● Fong, who has funds locked on Celsius, claims to have been given the information by disgruntled former employees and has been reporting on the bankruptcy case as it unfolds.

● Celsius' legal counsel has reportedly worked on drafting cease and desist letters and a motion to compel.

● The firm announced it would file a Disclosure Statement and Plan solicitation by the end of the month.

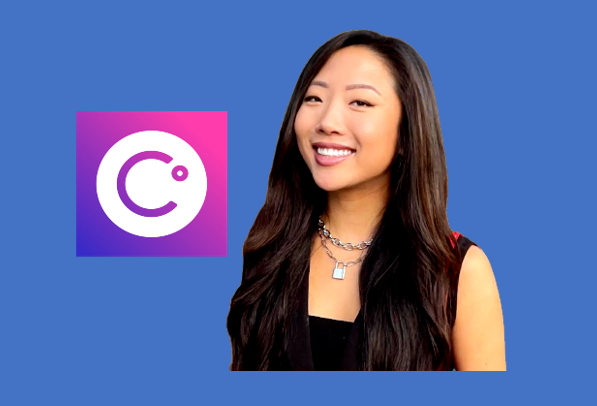

Celsius Network, which filed for bankruptcy last year, may take legal action against cryptocurrency blogger and Celsius creditor Tiffany Fong for sharing confidential internal information. Fong currently has around $119,000 in crypto assets, including Bitcoin, locked on Celsius after the company halted withdrawals in June 2022. Since then, Fong has been actively reporting on the bankruptcy case on social media platforms, including sharing leaked information allegedly provided to her by former Celsius employees.

According to a statement by Celsius' law firm, Kirkland & Ellis International, to the bankruptcy court for the Southern District of New York, the firm reported that it had billed 77 hours, worth about $72,000, for work on an invoice titled "Tiffany Fong litigation." The statement indicated that the law firm was drafting cease and desist letters for Fong and a motion to compel asking courts to enforce a request for information. Celsius' law firm also looked into the leaked information that Fong reported via her social media.

They sued you?

— The Financer (@thefinancer) April 14, 2023

⚖️ @Kirkland_Ellis attorney Ross Kwasteniet billed creditors $1M for his “work” over Jan-Feb.

— Cam Crews (@camcrews) April 14, 2023

This included $5,726 to “analyze fallout from @TiffanyFong_ leak.”

You could have asked any creditor for free: the leaked bids revealed you to be filthy liars. pic.twitter.com/CXjvsc8sjH

The confidential data relates to company bids on Celsius assets, alleged audio of private company discussions, and alleged transaction activity of executives, such as former CEO and founder Alex Mashinsky. Fong alleges that Celsius is attempting to sue her over something that is not a legal issue and that the company is using customer funds to do so. Celsius has not commented on the potential litigation. A few days ago, Fong and other crypto content creators approached Alex Mashinsky and his wife Krissy Mashinsky in public in an attempt to strike a conversation on the topic as the couple left hurriedly.

Celsius Network was once a prominent New Jersey-based cryptocurrency lending company that enabled users to deposit various digital assets, including popular cryptocurrencies like Bitcoin and Ethereum, into a Celsius wallet to earn interest. Furthermore, clients could secure loans by pledging their cryptocurrencies as collateral. By May 2022, Celsius had lent out a staggering $8 billion to clients, with almost $12 billion in assets under management, attesting to its success as a popular and reputable platform.

However, in June 2022, Celsius made headlines when it halted all transfers and withdrawals indefinitely, citing "extreme market conditions" as the reason behind this decision. This action had an immediate impact on the price of Bitcoin and other cryptocurrencies, leading to significant declines. Despite attempts to remedy the situation, Celsius filed for Chapter 11 bankruptcy on July 13, 2022, marking the fall of the once-thriving crypto platform.

Following the bankruptcy filing, software engineer and writer Molly White tweeted a compilation of excerpts from customer letters to the bankruptcy court judge that revealed concerns about frozen funds and the negative impact on customers' lives. The company announced two options on their bankruptcy website: the choice to recover cash at a discount or remain 'long' crypto.

Transparency was a priority for the court, as Celsius was ordered to publish customer lists containing financial details on September 28, 2022. The Celsius Networth website was created to provide information to the public, and the top three names were reported to have lost $40.5 million, $38.2 million, and $26.4 million, respectively. Despite owing users approximately $4.7 billion, Celsius lacked the funds to pay them.

Celsius announced on December 2, 2022, that it would sell GK8, a digital asset custody platform, to Galaxy Digital Holdings, a company founded by Michael Novogratz. The sale proceeds were expected to go towards Celsius's legal fees and former customers, according to a lawyer representing Celsius's creditors.

On December 7, 2022, a US bankruptcy judge mandated that Celsius return $50 million worth of cryptocurrency to users who had assets in the firm' custody accounts. In January 2023, the same judge ruled that about 600,000 customers had deposited cryptocurrency that belonged to Celsius under the company's terms of use, making them unsecured creditors.

At a court hearing on February 15, 2023, Celsius announced that it had selected NovaWulf Digital Management to provide guidance for its path out of bankruptcy. The deal was subject to approval by a bankruptcy judge and by Celsius's creditors, and while some creditors objected to the terms, the unsecured creditor committee (UCC) agreed that Celsius should proceed with the NovaWulf deal.

On April 13, Celsius announced in a tweet that it would plan to file a Disclosure Statement and Plan solicitation by April 28, 2023 and stated it "will continue to work with all stakeholders to progress toward this next key milestone in [its] cases." We will continue to observe the situation as it unfolds.