In a recent video, Charles Hoskinson teased major, confidential developments for Cardano scheduled for February.

“February is going to be a very crazy month. We’ve got some stuff going on—I can’t talk about it now, but you’re gonna see, it’s gonna be fun,”

Cardano Founder: “February is going to be a very crazy month. You’ll see.” $ADApic.twitter.com/CAusjsSUbW

— Altcoin Daily (@AltcoinDailyio) February 1, 2025

The $ADA token has been extremely volatile since November. Between then and today, its price soared from $0.35 to $1.20 before retracing down to $0.70. Hoskinson has been overtly positive, winding up speculation around Cardano even more.

The sentiment is partly fueled by news that Hoskinson has become an advisor to Trump’s crypto policy team. As such, he may lobby for Cardano’s interests, which, thanks to his recent excitement, would likely bear fruit.

Technical Upgrades and Integrations

In addition to these “political breakthroughs,” Cardano has been busy releasing technical upgrades and hinting at integrations with Bitcoin.

The project recently launched the Plomin hard fork, which introduces a decentralized governance system. Previously, Cardano’s three founding entities (Cardano Foundation, IOHK, and Emurgo) managed governance changes and chain upgrades. Now, however, Delegate Representatives (dReps), elected by $ADA token holders, will be responsible for the chain’s direction. Plomin arrived just four months after Cardano’s “Chang” hard fork, which implemented many of the mechanisms now incorporated into Plomin.

Looking ahead to the project’s roadmap, one of Cardano’s primary goals for 2025 is to enhance scalability. The team also plans to build more tools for developers and introduce privacy-preserving features.

Hoskinson has also teased the integration of Cardano with Bitcoin. Since both networks utilize the UTXO transactional model, he suggests that connecting the Bitcoin chain to Cardano could unlock trillions in liquidity and bring millions of Bitcoin users into the Cardano ecosystem.

BREAKING

— Nala (@NALAp20) January 27, 2025

Charles says the chain most likely to enable smart contracts for Bitcoin is Cardano, as both chains utilize the UTXO model.

This could bring trillions of BTC liquidity to $ADA without changing Bitcoin pic.twitter.com/2ASdHdC747

This approach could position Cardano as a Bitcoin side chain. However, given the recent surge in Bitcoin side chains, its success remains uncertain.

The Harsh Reality Behind the Fanfare

Cardano currently ranks as the ninth project on CoinMarketCap, with a market capitalization of $26 billion—a valuation largely driven by two factors: its long-standing community and its newfound political potential.

Yet, from a usage perspective, this valuation seems hard to justify. Cardano often seems to be playing catch-up, frequently adopting ideas that have already been successfully implemented on multiple other blockchains, but with questionable success.

