Financial writer JP Koning's recent viral blog post highlighted his changing views towards Bitcoin. The post captured his journey from initial optimism in 2012 (!) to a more measured recognition of its limitations as a mainstream payment method. Koning's current position on Bitcoin is that it is still an 'early-bird game'—one where early entrants benefit at the expense of new recruits.

Bitcoin is an incredibly infectious early-bird game, one that after sixteen years continues to find a constant stream of new recruits

His perspective adds to the broader dialogue about Bitcoin's role in the financial sector after its value skyrocketed last year.

Launched 16 years ago, Bitcoin was initially met with a healthy dose of skepticism and sometimes outright dismissal by many leading economists and regulators. However, 2024 was a game-changer for cryptocurrency, and now, the narrative surrounding Bitcoin has shifted, particularly after Spot ETF (Exchanged Traded Fund) approvals and Trump's election win.

ETF Investor - The Latest Early Bird?

ETFs have impacted Bitcoin in two ways. Primarily, ETFs bring a whole new swathe of new investors to Bitcoin while allowing the earliest adopters to sell out some of their gains. Retail investors can get on board without having to buy Bitcoin directly since they are making an investment in the fund rather than the coin itself. That means previously skittish investors can come on board through the relative safety of their asset managers.

The second impact is, of course, new business niches for the bankers. American banks want their share of the digital assets custody business, entering into competition with companies like Coinbase.

Bitcoin ETFs have reached a market cap of over $132 billion, and shares of some of the biggest ETFs are up an average of 114% since February 2024. After the election of Donald Trump, ETF's inflows reached $10 billion, capitalizing on its longest weekly run since 2021.

This Wall Street success highlights its changing attitude towards Bitcoin—or, at the very least, its reluctant acceptance.

Jamie Dimon, CEO of JPMorgan Chase, once a staunch critic of Bitcoin, labeling it a "fraud," has begun to acknowledge its potential by embracing blockchain through JPMorgan's digital asset project, Kinexis. Ray Dalio, founder of Bridgewater Associates, has also shifted from skepticism to seeing Bitcoin as a 'gold-like' asset, holding a small percentage in his portfolio. Lloyd Blankfein, former CEO of Goldman Sachs, remains skeptical about Bitcoin, citing its volatility and potential for fraud. And although he has softened his stance somewhat, he was recently outspoken in his critique of the U.S. administration's pro-Bitcoin approach and its potential impact on the USD.

Is The U.S. Government In The Game Now?

The concern about the new Trump administration's attitude to Bitcoin is not unwarranted. After all, this is the guy who called Bitcoin a scam just a few years ago. Now, in an astonishing turnaround, there are rumors swirling of a U.S. Bitcoin reserve under his administration.

Trump has already appointed pro-crypto Paul Atkins as chair for the SEC and former PayPal executive David Sacks as AI and crypto czar. In the weeks before the U.S. Election, Trump launched his family-owned cryptocurrency exchange, World Liberty Financial, and a governance token, $WLFI.

But how much of Trump's pro-crypto pre-election rhetoric will come to pass? Even the most crypto-friendly regulators are not going to fling the doors open. Americans are typically very protected by the government when it comes to speculative investments (even gambling is highly regulated), and investor protection will likely remain a core principle of any legislative easing.

A large, strategic Bitcoin reserve feels unlikely, although, in some sense, the US already has one. To date, the U.S. government has seized around 200,000 tokens worth about $21 billion, and Trump suggested in a speech last July that he could build on this stockpile. He also predicted Bitcoin could eclipse gold's $16 trillion market capitalization. It will be interesting to observe how Trump delivers on this dangling carrot in his coming term: a Bitcoin reserve makes investors out of all American taxpayers, a big risk on such a speculative asset for any government to take.

Leading U.S. economists agree. Paul Krugman, a Nobel Laureate and Professor Emeritus of Princeton University, recently called the creation of a national bitcoin reserve “a government bailout for a scandal-ridden, value- and environment-destroying industry.” And Larry Summers, who served as the U.S. Secretary of the Treasury and the Director of the National Economic Council, agrees, calling it completely “crazy.” He says, “There’s no reason to do that other than to pander to generous special-interest campaign contributors.”

Famously avid Trump campaign contributor and new government appointee Elon Musk is likely to be more focused on how opening up the industry fosters innovation. This position has been reflected in Trump's eagerness to out-pace countries like China. "If we don't embrace crypto and bitcoin technology, China will, other countries will. They'll dominate, and we cannot let China dominate. They are making too much progress as it is," Trump said.

Bitcoin - Digital Gold?

Maybe Trump is right, and there is a bigger plan behind his pro-crypto policies. After all, if the game lasts long enough and its size passes certain volumes, Bitcoin may become something like gold—an asset that humans hoard without any possible means of utilization.

