Celestia launched its mainnet amid significant fanfare in November 2023, with its token price nearly increasing tenfold immediately after the launch. The project introduced an innovative data availability layer that is significantly cheaper than Ethereum’s Layer 1 offering.

This cost advantage was designed to attract L2 solutions into its ecosystem and capture some of Ethereum L1’s market share. However, after more than a year, not much has changed—major Ethereum rollups still use Ethereum for data availability, while Celestia’s governance token, $TIA, plummeted 80% from its all-time high.

Data Availability in the Ethereum Ecosystem

Typically, Layer 2 chains manage data availability by periodically transferring data back to the Ethereum mainnet. However, storing data on Ethereum can cost millions of dollars annually for large Layer 2 platforms, with these expenses ultimately passed on to the users.

Given the high costs associated with Ethereum’s data availability, Celestia and several other projects have launched dedicated networks that offer significantly cheaper storage solutions for Ethereum’s Layer 2s.

According to project reports, Celestia’s data availability is currently up to 95% more cost-effective than Ethereum’s.

Why Aren’t Major Rollups Adopting Celestia Despite Its Cost Benefits?

According to the latest data from L2Beat, despite the emergence of Celestia and several other data availability layers, Ethereum still dominates the space with nearly 98% market share and a total value secured of $37.6 billion. Major rollups like Base and Arbitrum continue to choose Ethereum for several reasons.

First, Ethereum remains the largest decentralized chain in the space, offering stronger security guarantees than any other data availability layer currently available. Second, there are numerous political considerations—Base, Arbitrum, and Optimism all originated within the Ethereum ecosystem, and moving away from Ethereum’s data availability could be seen as a betrayal of their origins and community.

Ethereum’s future relies on Layer 2 solutions using its data availability layer, and the Ethereum team is actively working to make data availability more cost-effective to discourage chains from seeking alternative solutions. Last year, the introduction of blobs significantly reduced costs for Layer 2s, making Ethereum more competitive with newly launched DA layers. The network is also on track to increase its blob capacity, thereby accommodating the growing demand from emerging Layer 2 projects.

Furthermore, Vitalik Buterin has emphasized that if chains transition to a data availability solution outside of Ethereum, they may no longer be considered true Ethereum Layer 2s, as they would be relying on the security of another chain.

Are Celestia and Other DA Layers Doomed to Becoming Irrelevant?

However, despite Ethereum’s efforts to reduce data availability costs, its competition with Celestia and other DA layers is far from over. Some networks have already opted for Celestia as their data availability solution due to Ethereum’s high expense, especially for high-throughput networks. A prime example is Eclipse, the Solana Virtual Machine Layer 2.

There is simply not enough capacity for a high-throughput L2 today using EIP-4844 blobs. Eclipse posts more data today than what could fit in the entire blobspace for Ethereum, at an average of “only” 2k TPS!

Moreover, many chains may not require the exceptionally high-security guarantees provided by Ethereum, finding Celestia’s level of security to be sufficient. There are also advocates who believe that Celestia will outperform Ethereum in the long term—for instance, researchers at Nansen have presented a long-term thesis favoring Celestia.

Our long-term thesis is simple: the number of layer 2s will continue to grow, and the amount of data they consume will grow exponentially, which will create a lot of demand for Celestia’s Data Availability layer (DA). In other words, we believe that, at its core, Celestia can serve rollups better than Ethereum, and TIA can serve as an index bet on the direct growth of rollups rather than ETH

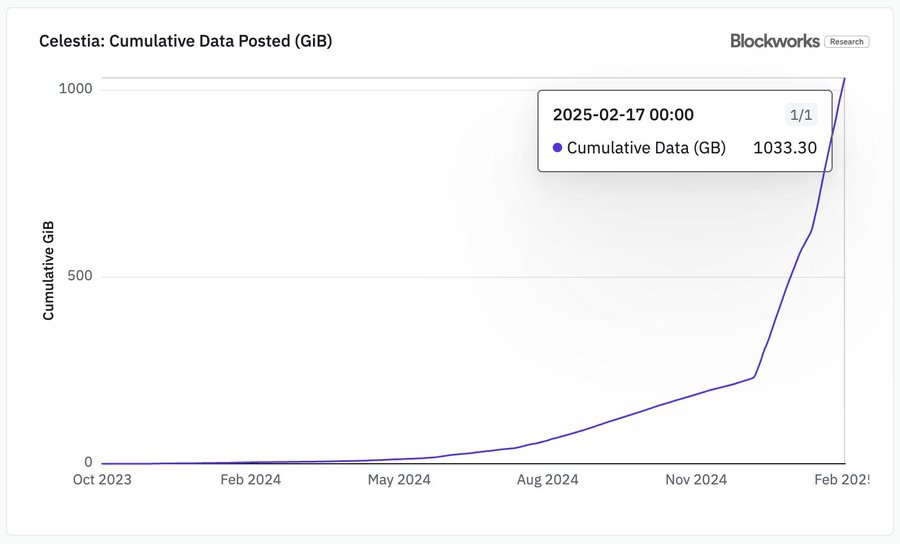

Currently, cumulative data posted on Celestia since its launch has passed 1TB.

Celestia’s Challenges with Tokenomics and Token Value Accrual

In the Web3 world, a project’s success or adoption doesn't always correlate with the success of its token. Despite Celestia’s growing adoption and technical progress compared to a year ago, the community is largely disappointed with the TIA token price, which has fallen significantly from its all-time high.

This significant decline is primarily due to investor unlocks and profit-taking, with around $146 million in TIA being unlocked monthly for the next nine months.

just a reminder that $TIA unlocks are 974,730 tokens per day which is $4,872,675

— merp (@0xMerp) January 13, 2025

this translates to roughly $146,180,258 per month

for the next 9 months pic.twitter.com/evdAUwvcDp

Additionally, the project currently generates relatively low fees from storage, around $500k-$600k annually, which doesn’t justify its $3.5 billion fully diluted valuation (FDV). For comparison, Filecoin, which is a different-purpose decentralized storage project, counts revenue in the hundreds of millions with an FDV of 5.8 billion.

All the above factors make Celestia an interesting but seemingly overpriced competitor to Ethereum, and only time will tell if it will succeed.