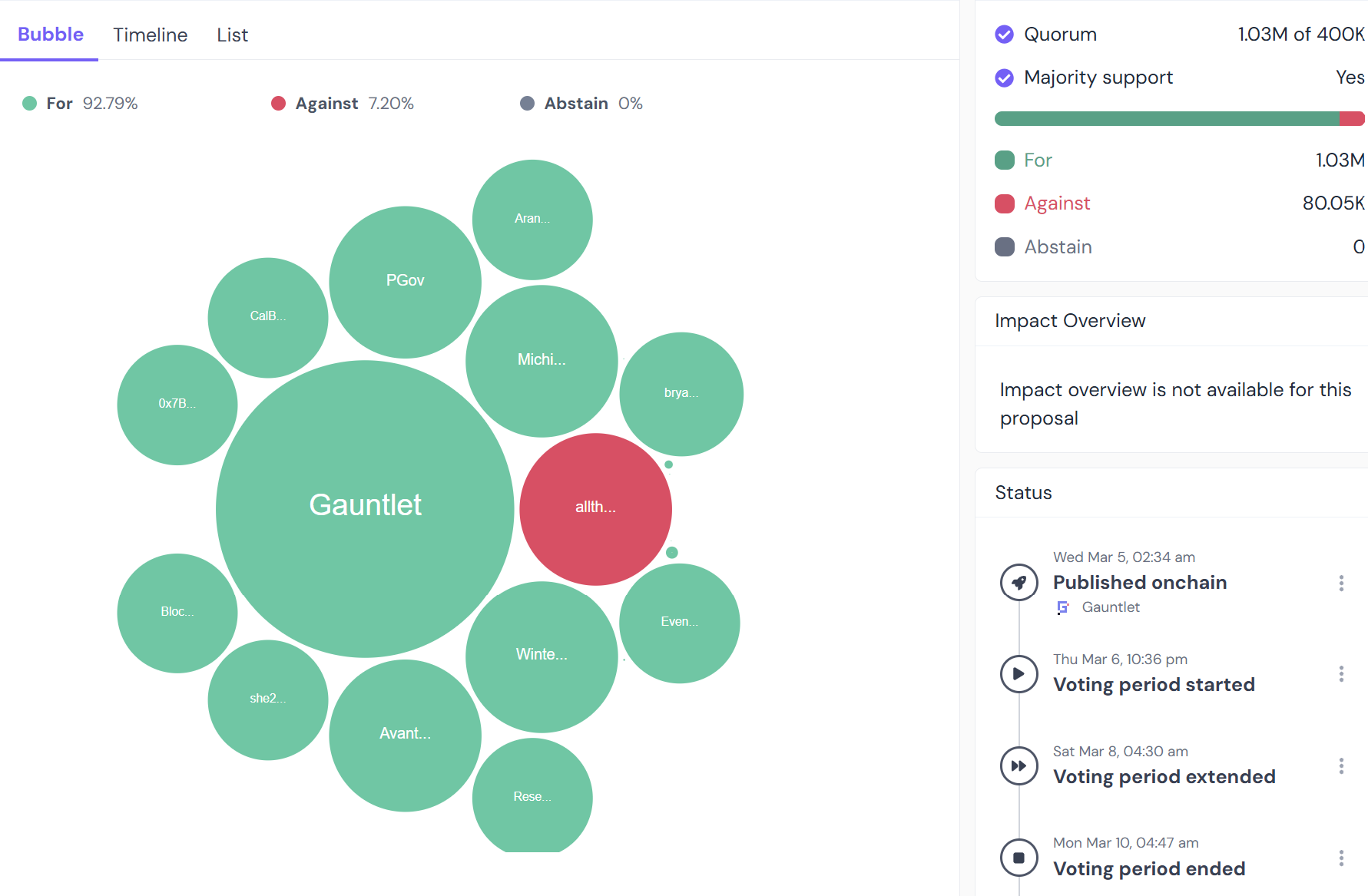

Compound DAO has approved Gauntlet’s proposal to launch Morpho-powered lending vaults on Polygon, with $1.5 million each from Polygon and Compound allocated for incentives. Although the proposal was passed with 92.79% “for” votes, it has sparked significant controversy and raised questions about whether the project has given up on competing in the lending market.

