Argentina is a country whose relationship with crypto is somewhat inconclusive. As we wrote earlier the country’s digitalization has progressed in localities. At the same time, the country has started regulating and charging innovations which may slow down their further development. One example is a mining tax decree recently issued in Buenos Aires. In addition, to exemplify the ambiguity, Argentina's first think-tank seminar was launched on December 22 by CITY Entertainment. It promoted topics such as Blockchain, Metaverse, E-commerce, and NFT gaming. The event assembled many important figureheads, intellectuals, and public administrators. Unfortunately, the importance of such events is overshadowed by the nation’s harsh reality: the economic crisis.

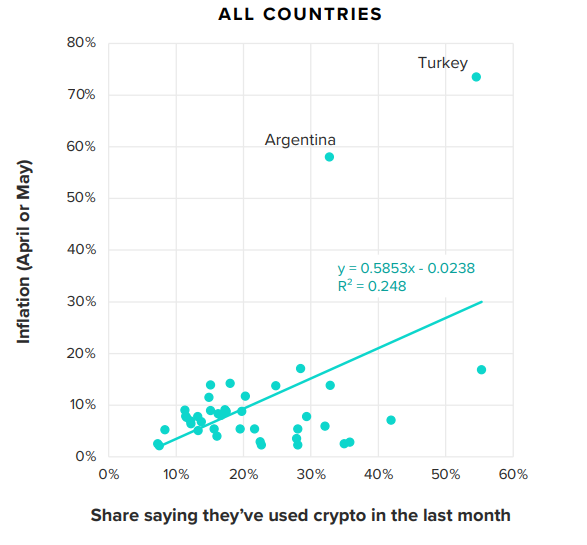

The crisis, which has beleaguered the 3rd largest economy in Latin America, has lasted for many years. With its annual inflation, sometimes reaching 100%, the use of local currency, the peso, has been utterly diminished as a monetary reserve. People have sought different ways of saving their money and, despite all warnings by the central bank of Argentina, crypto had become an alternative means of safeguarding money.

According to a survey in early 2022 by Americas Market Intelligence, 51% of Argentine consumers had already purchased crypto and 27% were buying cryptocurrencies regularly. These are double the respective averages in Latin America.

However, the crypto winter has fiercely targeted the people’s adherence to it. From April to November, it downgraded the usage by around 30% - from 12 to 8 out of 100 people. The current lawless crypto environment in Argentina has further exacerbated the situation as no official entity can guarantee healthy management of digital tokens and coins.

As the FTX crisis unfolded, the Argentinian markets suffered a severe withdrawal reaction. In that same week, Argentinian investors sold most of their crypto and high-risk investments, opting to buy a more obvious reserve: US dollars. The day after the FTX crash, the local currency had fallen by around 0.5%, and the most important index of the Buenos Aires Stock Exchange S&P MERVAL Index dropped by 3.7%.

