In a surprise notice, Coinbase informed its users that it will delist wrapped BTC (wBTC) on December 19.

The United States company said the decision comes after finding in their latest review that wBTC didn't meet its listing standards.

wBTC replied by denying a lack of compliance and urging the exchange to reconsider the decision.

With this exclusion, cbBTC, Coinbase's own wrapped Bitcoin product, will become the main Bitcoin representative ERC-20 token on the platform.

We regularly monitor the assets on our exchange to ensure they meet our listing standards. Based on our most recent review, Coinbase will suspend trading for wBTC (wBTC) on December 19, 2024, on or around 12pm ET.

— Coinbase Assets 🛡️ (@CoinbaseAssets) November 19, 2024

On Coinbase's listing standards page, it reads, "[we] list everything we can—as long as we believe it's safe and legal. We believe that the market will ascribe value over time."

So, does the exchange no longer believe in the market, or are they holding back relevant information?

wBTC's Legitimacy Shadowed By Sun

The ETC-20 token representing bitcoin on the Ethereum blockchain is one of the most used tokens in DeFi platforms: at $13,7 billion, it has the thirteen largest market capitalization of the crypto industry.

In August, the currency's custodial BitGo controversially announced that it would shift to a geographically distributed custody structure by transferring most control to the Justin Sun-related firm BiT Global.

"With diversified geographical jurisdiction that includes the United States, Hong Kong, and Singapore, we ensure that no single jurisdiction/entity controls the custody of wrapped Bitcoin assets," explained BitGo at the time.

Sun is a divisive figure in the crypto space, and the decision raised serious concerns in the crypto community.

Sky (former MakerDAO) immediately passed a vote to limit exposure to wBTC on its lending platforms.

"On the whole, we find that Sun's involvement as a controlling interest in the new wBTC joint venture presents an unacceptable level of risk," said the BA Labs proposal.

To counter the perceived risk, the joint custody venture opted to divide the three master custody keys by three institutions, one in each of the locations where custody is set up: in the U.S., saved by BitGo Inc, in Singapore by BitGo's country branch, and in Hong Kong by BiTGlobal.

Despite this measure, the change still had a negative impact on the currency.

While the market was getting bullish, the monthly supply of wBTC decreased from 154.53k in July to 146.74k in October, according to a Dune Dashboard.

Coinbase's Bet On Bitcoin Custody

Coinbase is the largest crypto exchange and holds all of the bitcoins of its retail and institutional users. The exchange also reportedly holds around 90% of bitcoin under spot exchange-traded funds (ETF). Representing bitcoin on non-bitcoin blockchains is another growing segment that Coinbase could not afford to miss.

A few days after BitGlobal's announcement in August, Coinbase unveiled its plans for its own ERC-20 Bitcoin representation—cbBTC, which was launched at the start of September and immediately picked up.

