At last week's Singapore FinTech Festival, the National Bank of Cambodia (NBC) announced a collaborative partnership between its Bakong payment system and China's Ant Group's Alipay+.

The Cambodian central bank, represented by Governor Chea Serey and the head of Alipay, Douglas Feagin, signed a Memorandum of Understanding to implement an integration of the two payment systems.

The NBC has operated the Bakong payment system since October 2020. Having been developed in cooperation with Japanese blockchain solutions firm Soramitsu, the system is similar to a central bank digital currency (CBDC) although the balances are the liability of the commercial banks which use it, rather than the central bank. It has cross-border functionality and has gained popularity not only locally but also in neighboring countries.

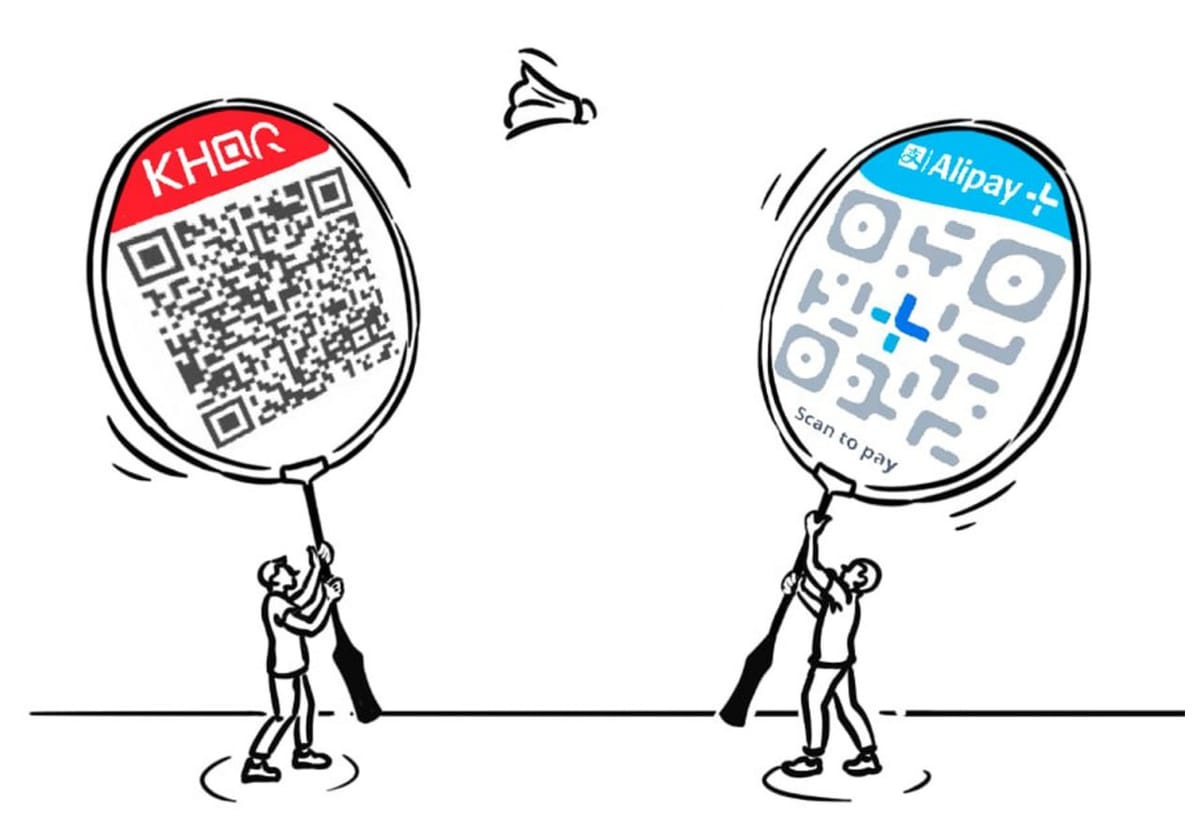

Powered by Bakong, NBC is now rolling out the KHQR system - a universal QR code-based interface for merchants and p2p transfers. Alipay+ is a similar solution from China's leading payment platform, which also uses QR codes as its main interface. Through the new partnership, Bakong users will be able to access Alipay’s vast merchant network, while Alipay users visiting Cambodia and the neighboring region can make payments using Bakong QR codes at local stores.

Alipay+ is Ant Group’s initiative to introduce international mobile payment services in China, where mobile wallet payment systems dominate credit and debit cards. Its growth strategy is focused on onboarding key mobile wallets from overseas, with an eye currently on the Asian market.

In September alone, the service announced the onboarding of mPay of Macao, Hipay of Mongolia, Changi Pay and OCBC of Singapore, Naver Pay and Toss Pay of South Korea, and TrueMoney of Thailand. AlipayHK (Hong Kong SAR, China), Touch ’n Go eWallet (Malaysia) and Kakao Pay (South Korea) were the first pilot integrations back in 2022.

NBC’s Bakong also has aspirations towards regional expansion, and the Chinese market is considered a strategic move in this direction. In July, NBC signed a MoU with China’s UnionPay International on the use of QR codes for cross-border payments. However, the partnership with Alipay+ is without a doubt a bigger win for Bakong, as an NBC spokesperson explained:

“The MoU aims to promote cross-border payment transactions via QR code between the KHQR network and Alipay+ efficiently and securely. Through this partnership, Bakong users can make payments with 83 million Alipay merchants worldwide.”

Mobile payment platforms and CBDCs are sometimes seen as two competing technologies. With integrations such as that between Bakong and Alipay, however, the lines are blurring and we are Observing interesting combinations of public services and commercial systems.