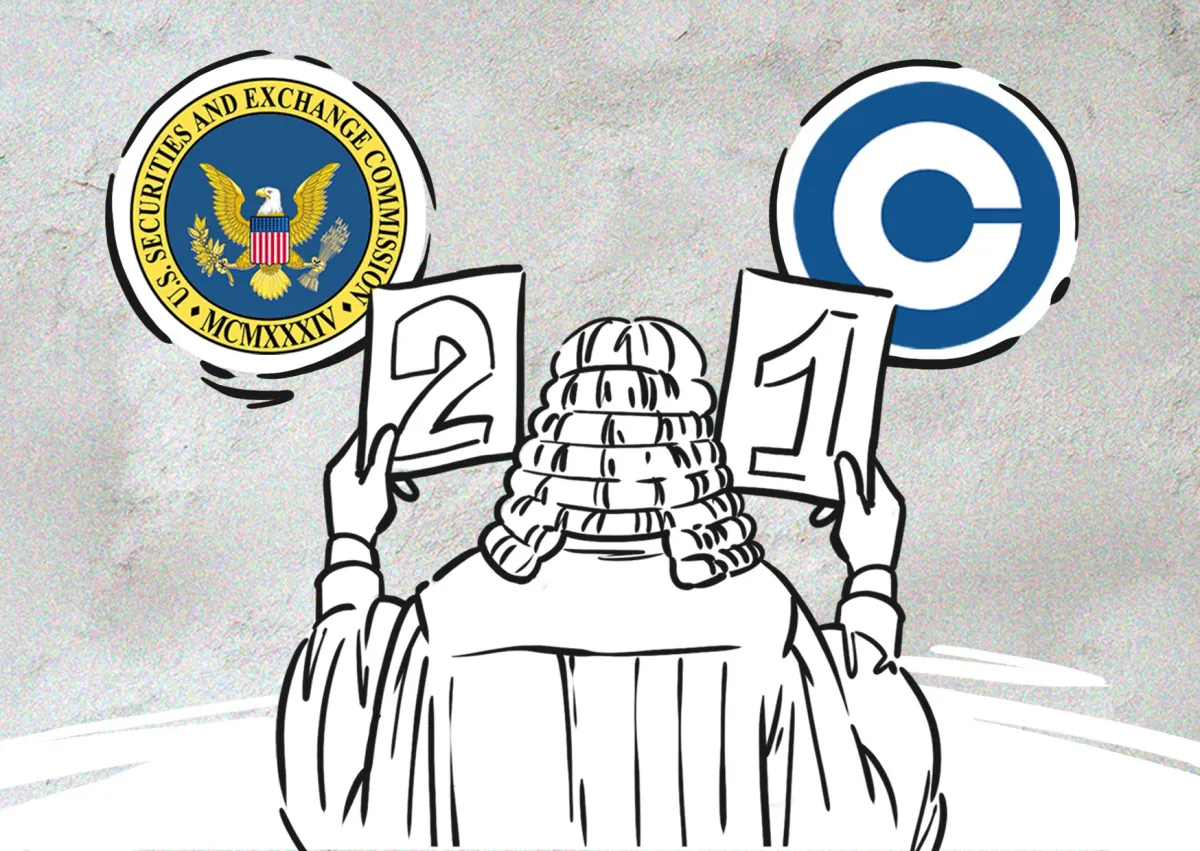

On Wednesday, Mach 27, New York Judge Katherine Failla rejected Coinbase’s motion to drop the lawsuit put forward against it by the Securities and Exchange Commission.

There were mixed reactions to this latest update; with people from both sides of the aisle calling the decision a “big win” and a “major setback." The case is seen as one of the critical legal tussles that will help shape the regulatory framework of the crypto industry in the U.S.

Last year, the market regulator accused the platform of operating as an unregistered exchange, selling unregistered investment contracts through its Staking Program, and acting as an unregistered broker through Coinbase Wallet.

Judge Failla has now reasoned that the government agency has enough proof to sustain the first two SEC claims but dismissed the complaint that the exchange acts as a brokerage firm through its wallet services.

According to the document provided by the Court, when interacting with Coinbase Wallet, “only a user has control over her own assets, and the user is the sole decision-maker when it comes to transactions.” Adding, “while Wallet helps users discover pricing on decentralized exchanges, providing pricing comparisons does not rise to the level of routing or making investment recommendations.”

This decision alleviates legal uncertainty for DeFi developers working on similar solutions, as it clears that their projects won’t be accused of acting as unregistered brokers.

For Coinbase’s CEO Brian Armstrong, this is a “huge win for self-custodial wallets. This ensures the onchain ecosystem will continue to innovate and create economic freedom around the world."

The victory is only partial, as the crypto exchange company must now prepare its defense regarding the two other charges. And on the allegations that the firm acts as an unregistered exchange selling unlisted investment contracts, the New York magistrate seems more prone to agree with the SEC’s logic of evaluating crypto as securities within the existing regulatory framework.

“The "crypto” nomenclature may be of recent vintage, but the challenged transactions fall comfortably within the framework that courts have used to identify securities for nearly eighty years,” wrote the Judge.

Coinbase’s Chief Legal Officer, Paul Grewal, responded on X, “We prepared for this, and we look forward to uncovering more about the SEC’s internal views and discussions on crypto regulation.”

If the exchange loses the upcoming court case, trading platforms might be looking at new restrictions and stricter limits on the types of tokens that can be made available to consumers.