Aave founder Marc Zeller introduced a new proposal for Aave tokenomics on the project’s governance forum. Zeller considers this “the most important proposal in the project’s history.” The proposal significantly revamps Aave’s tokenomics, introducing multiple new elements that directly affect the project’s token.

New Safety Protection System of Aave

An important part of the proposal is upgrading the Aave Safety Module to a new Umbrella safety protection system.

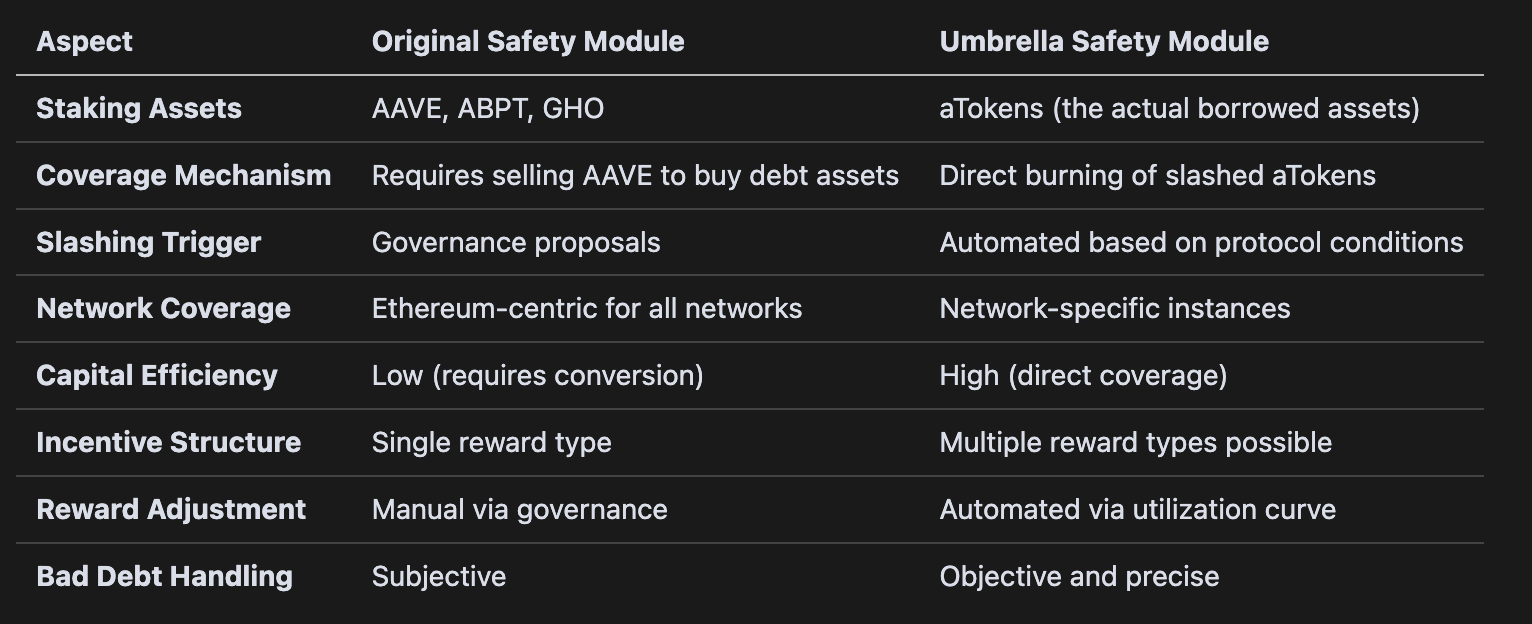

In the original design, users staked AAVE, ABPT (Aave Balancer Pool Token), or GHO (Aave’s stablecoin) with the acknowledgment that their assets might be slashed in the event of a shortfall needed to cover any protocol deficits. Thus, the staked funds were used to protect the protocol and its users during adverse situations.

However, this mechanism is not ideal. In an adverse event, the price of AAVE would likely fall regardless, and selling more AAVE from the safety module to cover the protocol losses could amplify the selling pressure on the token.

