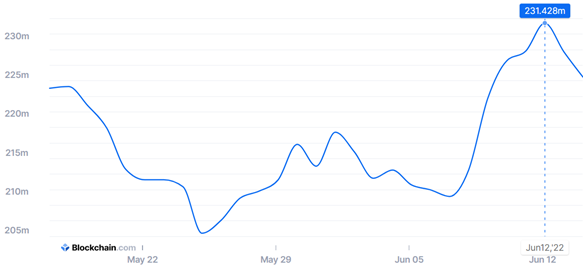

Against the background of a sharp drop in the price of BTC on June 12, the hashrate of the cryptocurrency jumped to 231.428 million terahashes per second. This is a record value for the entire existence of Bitcoin.

A month ago, we already wrote about the record growth of Bitcoin’s hashrate. And it happened again. As the chart shows on Blockchain.com, the hashrate of Bitcoin on June 12th exceeded 230 million terahashes per second. This is an absolute record for the hashrate of Bitcoin.

All this happened against the background of a sharp drop in the price of BTC on June 12. According to Coinmarketcap, the price of cryptocurrency for the two days on June 11–12 fell from $29,387 to $26,837, and then continued to fall, reaching a price of $20181 on June 14.

The question is, is there a connection between the sharp drop in cryptocurrency and the jump in hashrate? To begin with, it is worth understanding what a hashrate is. In simple terms, hashrate is the power in computing that mines cryptocurrency. Accordingly, the hashrate of a cryptocurrency is a number that reflects the power of all the equipment that is mining this cryptocurrency at a certain moment.

If the hashrate is growing sharply, it may mean that more miners are starting to mine cryptocurrency. Or miners have massively upgraded existing equipment, increasing capacity. Also, the growing hashrate increases network security, since more power will need to be allocated for a 51% attack. But, is there a connection between the fall in price and the growth of the hashrate?

In fact, a connection cannot be seen at the moment. That is, one cannot directly influence the other, but an indirect influence can be observed. On the website buybitcoinworldwide.com there is a chart showing the hashrate of Bitcoin and its related price. And in the description, the authors devoted a separate paragraph about criticizing this chart. Also, there are comments about the connection between hashrate and price:

«If you ask almost any miner, they will tell you that it is not hashrate that affects the price of bitcoin. Rather, it is the price of Bitcoin that affects the hashrate. When the bitcoin price is high, more hashrate joins the network as less efficient miners can remain profitable due to fatter margins. As the price goes down, the margin thins and fewer miners can remain profitable.»

Recently, a hashrate jump was observed in Ethereum. But in this case, everything was put down to the expectations of the imminent shutdown of the Proof-of-Work consensus mechanism of the network. Or simply put The Merge.

Also, there is an opinion that Bitcoin price follows the hashrate with a delay. That is, a jump in hashrate in theory can lead to a jump in price. This is supported not only by the correlation on the chart, but also by the fact that an increase in the hashrate increases the security of the network and, as a result, attracts new investors.

We do not give financial recommendations, we advise you to trade only the amount you can afford to lose. We are tracking the fall of the market, we remain hopeful for growth and continue to observe.