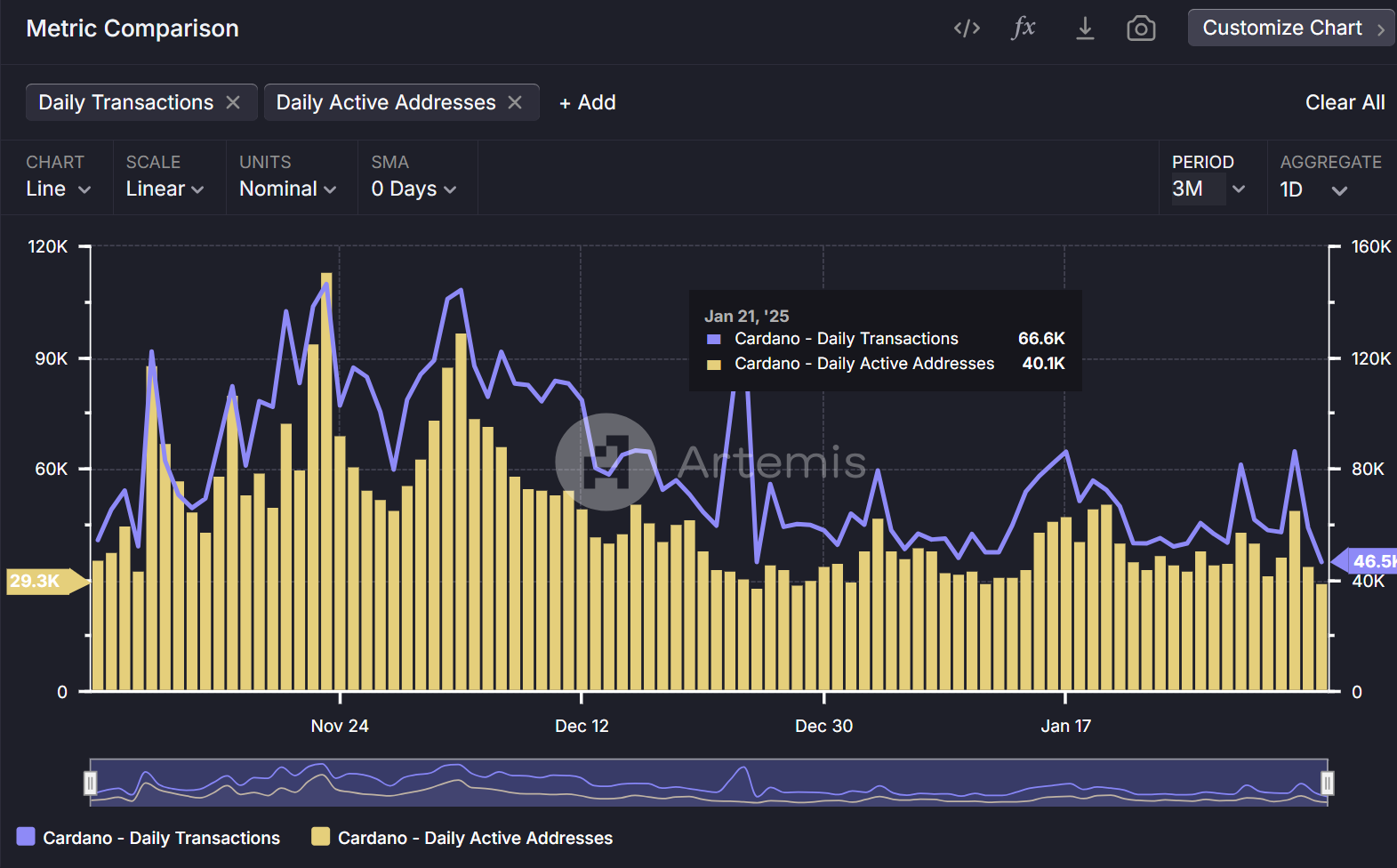

Cardano’s development roadmap has faced multiple delays, and there is little evidence of significant improvements. Currently, the network averages about 30,000 daily active addresses and around 70,000 daily transactions. In contrast, Ethereum sees roughly 1.3 million daily active addresses and 400,000 transactions, while Solana boasts 5.5 million daily active addresses and 64 million transactions.

If Ethereum has carved out a niche in DeFi and Solana in memecoins, Cardano’s slower development has left it struggling to define a unique selling proposition, as reflected in its lower usage metrics.

Ironically, in the crypto world, fundamentals sometimes take a back seat to attention. The rapid rise of meme coins demonstrates that the asset receiving the most attention often commands a higher price, regardless of underlying utility. Also, while traditional Web2 companies might fade away once their business models fail, many longstanding web3 projects have accumulated billions in their treasuries—despite their sometimes questionable management—and “continue to develop,” even if results are minimal.

After years of experience in the crypto space, Charles Hoskinson knows the rules well. His recent efforts at the White House could potentially spark a significant spike in Cardano and $ADA. Yet, whether these developments will translate into meaningful utility for the Cardano blockchain remains uncertain. It’s challenging to win in a competitive arena when one is consistently trailing the competition.

Whether Cardano’s “fake it till you make it” strategy will eventually pay off is still an open question. What is clear, however, is that Cardano has been enduring for over eight years since its mainnet launch and is likely to persist for many more years to come.