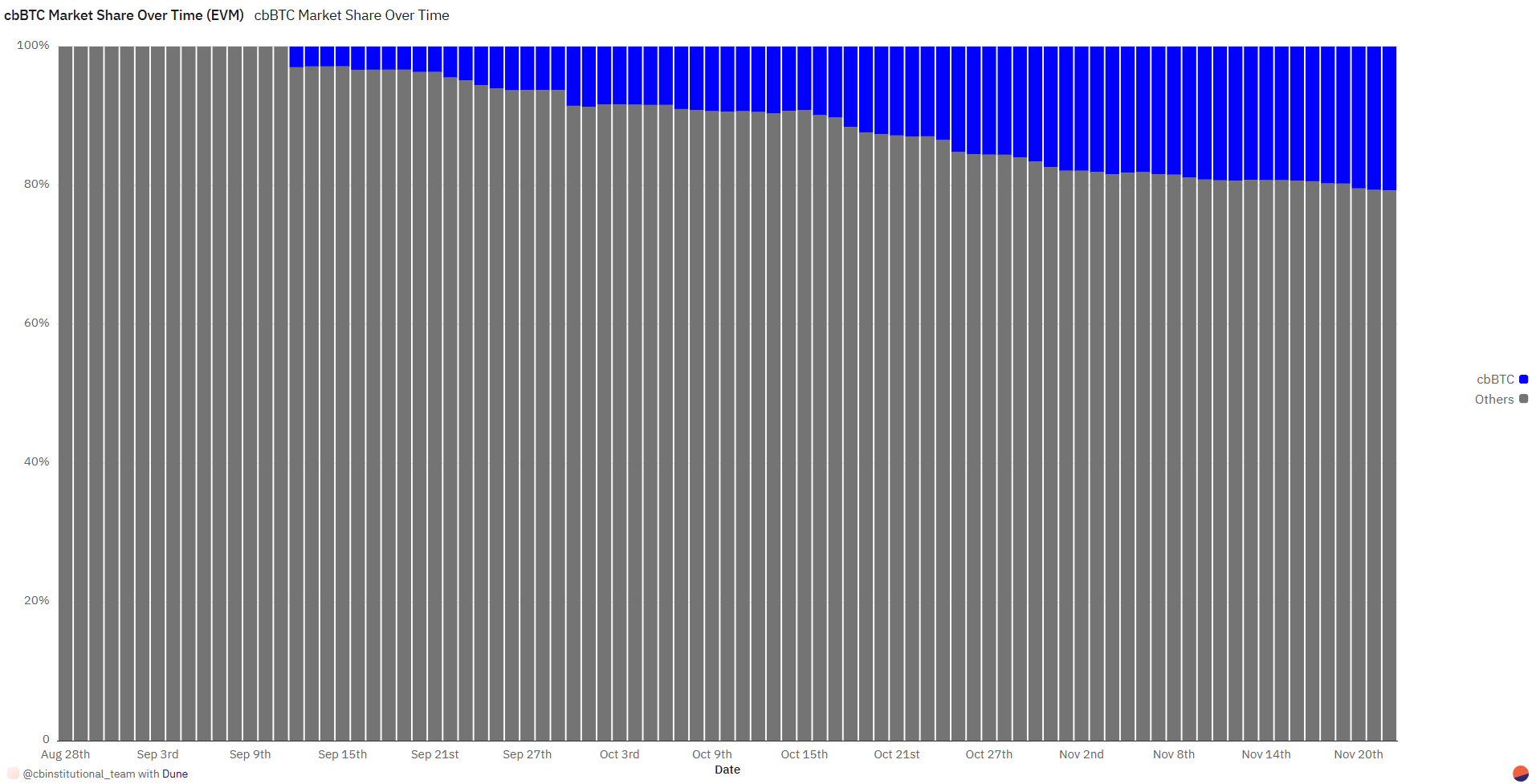

Two months after launching, cbBTC already has a market of $1.5 billion, around 10% of that of wBTC, and its market share on EVM is 20.4%.

Despite the Coinbase listing information page stating, "We want to avoid getting in the business of picking winners and losers," the notice of delisting wBTC effectively kills the competition for its own offering: cbBTC.

BitGlobal statement regarding the delisting accuses Coinbase of trying to "gain competitive advantage" and says the decision "goes against everything the DeFi and crypto industry stand for."

The decision has also been criticized for its randomness. Coinbase is a hotbed for meme coins of unknown origins and unclear proof of reserves, something which wBTC has.

Coinbase delists wBTC, won’t list Monero, but will list $WaffleBurgerBaldWombatWifDog as long as it has a market cap of $420. https://t.co/GxFbgUsKSQ

— Riccardo Spagni (@fluffypony) November 20, 2024

Over the last three months, the DESO token from Decentralized Social was the only other token delisted by the crypto exchange. The decision can be attributed to the U.S. SEC accusing the protocol founder of fraud and unregistered offering of crypto assets in July.

With wBTC, there is no other known justification other than Justin Sun's involvement in the custody of funds, which in itself is not against the exchange listing standards.

So if it isn't that, then the BitGlobal accusations might well be true: Coinbase has made a dirty move to win the market over.

On X, one user commented: "Centralised exchanges trying to control things will eventually become irrelevant."