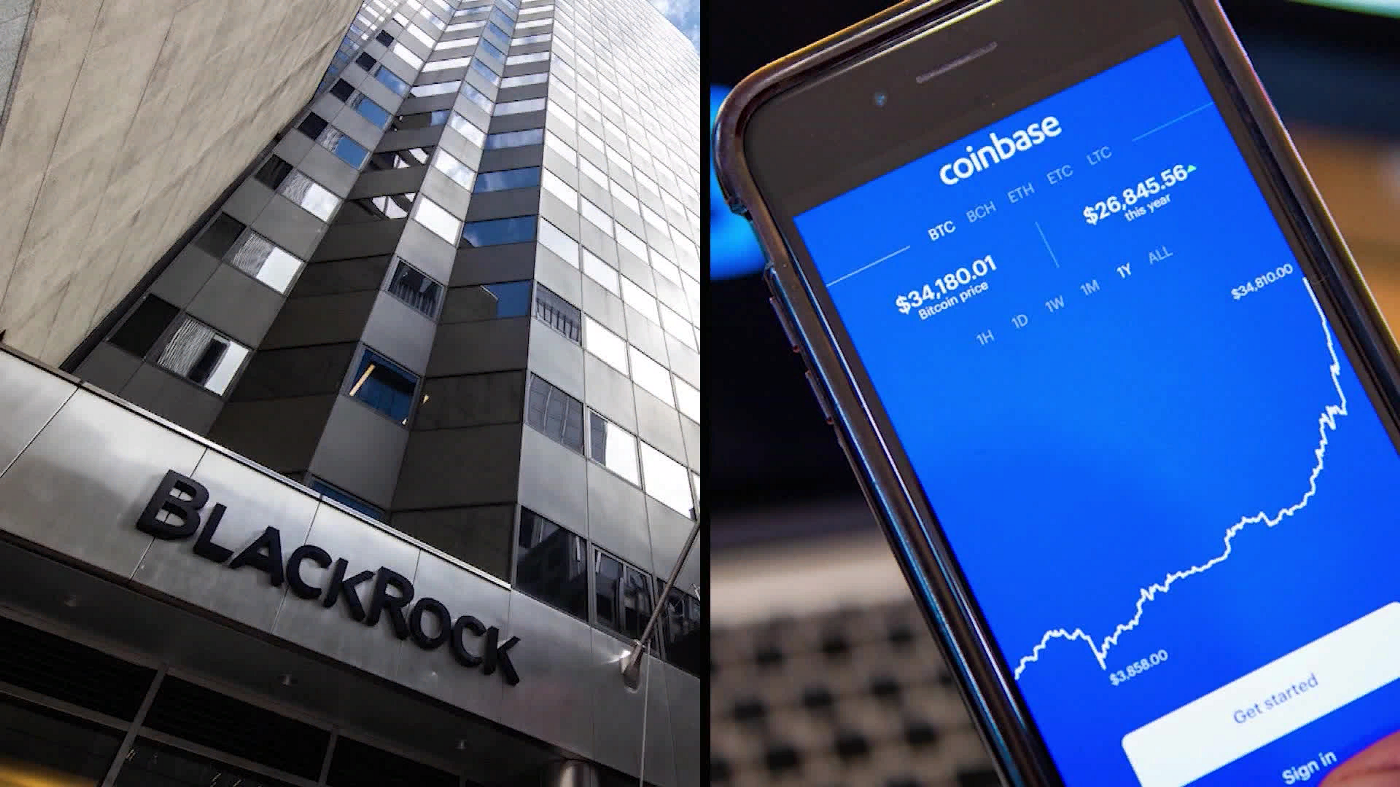

BlackRock, an American international investment corporation and the world’s largest asset manager announced the signing of a partnership agreement with Coinbase, the largest cryptocurrency exchange in the United States by trading volume.

BlackRock is going to provide its clients, who use Aladdin investment management system, to trade cryptocurrency via Coinbase. The first cryptocurrency that will be available for trading is Bitcoin, with other tokens to join later in the future.

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets.” Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships

This news pumped up the Coinbase stock price, which has been under pressure during the last year because of reports on staff reduction amid the falling crypto market and investigations into insider trading and unreported assets trading. However, the stock price was hit again by their second-quarter report where they fixed a $1.1 billion net income loss. It amounts to a loss of $4.98 a share, compared with the $2.47 loss expected by analysts.

This move might demonstrate that despite the bear crypto market, companies go on developing their digital tokens services. Earlier this year another Wall Street giant, Goldman Sachs, also entered the crypto world by giving out its first crypto-backed loan. The trend seems to persist.