project tokens. With Solana breathing on BNB’s back we may Observe more BNB token support soon.