On Friday last week, Binance launched its NFT loan service, allowing holders of ‘blue-chip’ non-fungible tokens to use them as collateral against a loan, and release the liquidity held within their assets without having to sell them.

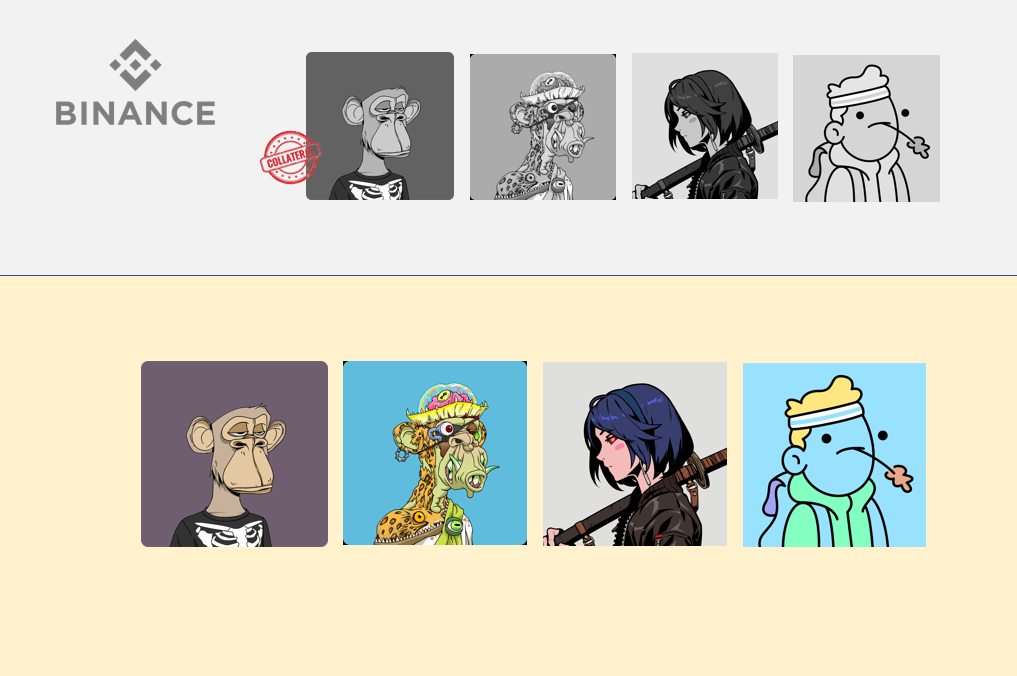

The service will initially support only Ethereum (ETH) loans to holders of NFTs from one of four collections: Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Azuki and Doodles. However, the platform claims that more borrowable assets and collateral options will be added in the future.

Loan-to-Value (LTV) ratios range from 40% (for Doodles) to 60% (for BAYC), and there is a promotional discount of 70% off the interest rate, so for a limited time borrowing is at an annual rate of 3.36% rather than the standard 11.2%.

With a floor price of 43.5034 ETH on Bored Ape Yacht Club NFTs, this means a holder can borrow 26.102 ETH per NFT (around $50,000 at current prices). Binance’s NFT loans are open-term, meaning that borrowers can keep their positions open indefinitely provided that the LTV ratio is not exceeded.

One aspect of Binance’s platform that differs from many of the others available is the peer-to-pool nature of its loans. This means that Binance acts as the loan pool provider, enabling benefits such as instant liquidity and zero gas fees.

This is in contrast to established players such as NFTfi, which offers peer-to-peer loans. In this system each loan is a custom agreement on fixed terms between the borrower and lender. While this removes the risk of automatic liquidation if floor prices go down, it does require a suitable lender to be found before any loan can be agreed on and liquidity released.

Also peer-to-peer, but catering to a slightly different type of borrower is the recently-crowned market leader in NFT lending, Blend, from top NFT marketplace Blur.

Blur lending (Blend) is geared towards those who want to purchase ‘blue-chip’ NFTs but don’t have the funds to buy in. Essentially, it works like a mortgage for NFTs. Lenders put down a deposit and finance the rest of their purchase with a loan. Again, rates and terms are agreed privately between the lender and borrower.

According to a report last week from DappRadar, since launching on May 1st, Blend has amassed over $300 million in trading volume, cornering a massive 82% of the NFT lending market. Similarly to Binance, Blend also only offers loans on a carefully curated selection of collections, including Azuki, CryptoPunks, Milady Maker, DeGods, BAYC and MAYC.

With Blend’s impressively rapid rise to the top of the lending leaderboard, it seems that there is still a very high demand for popular NFT collections. Whether Binance can make a dent in its market share remains to be Observed. Perhaps these new buyers will want (or need) to release liquidity when they’ve paid off their non-fungible mortgages.