BlackRock's BUIDL fund has already taken the Ethereum network by storm — and now, it's expanding to five new chains.

Just eight months after launch — and swelling to a market cap of $541.7 million — the tokenized fund is branching out to Aptos, Arbitrum, Avalanche, Optimism and Polygon.

It's hoped the move will reduce fragmentation and enable a greater cross-section of institutional investors to gain exposure to BUIDL, all while enabling the fund's tokens to interact with more blockchain-based financial products and infrastructure.

The fund has been developed in conjunction with Securitize, and its CEO Carlos Domingo said:

"Real-world asset tokenization is scaling, and we're excited to have these blockchains added to increase the potential of the BUIDL ecosystem."

Each of these networks has established a reputation for offering greater levels of scalability than older Layer 1 chains — all while driving down the cost of transactions.

And it's interesting to note that there are differing management fees between these blockchains. While Arbitrum, Ethereum and Optimism are set at 50 basis points, the likes of Aptos, Avalanche and Polygon are 60% cheaper at a mere 20 bps.

BUIDL's background

BUIDL has now cemented itself as the largest blockchain-based money market fund, and is primarily backed by short-term U.S. Treasuries.

Of course, BlackRock has also been heavily involved in rolling out market-leading exchange-traded funds based on the spot prices of bitcoin and Ether — with speculation growing that ETFs for smaller altcoins could follow as president-elect Donald Trump pursues a relaxed regulatory landscape.

The ambition being tokenizing a money market fund is rooted in delivering faster settlement times and greater efficiency behind the scenes, bolstering access to digital dollars in the process.

Use cases for BUIDL include providing collateral when institutional investors are trading, or providing a yield.

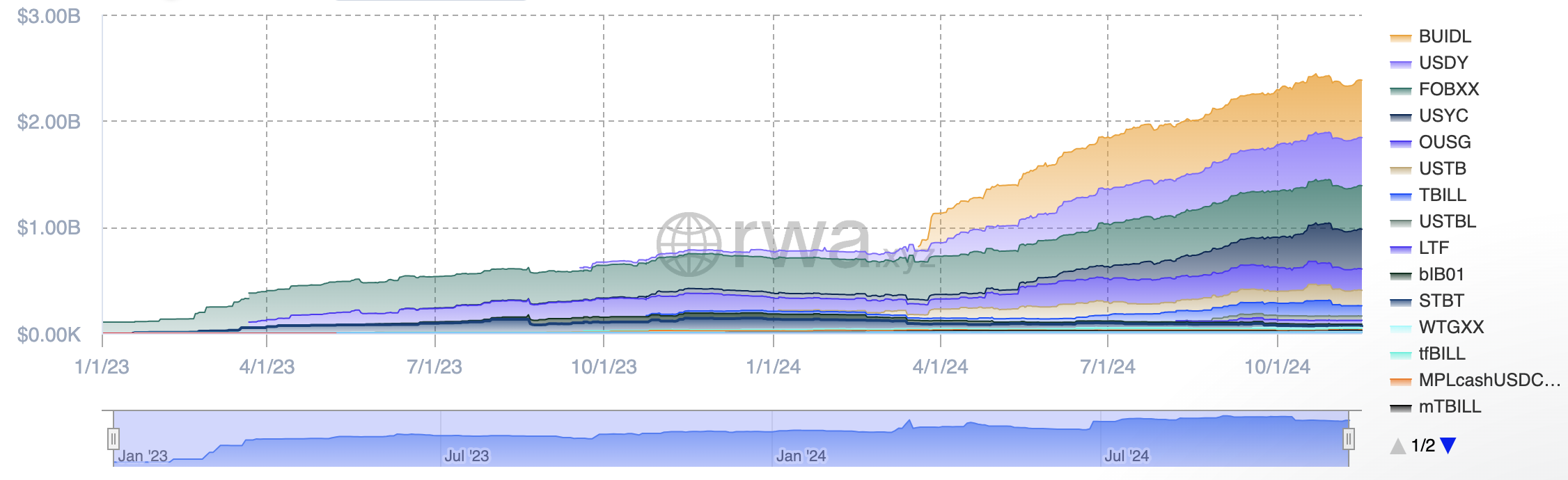

Data from rwa.xyz shows how this fund has established an early headstart in this rapidly growing industry — commanding 22% market share in a Tokenized Treasuries sector worth $2.3 billion.

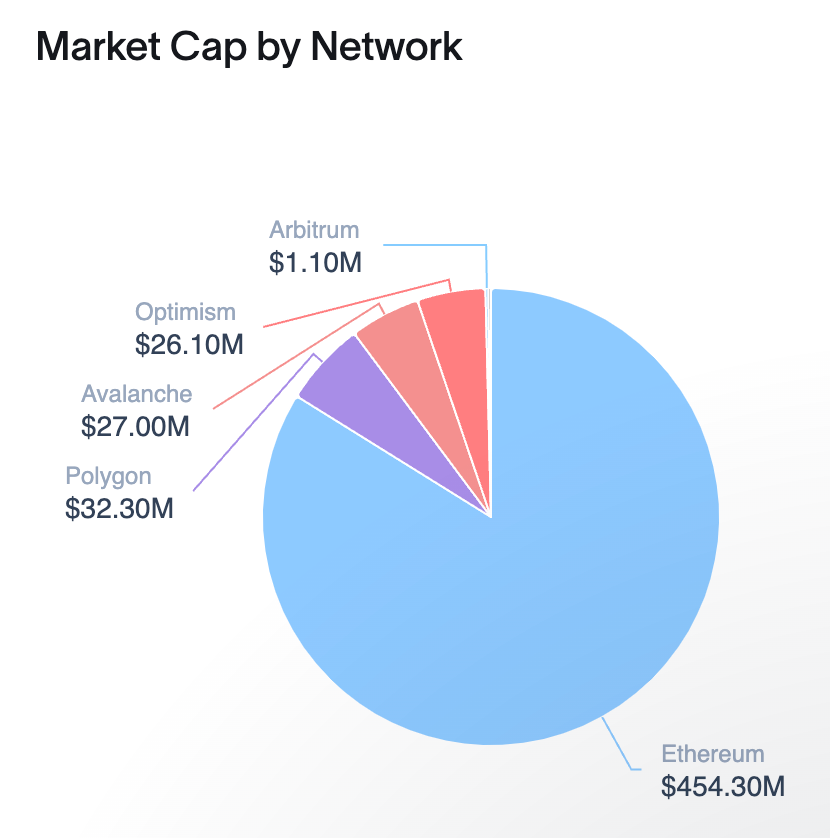

Early doors analysis shows Ethereum remains the most popular blockchain for BUIDL by a country mile, with Polygon a distant second, and Avalanche and Optimism vying for third.

BlackRock's diversification could be regarded as a vote of confidence in smaller blockchains, and offer a hint as to how it might innovate in the years to come.