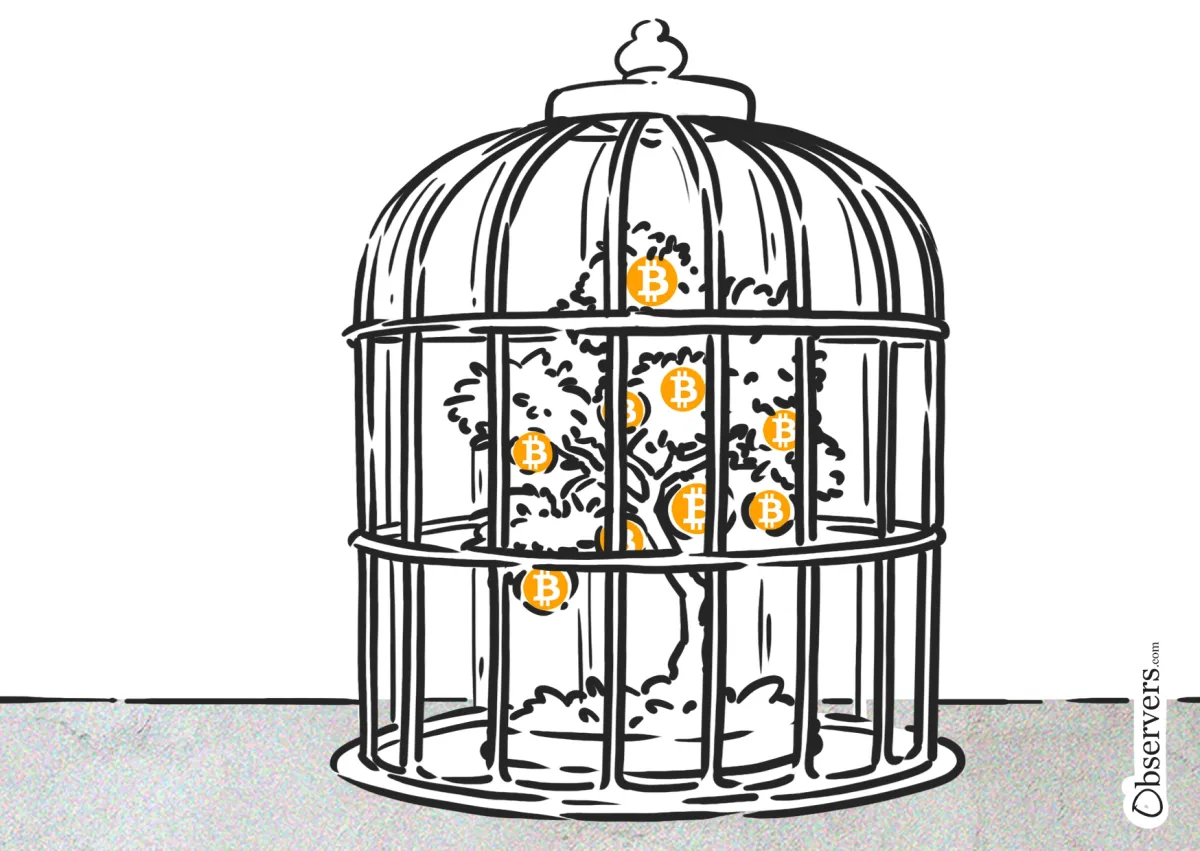

In the second half of 2022, when crypto-related companies began to fall like dominos, many thought that due to the lack of regulation of the nascent market and the magnitude of the losses, users would never recover the funds invested. They were wrong.

Following almost two years of litigation, users are starting to recover the assets that have been locked away in failed platforms. Two weeks ago, crypto-exchange FTX filed a plan to give back 98% of customers' funds. Now, Genesis and Gemini Earn users have received even better reimbursement news.

Last Friday, New York State Judge Sean Lane agreed to the repayment plan for the failed crypto lender Genesis Global Capital. According to the ruling, the company will pay back $3 billion to its users, corresponding to 77% of its total debts.

The former cryptocurrency lender filed for bankruptcy in January 2023 following a prolonged liquidity crisis caused by the collapse of crypto-exchange FTX, where it had $175 million in funds locked, and the collapse of Three Arrows Capital, to which it had extended $2.4 billion in cash and digital assets.

Judge Lane has agreed that the funds will be returned to investors in kind: a Bitcoin for a Bitcoin. "So if a hypothetical customer was supposed to receive back the 100 Bitcoin that it lent to the Debtors — but did not receive back because of the alleged fraud—the measure of restitution is 100 Bitcoin," the 135-page court document reads.

When the crypto market collapsed around May 2022, Bitcoin was trading at around $30,000 and Ethereum below $2,000. According to Coingecko, the assets are currently trading at $70 thousand and $3,779 respectively.

Genesis's parent company, Digital Currency Group (DCG), had opposed the repayment plan, arguing that, due to the rise in cryptocurrencies' prices in the last two years, Genesis' creditors would be better off at its expense. Its claim, however, was overruled.

The judge noted, "There is not sufficient value in the Debtors' estates to provide DCG with a recovery as equity holder after unsecured creditors are paid."

Gemini Earn

Gemini Earn was a lending program operated by Gemini, the Winklevoss brothers' crypto exchange, and Genesis. The platform was marketed as a low-risk investment option where customers could lend crypto assets to Genesis and earn up to 8% interest. On January 2023, after Genesis failed to return over $900 million worth of assets to users, Gemini terminated the program.

The New York State Department of Financial Services accused Gemini of not conducting due diligence on Genisis and failing to maintain adequate reserves. In February 2024, the crypto-exchange agreed to pay $1.1 billion to customers of the failed lending program and a $37 million fine to the regulator.

The crypto-exchange also announced on Friday that it will return 97% of the funds to users by the end of May. The payback will also be in-kind, meaning that customers will receive exactly the amount of crypto assets lent to Gemini Earn before the service was suspended.

Former Genesis and Gemini Earn customers are on the best end of the repayment plans. FTX's proposal, which intends to return between $14.5 billion to $16.3 billion to customers and creditors, is certainly not in-kind.

Instead, the lawyers of the failed crypto-exchange propose that the assets be paid based on the value of their claims as determined by the court, with interest payments of up to 9% per year, calculated from the date FTX filed for bankruptcy.