Binance Alpha 2.0 connects centralized (CEX) and decentralized (DEX) trading in a single interface. The idea is straightforward: allow users to buy on-chain tokens directly through Binance, simplifying the process and eliminating the need for external tools or wallets.

The original version of Binance Alpha was accessible through Binance Wallet. It offered users a way to purchase select tokens—mostly new and trending projects—curated by Binance. However, not every DEX token was included. Binance was selective, highlighting tokens it saw as promising but without promising any future listings on the main exchange.

From the start, Binance clarified that being featured on Alpha did not guarantee a full exchange listing. It was more of a trial spotlight than a formal endorsement. This cautious stance helped manage user expectations while still giving lesser-known projects a chance to reach more eyes.

Alpha 2.0, however, takes a different approach. Now part of the Binance Exchange itself, it removes the need for on-chain setup or external wallets. Users can use existing balances from their Spot, Funding, or other Binance accounts to trade Alpha tokens. No additional tools, no gas tokens—just a smoother path to DEX trading within a centralized interface.

To sweeten the deal, Binance has waived trading fees on Alpha 2.0 from March 17, 2025, through September 17, 2025. That said, network fees for on-chain transactions still apply and must be covered by users.

At this stage, Alpha 2.0 is still in testing. Tokens can’t yet be withdrawn or sent to external wallets or platforms unless they are listed on Binance Spot. The service is also not available globally—it’s currently limited to certain regions.

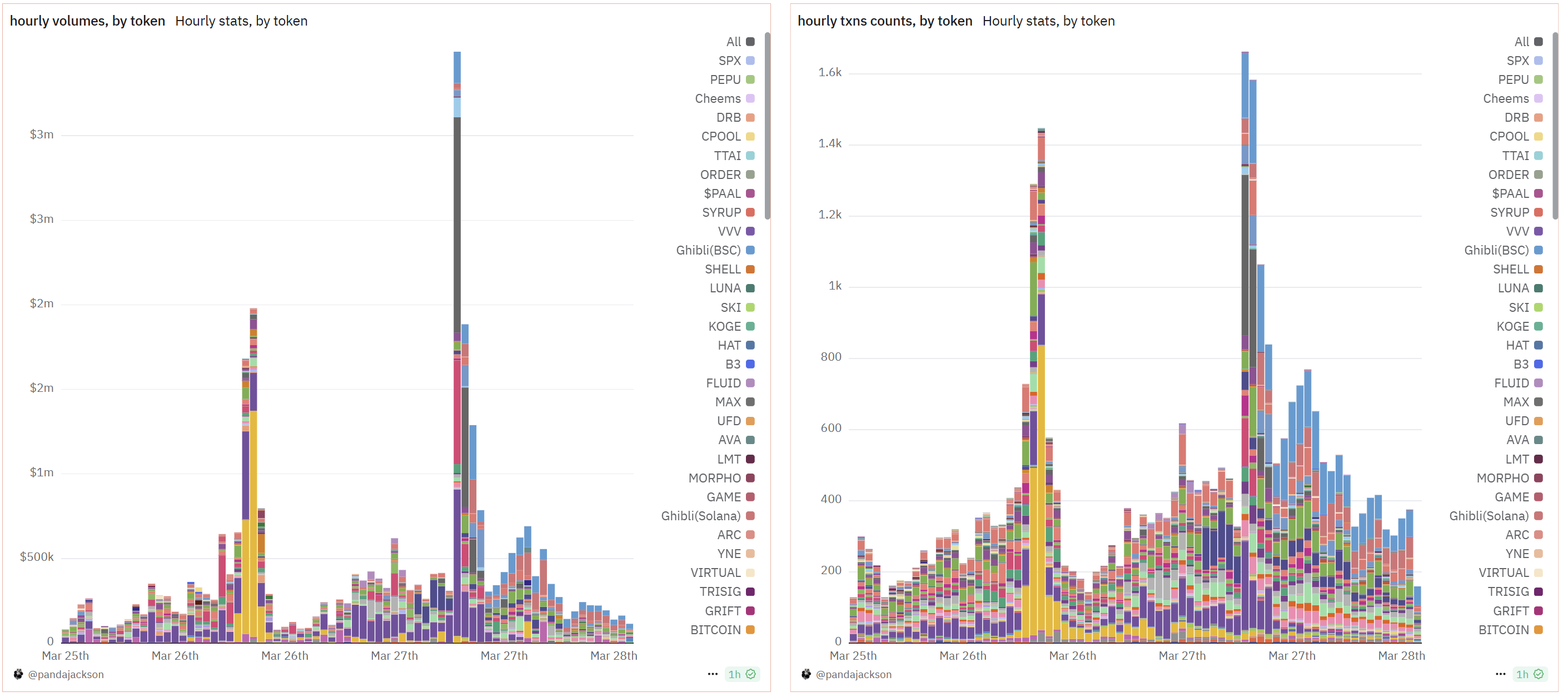

Despite these limitations, the product has gained traction. Since launch, Alpha 2.0 has handled more than $150 million in trading volume, much of it driven by popular memecoins across Solana, Base, and Ethereum networks.

Alpha 2.0 shows how Binance is responding to the growing popularity of decentralized exchanges. By integrating DEX access into its own platform, Binance not only retains its large user base but also enters the decentralized trading space on its own terms.

CeDeFi: Not Just a Buzzword?

The concept of CeDeFi (Centralized-Decentralized Finance) has long been controversial, often criticized for cherry-picking the best parts of DeFi while compromising on its core principle of decentralization.

With Alpha 2.0, Binance introduces an institutional-grade version of this hybrid approach—designed to function under regulated frameworks, while borrowing security and automation features from DeFi protocols.