I recently came across a funny video about living in a social credit system, and decided to check up on China — the country where the dystopian “Black Mirror” reality is about to come true.

The video depicts a life of an average young man in a country with a social credit system: first, he gets punished for spending too much time playing video games, then he doesn’t have enough social credit points to ride a bus, tries to earn some by donating money to the homeless, and finally rides the bus. Unfortunately, a female passenger on the bus files a complaint that he is harassing her, and the guy is out in the street again. Luckily, a fellow citizen offers him a ride, but gets too honest about his discontent with the social credit system, loses considerable points and is no longer allowed to drive a car. This entertaining, but Chinese reality is far more complicated and, in some ways, worse.

China’s social credit system is a regulatory framework intended to report on the ‘trustworthiness’ of individuals, corporations, and governmental institutions in the country. The goal is to make it easier for people and businesses to make fully-informed business decisions. A high social credit score will be an indicator that a party can be trusted in a business context. The outcome of the system will be a unified record of people, businesses, and the government, which can be monitored in real-time.

The introduction of a unified China social credit system was formally announced in 2014 and was supposed to be fully implemented by 2020, but the Covid pandemic delayed the process. The precursors of this system have operated in the country for centuries, like the existing social rankings and ratings. For instance, there is the dàng’àn (still being used in China) — a set of records related to an individual within China, it includes information about physical appearance, employment, academic records, penalties, etc. One copy of it is kept by the Public Security Bureau and the other by the individual’s work unit. Based on this file, one can get a promotion or not, or get a passport or not. The major difference with the modern social credit system is that the paper version is far less convenient.

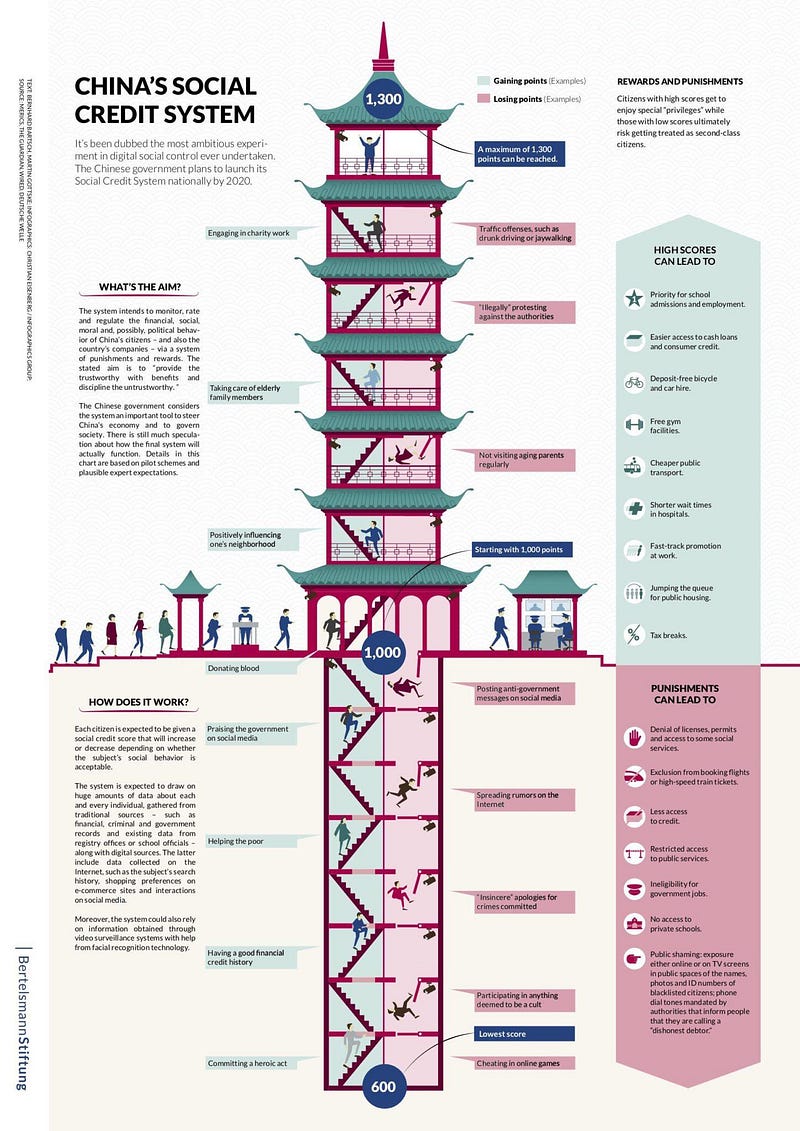

Let’s try and outline the main mechanisms of the system. The fundamental building block of the social credit system is data gathering and sharing, with “big data” coming in handy. Then this data will be used to put corporations and individuals on blacklists and redlists. Based on their score (and not only) on the lists, they will be punished or rewarded.

The mechanisms outlined above will be performed by various actors. The social credit system is driven by the State Council assisted by the National Development and Reform Commission (NDRC). The People’s Bank of China (PBoC) also plays a prominent role in policy direction. Then there are central government departments and agencies and the Supreme People’s Court. Finally, there are private companies that have developed their own credit systems with voluntary participation, and those who provide the infrastructure for the system.

As for the implementation, everything was going well, and in 2018 12 cities in China became ‘model cities’ for testing the system. Maybe the most prominent example is Rongchen — it introduced a comprehensive grading, reward and punishment system. The following year they started moving towards using AI to provide early warning of risky actors, but in 2020 the whole plan was largely altered by the pandemic.

2022 marks a new phase in the development and implementation of China’s social credit system. Until now, development has been guided by a national policy document known as the ‘Planning Outline for the Construction of a Social Credit System (2014–2020)’. This has seen the deployment of the social credit system widely throughout China. The implementation of the system for corporations is even more advanced: about 33 million businesses in China have already been given a score under some version of the corporate social credit system.

In the video we watched, as well as in real life, people are scared of consequences, but as the system is still evolving, it is impossible to say what exactly the negative consequences will be. These could be travel bans, school bans, employment limitations or even public shaming. Rewards for businesses could mean faster administrative procedures, fewer inspections, etc.

Moreover, China has recently introduced its own digital currency, controlled by China’s central bank, the People’s Bank of China, and it is seen by some commentators as a form of Chinese government surveillance and control over users and their financial transactions. Worst scenario: people with low social credit score will have limited access to this ‘new money’. However, currently the central bank states that it is limiting how it tracks individuals, through the so-called “controllable anonymity”.

Surprisingly, most Chinese citizens approve of the social credit system. And there are quite a few examples of ‘similar’ trust systems in other countries. In Australia, New Zealanders have to pass a ‘good character’ test, which has been used to deport those who have been a resident in Australia for decades. In Germany there is ‘SCHUFA’ — a score that is necessary for renting or buying a house, borrowing, or receiving goods on credit. Moreover, quite a similar thing is happening in Russia, where people can get real sentences for graffiti or a social network post.

In China the social credit system aims to be an all-encompassing system for assessing the trustworthiness of individuals, corporations and government actors. To date, there is no unified social credit score. But the government could be quite quick to bring it all together. Let’s further monitor the situation.