The community has been talking about launching its own Curve stablecoin for several months, but developers have been in no hurry to share any information with users for a long time. But a white paper has recently been released, which has become the official source of data on the work of the new stablecoin.

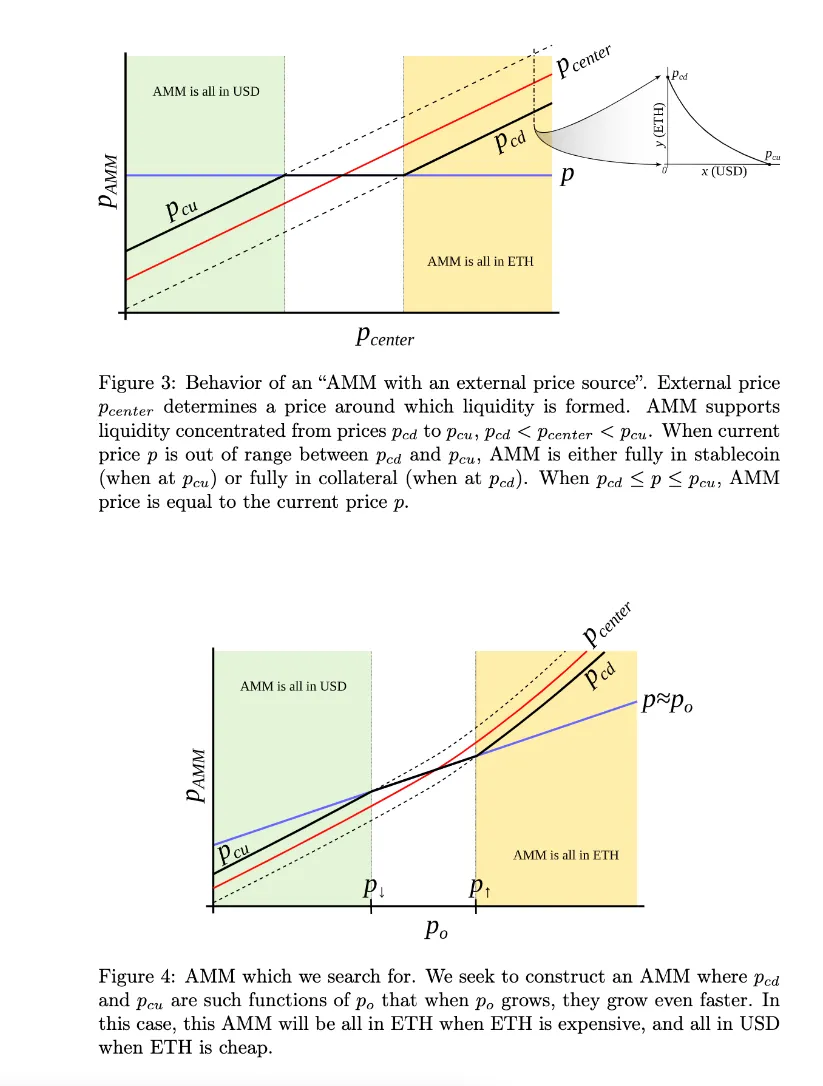

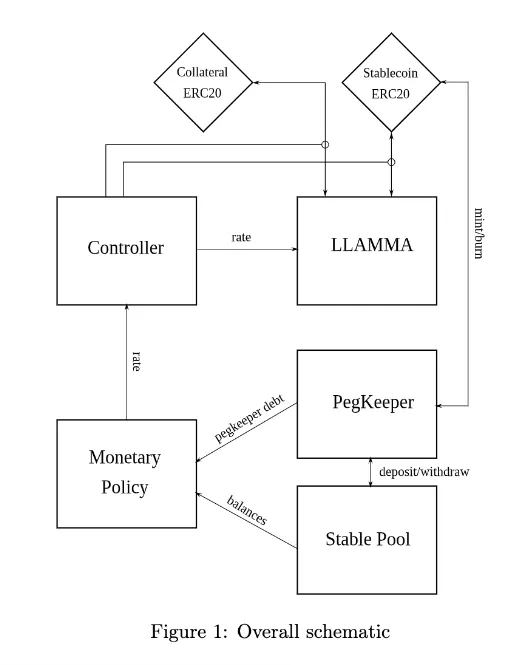

The Curve team highlights automatic self-liquidation as one of the most important features of its stable coin, namely the “Lending-Liquidating AMM Algorithm.” The algorithm helps to reduce risks and allows users to avoid instant liquidation.

“Within the $crvUSD universe, once you initially lend your collateral, your portfolio has a balance consisting 100% of this collateral. If the LLAMMA observes the price of this collateral is dropping, it automatically liquidates your portfolio into $crvUSD. If the price goes back up your collateral gets repurchased. Therefore, instead of an instantaneous liquidation, the process occurs smoothly over a continuous range.” - it is written in the document.

Another feature that Curve is calling a key is that the stablecoin will work in the LLAMMA ecosystem, in which each of the types of collateral is a publicly traded AMM.

“For example, the documentation references using ETH as collateral for $crvUSD. This will automatically create an $ETH / $crvUSD liquidity pool that traders can arbitrage and trade, featuring the same 24/7 uptime and resiliency that makes Curve v2 superior to other DEX/CEX offerings.” - the Curve team reported.

It seems that users also see the advantages that the special principles of crvUSD's work give.

Curve stable ELI5:

— Alunara (@0xAlunara) November 22, 2022

Old fashioned CDPs have a liquidation price. If your collateral goes below price then boom!

LLAMMA is a loan that constantly rebalances your collateral, such that if your collateral price dips, your collateral gets swapped for what you borrowed.

Users also note that providing a stable coin with other crypto assets makes the principle of operation of crvUSD similar to the stablecoin from DAI, which regulates MakerDAO.

However, Curve warned on Twitter that its white paper would probably be slightly changed and it recommends to keep an eye on updates.

Keep in mind - there will be clarifying edits. Paper is a bit too dense currently - some folks are looking at how to make it easier to read! https://t.co/Emsc1EvtbC

— Curve Finance (@CurveFinance) November 22, 2022

Overall, the project seems to be an interesting implementation of automatic collateralized stablecoin - a concept that received much criticism after Terra/Luna collapse. We hope it will be successful and will continue to observe its developments.