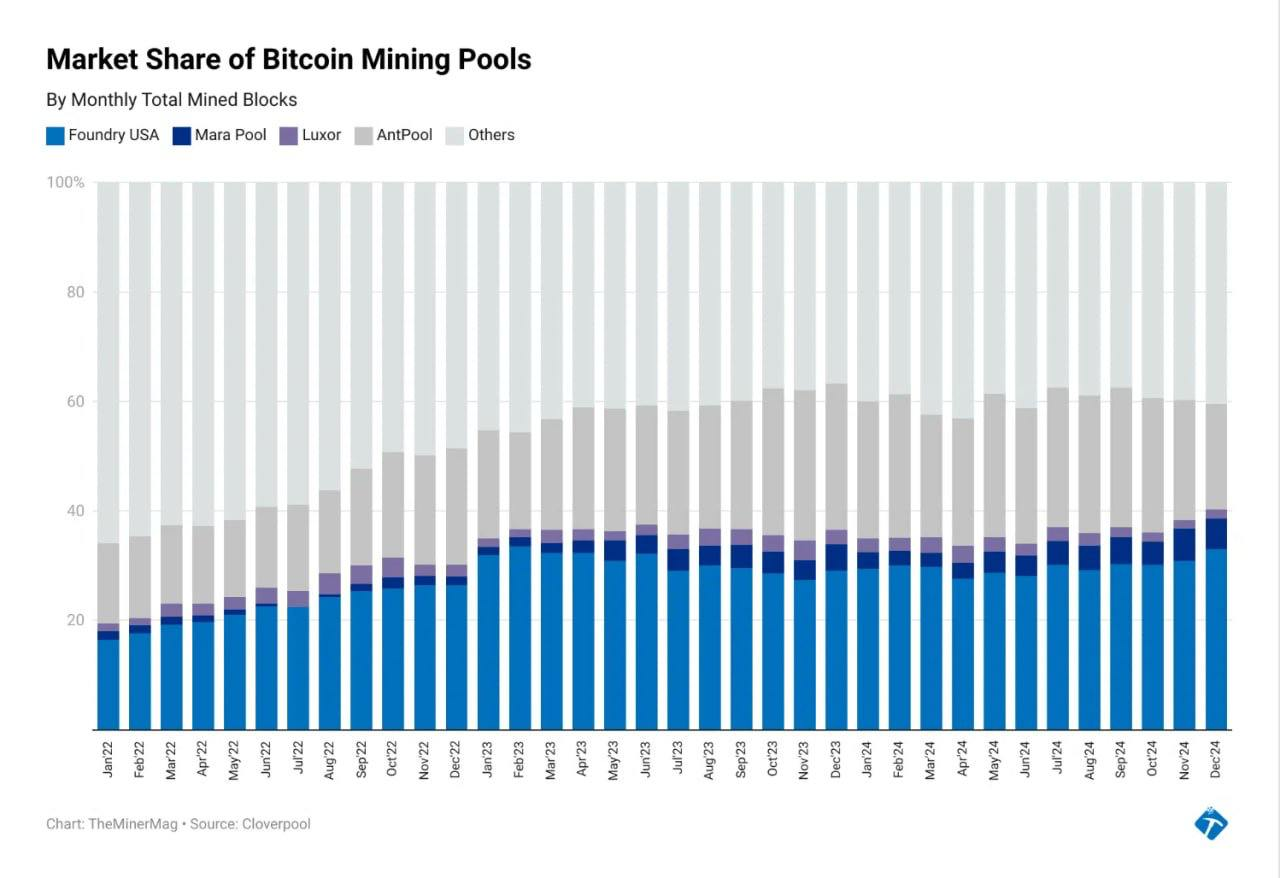

In this regard, the U.S. does have a competitive edge now. Despite all the restrictions, it is the largest crypto trading market, startup and community home. The most common bridge between fiat and bitcoin, stablecoins are largely denominated in U.S. Dollar. Even bitcoin mining, which heavily depends on the cost of infrastructure, has an almost 40% share in the U.S.

JP Koning's evolving perspective on Bitcoin reflects a broader shift in attitudes towards cryptocurrency, from skepticism to a pragmatic, albeit cautious, acceptance within the financial sector. Still, his position is that strong-arming Bitcoin adoption through the government is a slippery slope.

My worry is that calls for government support will only accelerate as more voters, government officials, and bureaucrats catch the orange coin mind virus and act on it. It begins with a small strategic reserve of a few billion dollars. It ends with the Department of Bitcoin Price Appreciation being allocated 50% of yearly tax revenues to make the number go up, to the detriment of infrastructure like roads, hospitals, and law enforcement.

Whatever the future of Bitcoin, as it surpassed a $2 trillion dollar market cap last year, early adopters are still the big winners, and there is still a lot of "new" market left to mine.

All I can hope is that my long history of writing on the topic might persuade a few readers that forcing others to play the game you love is not fair game.

Would you force others to play the game?