“What type of organizational structure will an AI use?”

Arthur Hayes, co-founder of 100x and cryptocurrency exchange BitMex, has an idea of what the future of financing and economic growth in the age of Artificial Intelligence (AI) could be like.

In a Medium post published on July 29, he shared his vision on how the two emerging technologies of our times (blockchain and AI) may fuse.

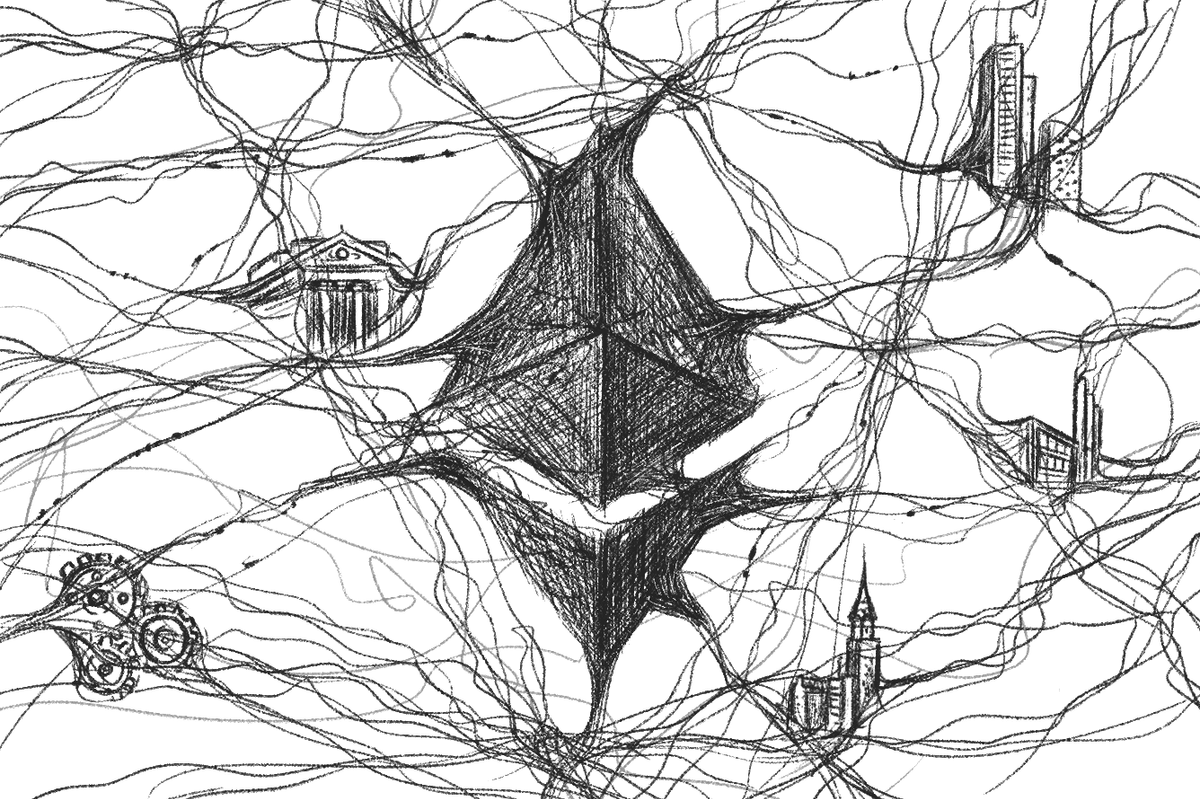

One month after predicting that Bitcoin would be the natural cryptocurrency of AI-based economic systems, Hayes now says that Ethereum will be its key organizational blockchain.

You can't kill, tie-down, or imprison an Artificial Intelligence (AI), argues Hayes, therefore making the laws that govern humans useless in the face of artificial intelligence. The omnipresent governmental laws that control, regulate, and organize today´s economic system, are thus powerless in the face of this new borderless technology.

To organize itself then, AI will, according to Hayes's thought experiment, have to follow immutable and transparent public code, aka smart contracts, that as an economic entity will exist as a public address on the Ethereum network, hence becoming a Decentralized Autonomous Organization (DAO).

Why Ethereum and not any other blockchain?

Hayes believes the Ethereum Virtual Machine to be “the most robust decentralized computer on the planet,” and that many other blockchains are just Ethereum clones. Though these may allow for short-term gains to investors, “none will ever eclipse Ethereum in terms of adoption and usefulness.”

Because of Ethereum's status among blockchains, it will naturally become the place where AI will be managed, hence predicts Hayes, ETH price will grow exponentially.

“Ethereum transactions will grow exponentially as DAOs proliferate. As a result, the price of ETH should skyrocket if anticipation of this AI DAO hypothesis is widely believed.”

Governments have, since the dawn of modern civilization, ruled over economic activity. The usurping of this power by computer code managed by a DAO will hopefully spell the end of centuries-old market failures resulting from central governance.

Replacing easy-to-forge and sporadic auditing will be the transparent terms of the smart contract and transaction data. By allowing continuous monitoring they assure complete accuracy of accounts at all times, significantly reducing the information gaps that hinder today´s capital markets.

“The fact that investors can be 100% cryptographically sure any DAO´s books are always accurate will give them the comfort they need to allocate capital to the DAO. The only requirement is that DAO´s business is conducted wholly on a public blockchain.”

Equally important is the democratization of financial markets, which can currently be hard to access for many people. According to BitMex's former CEO, in the times of AI DAO, the state will lose its power to limit companies and allocate 'permission' according to its preferences. Instead, “the DAO capital markets will be the first truly global markets where anyone with an internet connection [...] can interact.”

Lastly, globalization is being limited by states' actions, which restrict international companies to the rules of particular geographical locations. This 'unnatural state of affairs', as Hayes calls it, has its days numbered as he believes the future of the world´s economy will be AI-based and DAO governed.

Hayes is a big dog in the blockchain ecosystem, and his words often have an impact on the crypto market. Last week, Ethena announced that they have received $6.5 million in funding to turn Hayes' concept of a crypto-based stablecoin into reality. Will the market follow Hayes again or is this purely a thought experiment?