The Western allies have removed some Russian state-controlled banks from SWIFT after another round of sanctions, keeping the rest within the global financial system. The country seems to be ready to shift the sanctioned banks to its own SWIFT analogue.

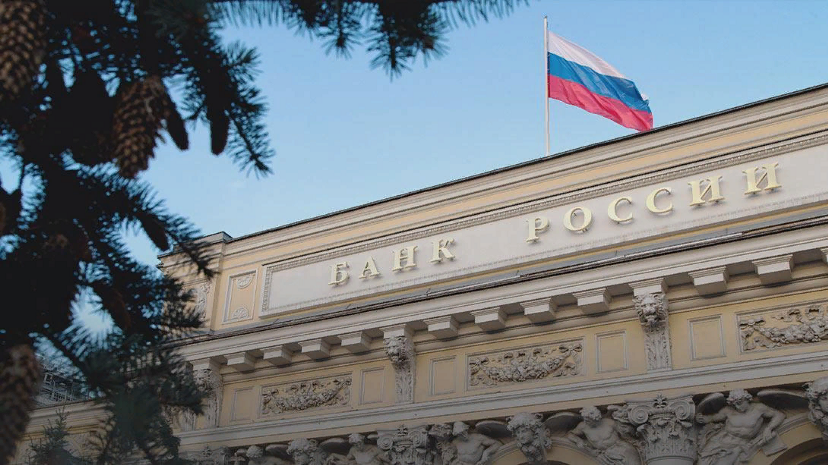

Back in 2014, the Central Bank of Russia began to develop its own messaging network for financial institutions amid increasing talk about cutting off Russia from the global SWIFT network. Now, in 2022, some Russian banks are indeed banned from SWIFT in response to Russia’s invasion of Ukraine, and SPFS has become especially significant for the blacklisted organizations.

💡 SWIFT, the Society for the Worldwide Interbank Financial Telecommunication, is the dominant global payment network for corporates that enables a messaging service for financial data. It counts more than 11,000 financial institutions in over 200 countries and territories. SPFS, or the System for Transfer of Financial Messages, is the Russian equivalent of SWIFT.

As of March 15, the most recent available webarchive copy of the page on the website of the Central Bank of Russia, there were 338 foreign banks connected to the SPFS from 9 countries, including Germany, Switzerland, Cuba, and some former USSR countries (European countries are in fact represented by Russian subsidiaries). Now, the CBR is keeping the names of participants secret.

There have also been reports about a Russian proposal to the Indian government to use the SPFS for bilateral payments. Yet, no official information on the discussion of the offer was published. Probably, the Central Bank of Russia is not disclosing the new participants of the SPFS to keep them away from international pressure.

Russia is not the only country to implement its alternative for SWIFT. In 2015, China’s central bank introduced CIPS (Cross-Border Interbank Payment System) intending to internationalize the use of the yuan. According to Announcement №65 published on May 31, CIPS has a much larger network than the Russian system: 1189 participants, covering 101 countries and regions around the world.

Although the SPFS could be a viable option, to this day only banks from very few countries are linked to the system, with the overwhelming majority of the participants being within the country. Therefore, CIPS’ vastly superior coverage becomes the more likely alternative for the Russian sanctioned banks.