With the Umbrella Safety Module, the protocol will use Aave aTokens (the actual borrowed assets on the platform), and will directly burn them to cover the bad debt. Therefore, in any adverse event, there will not be significant selling pressure on the AAVE token from the safety module. This mechanism should better automate Aave’s management of bad debt while also protecting token holders.

Aave Token Buyback

Besides adding a new safety module, the Aave team also plans to implement significant buybacks of the token. According to the proposal, the team intends to conduct a $1M/week buyback for the first six months, totaling around $24 million. Moreover, the team believes that the buyback will likely be even higher due to the expectation of new revenues coming in 2025.

Notably, to manage the protocol treasury and revenue distribution, Aave plans to create the Aave Finance Committee, which will have the mandate to propose a budget for the first six months and control revenue distribution. The committee will also be able to work with market makers to buy AAVE tokens on secondary markets and distribute them to the ecosystem reserve.

Aave is among the top revenue-generating protocols in the space. In 2024, the project earned over $95 million in revenue and currently has over $115 million in its treasury. Notably, the project will receive another influx of around $65 million from the discontinuation of the LEND token. With the new tokenomics proposal, users will lose the ability to migrate Aave’s old token, LEND, to the new Aave token, which should bring this one-time influx of $65 million to the protocol treasury.

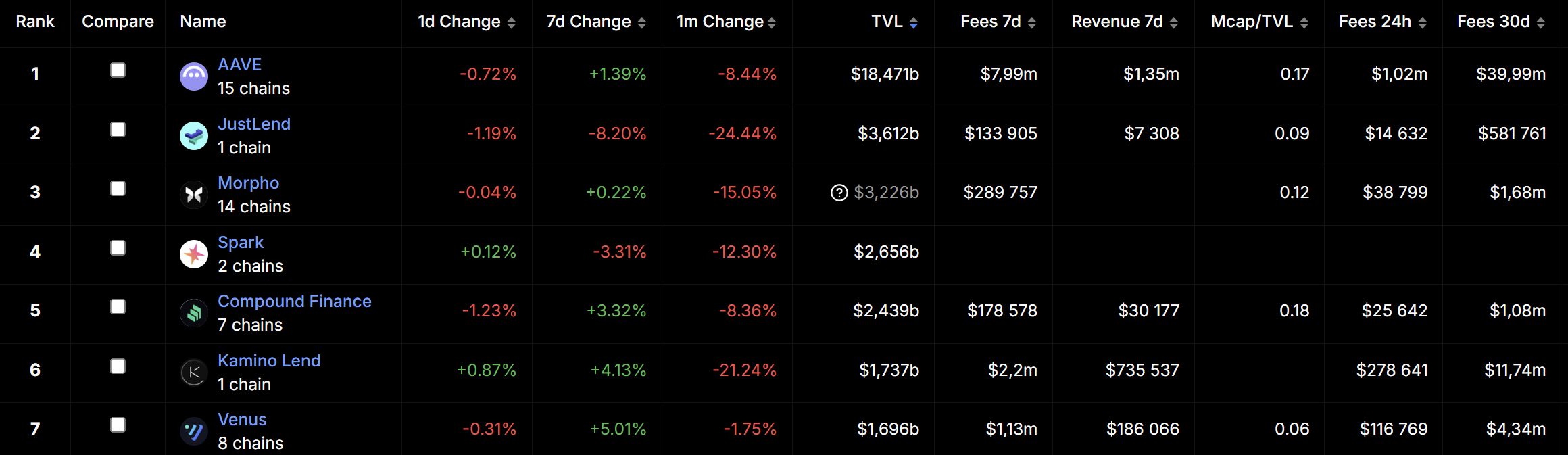

The project is also the leader in the DeFi lending space. The protocol has over $11 billion in active loans and $18 billion in TVL, giving it a 43% share of the total lending market in the space.

Overall, the new tokenomics proposal has been receiving positive feedback from the community and has had a positive effect on the AAVE token price. The next step will be a follow-up off-chain Snapshot vote. If approved, it will advance to an on-chain governance proposal (AIP) for final execution.