At the beginning, back in 2016, the Brazilian Central bank president, Ilan Goldfajn, launched a research on the necessity of instant payments in the country. Inspired by similar tools, such as American Zelle fintech, Federal employees reported the upcoming benefits of its eventual implementation. It was expected to be an excellent policy encouraging competition, efficiency, security, and inclusion in Brazil’s payment system.

After it was fully developed, the project was launched effectively in 2020. Since then, it has been used consistently by all banking institutions, available 24/7.

Customers who want to use it must register a personal key (it could be one’s cell phone number, governmental ID) at any participating bank.

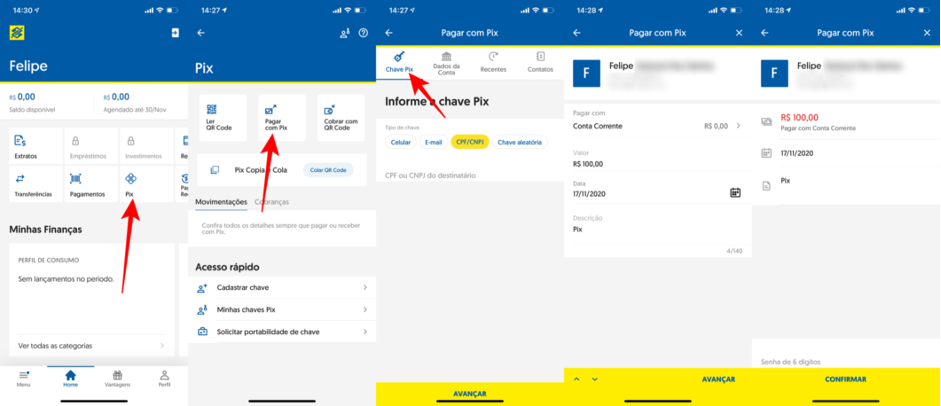

To “send someone a Pix”, all the customer needs is to enter the person’s key to which he is directing money to, confirm a certain value - done:

Unlike regular bank transfers, PIX works tax-free for natural citizens and is integrated smoothly into Apps of various kinds (from WhatsApp to Uber) allowing users to make faster and less bureaucratic use of services. It totally optimizes cash flow, eliminating unnecessary intermediaries.

Another PIX innovation was limiting transaction to 200 USD during the night. That policy goes along side with the rising number of Pix-related crimes, in which victims are kidnapped and forced to “pix out” all their savings to the criminals.

As for companies, PIX transactions are limitless (the only limit can be established by the company itself in order to avoid fraud).

🙋🏼 “For me pix was more related to organizing parties. Folks used to create WhatsApp groups, share their keys, and then all had to contribute with a certain amount of money so they could afford the party. Or, if I needed to pay something. My mom transfers me a pix, and then I instantly pay what I need, it takes like 5 min hah” - PIX user sharing his experience.

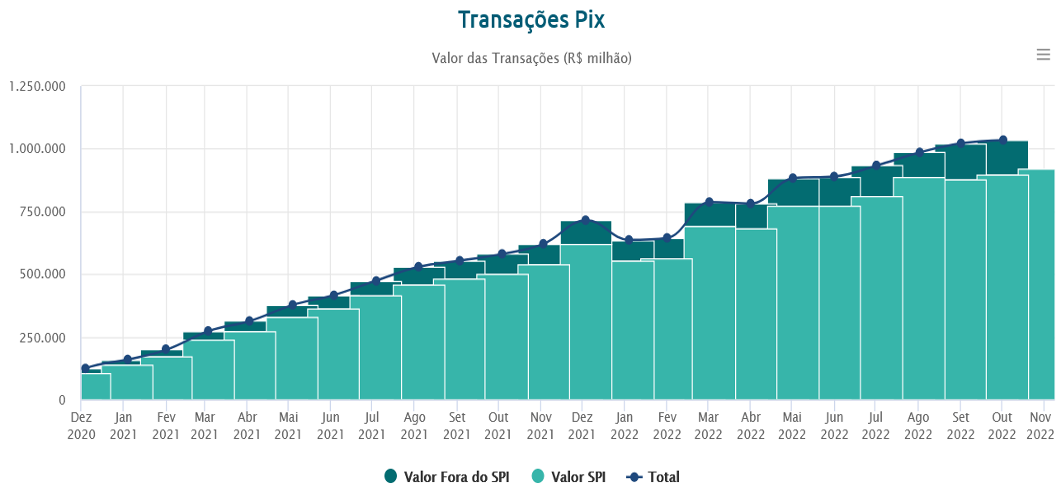

So far, according to Brazilian central bank information, PIX users have reached 140 million, out which 130 million are physical persons and 10 million are corporates. The transaction volume is already surpassing traditional payment methods for that niche and turning over more than USD 200 million a month:

As a consequence, the digitalization of the economy has ramped up drastically. According to the central Bank, Pix had dropped the quantity of paper money by 10% of its total size. That amount sums up to 40 billion Real (USD 7.5 billion) in a brief 8-month time period. Hence, further decay of Real banknotes is expected, with the upcoming Real-digital Initiative only adding to such prospects.

Pix payments have become so widespread that authorities started to think about taxing them. The current liberal minister of economy, Paulo Guedes, has even at some point proposed a 0.15% tariff on all Pix transactions. The idea was shelved to avoid waves of opposition at the brink of the 2022 elections.

Pix falls in the category of Alternative Payment Methods (APM), or Fast Retail Payment Systems (FRPS), defined by BIS. By its definition, it is focused on small-size retail utility, targeting the cash niche. Because of this, it is considered to be a potential alternative or maybe groundwork for CBDC. In different countries FRPSs are developing differently. Mexican Cobro Digital (CoDi) introduced in 2019, has reached a monthly transaction volume of only USD 13 million.