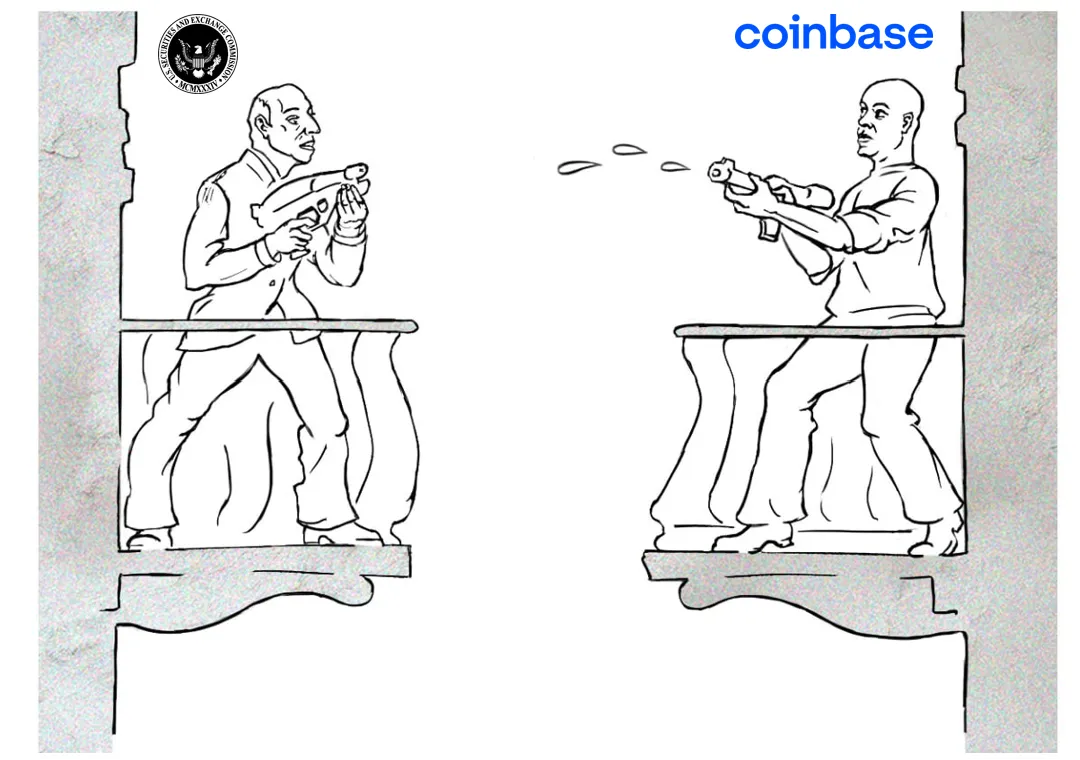

Coinbase, one of the leading centralized crypto exchanges, has accused the U.S. Securities and Exchange Commission (SEC) of breaking the law when it denied the company's petition for crypto rulemaking without proper explanation. A 'Brief for Petitioner' filed in the U.S. Court of Appeals for the Third Circuit aims to prove that the Commission’s refusal to engage in rulemaking violated the Administrative Procedures Act and that its failure to provide a reasoned explanation for the denial of the rulemaking petition was (those words again) “arbitrary and capricious.” Coinbase requests that the court vacate the SEC’s denial and direct the agency to begin the “long-overdue” process of rulemaking or at least provide further explanation.

The filing echoes accusations that have been flying around over the past year; that the SEC claims authority over crypto assets without legal ground and requires market participants to comply with inapplicable and outdated requirements or else face enforcement actions.

“The SEC is asserting sweeping new authority over a vibrant, rapidly expanding industry—digital assets. But the SEC is pursuing this power grab through enforcement actions, and it has refused to set forth its new interpretation of its enabling statutes in a rulemaking, where the lack of legal basis for its self-aggrandizement would be laid bare.”

Don't want to read our entire 78-page brief in our Third Circuit suit against the SEC? Just read this to understand how broken the Commission's approach has been. pic.twitter.com/jBlEr9DKOZ

— paulgrewal.eth (@iampaulgrewal) March 11, 2024

Notably, the lawsuit specifically states that “the digital assets on Coinbase’s platform are commodities, like gold or diamonds.” We earlier observed the SEC and CFTC disagreeing over the classification of cryptocurrency. If they are to be considered commodities, then most of the regulatory risks are in trading practices and fall under the CFTC's remit. It would seem that the exchange prefers this scenario.

Coinbase initially filed its petition with the SEC in July 2022, requesting that the regulator “propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods, including potential rules to identify which digital assets are securities.” With no response obtained, the exchange filed a lawsuit against the SEC last April, aiming to force the agency to answer. In May, the SEC was legally obliged to provide a legal basis for why it has not responded to the petition. However, after 18 months of silence, the Commission concluded in December that the requested rulemaking was "unwarranted”. It denied Coinbase's petition, thus providing the exchange with a legal basis that allowed it to proceed with its further pursuit of the regulator. Coinbase’s Chief Legal Officer Paul Grewal immediately said the company would fight further and challenge the “SEC's arbitrary and capricious denial.”

As the U.S. legal system relies heavily on court precedent in formal adjudications, all of the currently ongoing cases will become part of the new legal landscape in the crypto industry and are to be considered cumulatively. Recently, we observed an update in a related case: an insider trading charge against former Coinbase product manager Ishan Wahi, along with his associates. In a default judgement, the court agreed with the SEC's claim that nine of the 25 tokens the defendants invested in were securities and confirmed that secondary sales of cryptocurrencies are securities contracts.

The SEC could also use the summary judgment in the Terraform Labs case, which states that the collapsed company had indeed offered and sold unregistered securities, as a precedent in ongoing cases against Coinbase and Binance. However, it should be noted that, as these cases were uncontested, the SEC would seem to be merely amassing meaningless ‘confirmations’ that crypto assets are securities.

The Commission's opponents respond by accusing the agency of 'overreach’ and an ‘enforcement-only’ strategy. The SEC has recently faced pushback from several prominent industry names and even several state attorneys general over its furious pursuit of all that is crypto. Less prominent (and not even launched yet) crypto-exchange Lejilex joined with major industry figures to sue the SEC over its "unlawful assertion of regulatory authority over digital asset transactions."