Gate.io, one of the world’s leading crypto exchanges by trading volume and number of listed coins, decided to end its services in Japan. The exchange explained the decision by pointing out that it is not compliant with local regulations and cannot operate in the country. The announcement doesn’t specify why the decision was made now or if it was made independently by the exchange or ‘motivated’ by the regulators.

“We strive to comply with financial regulations in all regions in which we operate. Based on this commitment, we are very sorry, but we have decided to terminate our service for Japan,” - the announcement states.

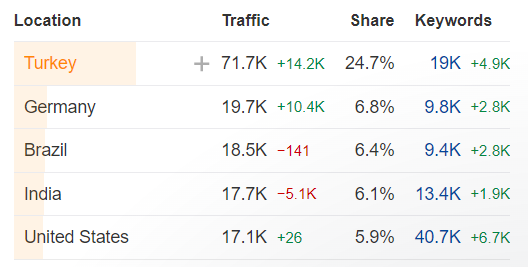

According to Gate.io website, the exchange holds licenses in only eight countries: Hong Kong, Gibraltar, Malta, Italy, Australia, Dubai DMCC, and the Bahamas. The web traffic of gate.io website, however, shows a different set of countries:

This data contradicts the company’s claim that it is striving to comply in all regions of operations.

No related changes to the Japan regulations have been made recently, and we have not observed any signs of local regulators ‘hunting’ crypto companies lately. Still, the Japanese crypto regulations, introduced following the Mt.Gox collapse, are relatively strict. Several reports have named Japan’s FSA’s increasing regulatory scrutiny, compliance requests, and pressure as the main reasons for this decision, and we tend to agree with the assumption that Gate.io's exit from the market is not fully voluntary. The FSA hasn’t commented on the situation so far.

Effective July 22, Gate.io will no longer open new accounts for Japanese citizens and residents. It will also remove all information in Japanese from its website. Over time, it will assist Japanese customers in migrating assets to compliant exchanges. The details of the migration process will be announced later “in accordance with compliance requests from authorities,” allegedly together with the date of the complete shutdown. The wording of the announcement might imply that instead of a complete shutdown, Gate.io will only limit the range of services:

“Details of the suspension of our services… will be implemented in accordance with compliance requests from authorities… and will be announced promptly. We will also explain the services that can be provided based on laws and regulations, the types of crypto assets, etc.”

The company is not fully licensed anywhere in Asia, although it has Chinese origins and is reportedly one of the most popular exchanges in Greater China. The first country stated in the list of licenses is Hong Kong. However, we earlier observed that Gate Group decided to exit the country on the eve of the implementation of new registration requirements. The existing Trust or Company Service Provider license doesn’t allow the company to operate as a VASP; it can only operate as a custody provider. Also citing compliance commitment, Gate.HK promised to undergo a "major overhaul" and then resume its registration process in Hong Kong, where, at the moment, only two exchanges are operating legally.

The Japanese crypto regulator has provided its residents with other options. According to the FSA website, 29 crypto-asset exchange service providers are registered in Japan. While the majority of the companies are relatively small, the list includes some first-tier exchanges, namely Coinbase and Binance Japan, the latter offering the widest selection of coins available for trade.

Another prominent name in the list is the notorious FTX. At the end of June, it was announced that BitFlyer, one of the major local exchanges, was going to acquire the Japanese arm of the collapsed crypto trading platform. After rebranding, it will offer crypto custody and ETF-related services as soon as they are approved in the country. It is expected that this will not take long after Hong Kong’s approval of applications for spot Bitcoin exchange-traded funds this April.