Bitcoin and Ether in Spotlight

Bitcoin gained more than 50%, settled above $20,000, and crypto FUD has given room for slight optimism. Nevertheless, there are factors that analysts advise considering before making the bets.

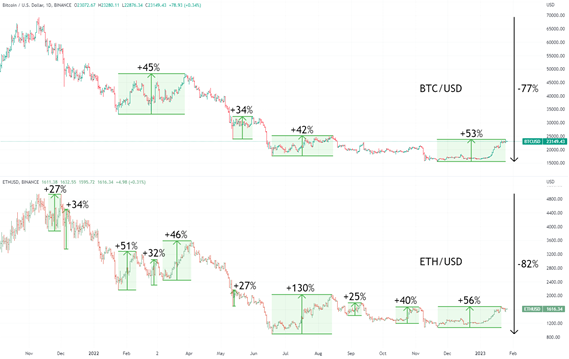

We have observed indicators hinting at the growth potential of Bitcoin, and indeed, the price rose and consolidated above the psychologically significant level of $20,000. Yet, it is worth examining a broader context: to look at the fall of the cryptocurrency market, starting from the global maximum price of Bitcoin above $60K and Ethereum above $4K (November 10, 2021).

The chart shows price retracements of these two top assets as a percentage of local lows. We can see that similar pullbacks from downtrends have happened before. Ethereum had opportunities to win up to 130% in 2022, and the current growth that lasts since November 21, 2022 is the second largest: 56%. In the case of Bitcoin, the current growth of 53% is the largest for the review period. This could be the start of a new uptrend, but analytics point to several factors that may affect it negatively.

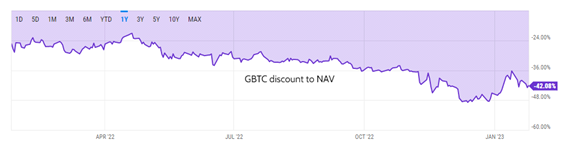

Grayscale has not received approval from the SEC to reorganize their GBTC bitcoin trust into an ETF. A positive decision from the SEC and the ability to buy a spot Bitcoin ETF could significantly increase investor confidence in Bitcoin and also eliminate a risk of crypto selloff by the fund.

But for now, Grayscale is still waiting for the hearing on its lawsuit against the SEC, which will take place on March 7th. The company is actively drawing public attention to the problem, the progress of the case can be followed on the official website. If lost, according to Michael Sonnenshein, the CEO, Grayscale can sell up to 20% of its holdings, offering investors to buy back their shares at some fixed price. During his appearance on CNBC, Michael Sonnenshein said that the final court decision is expected in the second or third quarter of 2023. Analysts do not expect a quick resolution of the dispute, the case may drag on for a year or more. Meanwhile, GBTC is still trading at a 42% discount, despite the rise in Bitcoins price.

The Shanghai update of the Ethereum network will open up the possibility of withdrawing coins from staking. It can be assumed that some investors may want to take profits if the price is attractive enough. A significant amount of Ether was used in staking as early as late 2020, when the price hovered around $600. If the price stays significantly higher in the coming months, then the withdrawn coins could be sold, slowing down or even stopping the uptrend. Long term, however, with liquid staking, we might see an even larger portion of Ether re-staked and removed from circulation which can push its price up.

Everyone in crypto agrees that regulations are inevitable. The mess that some crypto projects created in 2022 won’t go without response. And the response needs a certain address to be applied to. In this regard, many believe that Bitcoin has an advantage because there is no single entity or person behind it. We observed the return of “Bitcoin maximalism” among the people working in the industry, such as Brian Armstrong, CEO of Coinbase

This is the bull case for Bitcoin https://t.co/ic9iPso51q

— Brian Armstrong (@brian_armstrong) January 23, 2023

To summarize, the current season in the crypto industry cannot be described by a single animal character. While the price increase is healthy for the participants, it always distracts projects from their core activities. As one of our Observers put it: “if Bitcoin price increases every week, we won’t be able to tell our readers about other exciting things happening in crypto”.