According to Gauntlet, the proposal was motivated by a desire to give Compound “a path towards sustainability.” Since the release of Compound V3 in August 2022, the protocol has been stagnant with no meaningful updates. Moreover, its competitiveness will face further pressure from the release of Aave V4 and upcoming iterations of Morpho. Additionally, the project lacks a strong leadership team, with most of the original Compound Labs team having moved on to other projects.

Despite having a significant presence on Ethereum and its L2s, Compound has been steadily losing market share to both Aave and Morpho. While fluctuations in market share are normal, what is more concerning is that Compound DAO has no clear plan to reverse this trend. Gauntlet’s team was clear in offering a path forward.

At the end of February, the Aave team voted to cease lending on the Polygon PoS chain, as the Polygon DAO considered depositing bridged assets into Morpho. With Aave voluntarily choosing to leave Polygon, the Gauntlet team proposed a partnership between Morpho, Compound, and Polygon. In the absence of competition, Compound vaults are expected to find a natural product-market fit.

According to the proposal:

"The Compound DAO will be Owner and Gauntlet will serve as the Curator of the vaults to optimize risk-adjusted returns. The Morpho Association will assist in the technical implementation."

To attract more users to these lending vaults, Polygon will offer $1.5 million in POL rewards, matched by an additional $1.5 million in COMP tokens from the Compound DAO.

According to Gauntlet, the deal should benefit all parties. Compound will gain a stronger presence in the Polygon ecosystem, and for the foreseeable future, the DAO will collect all fees generated by the vault, while Morpho and Gauntlet will receive no fees for their contribution. Notably, the DAO’s security is reinforced by the fact that Morpho contracts are immutable once deployed, making it technically infeasible for Compound to lose ownership of the vaults without a governance vote.

Furthermore, according to calculations from a user, the proposal should generate approximately $2–3 million in revenue for the DAO over the next 2–3 years and help increase Compound’s market share on Polygon by at least 10x.

At the same time, Morpho will benefit from a greater distribution channel as it aims to serve as the underlying infrastructure for decentralized lending, while Polygon fills the gap left by Aave’s exit from its ecosystem.

Multiple Concerns Regarding the Proposal

However, there have been multiple concerns with the proposal. The fact that Compound is abandoning its own technology in favor of Morpho’s technical solutions represents a significant shift in Compound DAO’s strategy.

As a user stated:

"If Compound itself refuses to use its own product, it raises serious concerns. Why would anyone continue to believe in the project?"

Additionally, by adopting Morpho’s technology, the DAO will no longer have full control of the protocol. Both Gauntlet and Morpho will not only have a say in how these vaults develop in the future, but they will also likely share in some of the vaults’ profits, even though they have chosen not to earn any profits at present.

Profit share was one of the major concerns:

"At some future point, Gauntlet may introduce a fee-splitter contract as revenue share” is not really close to “driving growth on Compound”. It seems like an opportunity to finance the Morpho ecosystem at the expense of current and future users."

Notably, users have also highlighted significant conflicts of interest. Robert Leshner (co-Founder & ex-CEO at Compound Labs) and Tarun Chitra (Founder & CEO at Gauntlet) co-founded a VC called Robot Ventures, which invested in Morpho. Meanwhile, Gauntlet became one of the main curators for Morpho in February 2024, and Leshner delegated a large portion of his COMP tokens to Gauntlet, which voted in favor of this proposal.

Therefore, it feels that Gauntlet’s interests may be more closely aligned with expanding the Morpho ecosystem than with rescuing Compound from its current crisis.

Path Forward for Compound DAO

Despite the above concerns, the community voted in favor of the proposal. Many argued that while critics merely highlighted problems with the offered proposal, they had nothing better to propose as an alternative.

As a user commented in chat:

"Love throwing stones with no suggestions on how to improve the status quo. Lol, tired of people doing this."

Some have pointed out that the proposal would shift Compound’s focus from being a purely protocol-driven project to functioning more like a “fee-driven holding company”. It also appears that Morpho is open to pursuing similar collaborations on other chains, so perhaps this setup is not too bad, given that, in terms of technology, Compound is behind the competition.

The future of Compound remains uncertain, as another “Compound Future” proposal is currently under discussion in the governance forum. This new proposal is expected to tackle key decisions, whether that means adopting centralized leadership, further expanding the partnership with Morpho, or restructuring DAO governance to better manage the protocol.

It is quite ironic to see a DAO debating the need for a leadership team. Where this path will lead Compound remains to be seen, we will continue to Observe.