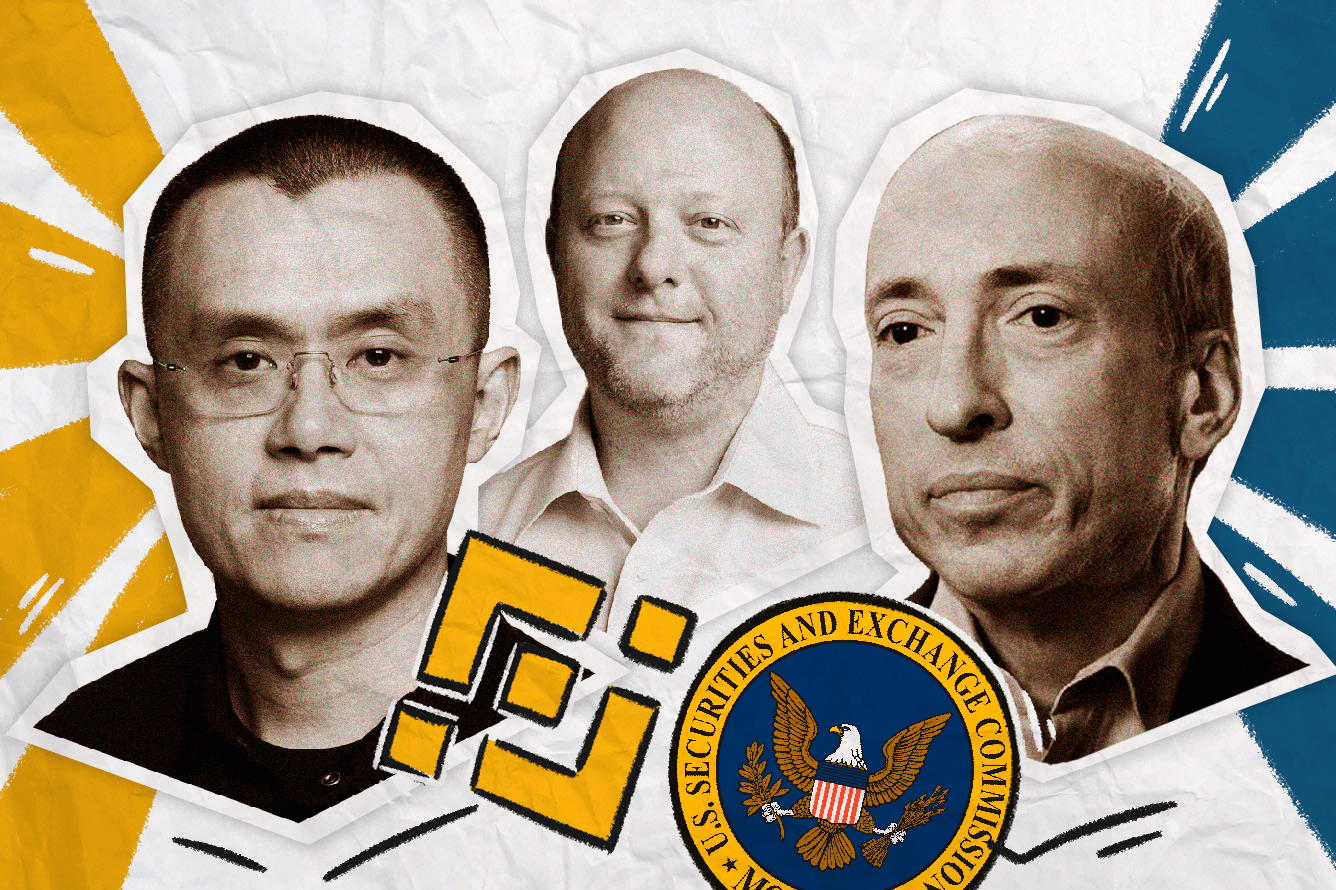

This June the SEC accused Binance, Binance.US and CZ of multiple legal violations, including the operation of unregistered exchanges, broker-dealers and clearing agencies, misrepresenting trading controls, and lack of oversight on the Binance.US platform.

The defendants filed a motion to dismiss the lawsuit claiming that the SEC primarily failed to establish proper regulation and then overstepped its authority. Both parties asked for a protective order from the judge to “govern the treatment and disclosure of certain confidential information during the course of this litigation.”

October 12 was expected to be the key hearing date between Binance and the SEC. We all expected a fight but it never really happened.

One day before the hearing Judge Jackson accepted Circle as amicus curiae. The USDC issuer claimed that stablecoins are not securities and that the SEC doesn’t have jurisdiction over payment stablecoins, which might strengthen Binance's position and its motion to dismiss the lawsuit. The amicus curiae may only participate in oral argument after the court’s permission.

On the same day Binance, Binance.US, and CZ, along with the SEC submitted a joint status report in response to the September court order to work on the various discovery requests and depositions together. Unfortunately, both parties have failed to reach any conclusion on the matter of discovery requests. Binance.US believes the SEC's requests are unreasonable, and that its approach is inconsistent with the consent order. However, parties have reportedly confirmed the next deposition for October 18, with several more to follow throughout the rest of October and November.

The SEC is not alone in this fight. Binance also has ongoing litigation with CFTC, along with other authorities worldwide. Moreover, the exchange is allegedly also under investigation by the U.S. DOJ for potential violation of sanctions against Russia.

The exchange has been hit hard by all these legal issues. Binance’s spot market share has fallen for seven consecutive months, according to CCData. Currently, it accounts for 34.3% compared to 55.2% in January this year. This September, Binance.US daily trading volumes had dropped by more than 98% compared to September 2022.

Compliance issues have not only resulted in a loss of customers but also personnel and partners, including Mastercard and Visa, which have pared back their co-branded card projects with the exchange. Brian Shroder, the CEO and president of Binance.US, left the company in mid-September, adding to several employees from the legal and compliance units that fled the exchange this summer. Binance.US has cut roughly a third of its workforce, and Binance had to sell its Russian branch, previously one of the exchange's biggest markets, to the mysterious CommEx.

As the legal battle unfolds, we continue Observing and watching for potential impact on the industry.