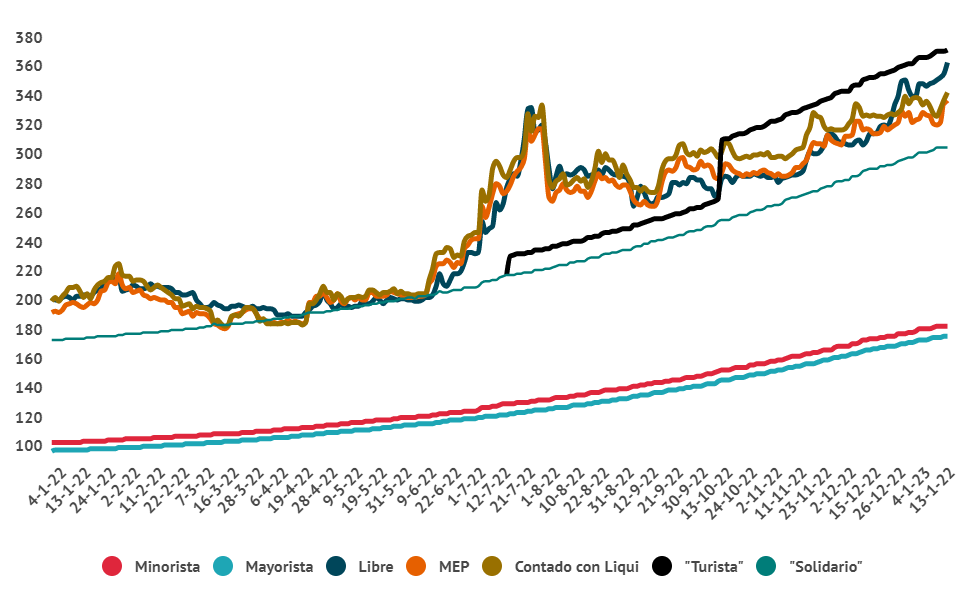

Since then the crypto downfall was summed up with high-interest rates, unsurmountable debt, and a solid dollar, and they all contributed to the dollar blue or libre (de-facto price) reaching its highest pairing price ever - 357 pesos, around a 23% rise.

Note: due to foreign currency control measures, Argentina currently has around 20 different exchange rates. Here are some of them:

The official retail (Minorista) and wholesale (Mayorista) Dollar exchange rates are used only for official transactions with the banks and are used as a basis for the calculation of other derivative rates.

Dollar Solidario rate with a limit of $200 per month, allows the general population to officially buy USD for "savings". The rate is a derivative of the official rate, calculated by applying a 30% "solidarity tax (PAIS) and 45% Income tax to the official retail rate.

Soja Dollar: the government applies this dollar rate expecting to lower grain and food exporting, therefore downgrading the national prices. This dollar rate is enforced and causes a disturbed relation between the government and farmers. As a consequence of its implementation, while the globally accepted price for each ounce of grain is x, in Argentina, the farmer is obliged to sell it for half the original price, while the government takes the other half.

Blue or Libre Dollar: the one which people most commonly use on the black market with cash transactions. It fluctuates according to demand and market variations (de facto price).

Dollar Tarjeta and Tourista are the rates that Argentinians can use to pay for services in dollars or for consumption during trips abroad. As long as the limit of 300 dollars per month is not exceeded, the official dollar price is used, plus a charge of 35% of the PAIS tax and 45% on the Income tax account.

The MEP rate is very close to the blue dollar. In the summer of 2022, the government launched a new initiative with Visa and Mastercard which allows a person to use the MEP rate if he/she is paying by a foreign Visa or MC. Western Union also has a "negotiated" exchange rate for dollar transfers that is close to Blue Dollar.

Contado con Liqui Dollar: This rate is also close to the Blue dollar, yet available only to legal entities trading on Argentinian and foreign stock exchanges. A security is bought in pesos on the Argentinian stock exchange and then sold on the foreign stock exchange. There are certain restrictions such as the minimum period of holding and transfer of the title that allows authorities to control this channel of exchange, yet overall this works as an effective tool for large companies engaged in international trade.

Finally, the Crypto Dollar is the rate that exchange platforms apply when they sell or buy stablecoins and other digital assets. It's usually paired with the Blue dollar. Exchangers take a commission of 4-5% for cashing out crypto (usually USDC or USDT) in pesos.

Although cryptocurrencies like Bitcoin and Ether lost significant value in 2022, crypto remains popular as a tool to override governmental controls, for cross-border transfers, and as a free-to-join banking infrastructure. Black market exchanges, known as "cuevas", actively use crypto tools in their operations.

Of course, the authorities are not satisfied with such a situation. One of the recent initiatives by the Argentinian Government is a bill aimed at encouraging a declaration of crypto holdings, along with other financial assets.

Argentina is an interesting case to observe how a fragile economy with ineffective monetary policies adopts crypto assets and how it reacts to crypto volatility. This case is different from the much-discussed "libertarian" or "financial inclusivity" justifications of digital currencies. Also, on the ground, many features of digital currencies remained unclaimed while the others, such as stability, low fees and liquidity are in ordinary people's talks. One thing is for sure, such markets are perfect testing grounds for crypto projects that want to move from labs and whitepapers to the real world.