Ether.fi, the Ethereum restaking protocol, is taking a big step forward with the launch of its own DeFi bank and plans to bring a range of CeFi features into its platform. The goal is to build a vertically integrated, crypto-native alternative to traditional banking.

Since its launch in 2023, Ether.fi has grown into one of the largest restaking protocols in the market, with more than $4.8 billion in total value locked (TVL). Ether.fi charges a 10% commission on staking rewards earned by users. In fiscal year 2024, the project reported $26 million in revenue and a $1.9 million operating profit, even after spending 5% of revenue on $ETHFI token buybacks.

Ether.fi is eyeing $65 - $96 million in revenue this year, with profit margins around 30%. It also plans to ramp up buybacks, setting aside about 25% of revenue to buy $ETHFI from the market. Longer term, the goal is even more ambitious: $1 billion a year by 2028, with margins somewhere between 30% and 40%.

Ether.fi Bank

Crypto, and Ethereum specifically, will only be globally relevant if there are hundreds of businesses large enough to be publicly traded companies operating on it.

Ether.fi sees deeper CeFi integrations as a key part of this growth, giving users access to both CeFi and DeFi tools under one roof.

That said, Ether.fi isn’t trying to build a traditional deposit-taking bank. Instead, it is offering users all the financial services they would expect from a conventional bank, but built on crypto rails.

The first major move toward this vision is the launch of Ether.fi’s own credit card, along with fiat on- and off-ramps for USD and EUR through SWIFT, ACH, and IBAN. The cards are currently being rolled out in the U.S., with broader international expansion expected soon.

Thanks to these fiat integrations, the Ether.fi app will start to feel much more like a typical fintech platform — letting users spend, save, and earn — but with crypto-native features like restaking seamlessly baked in.

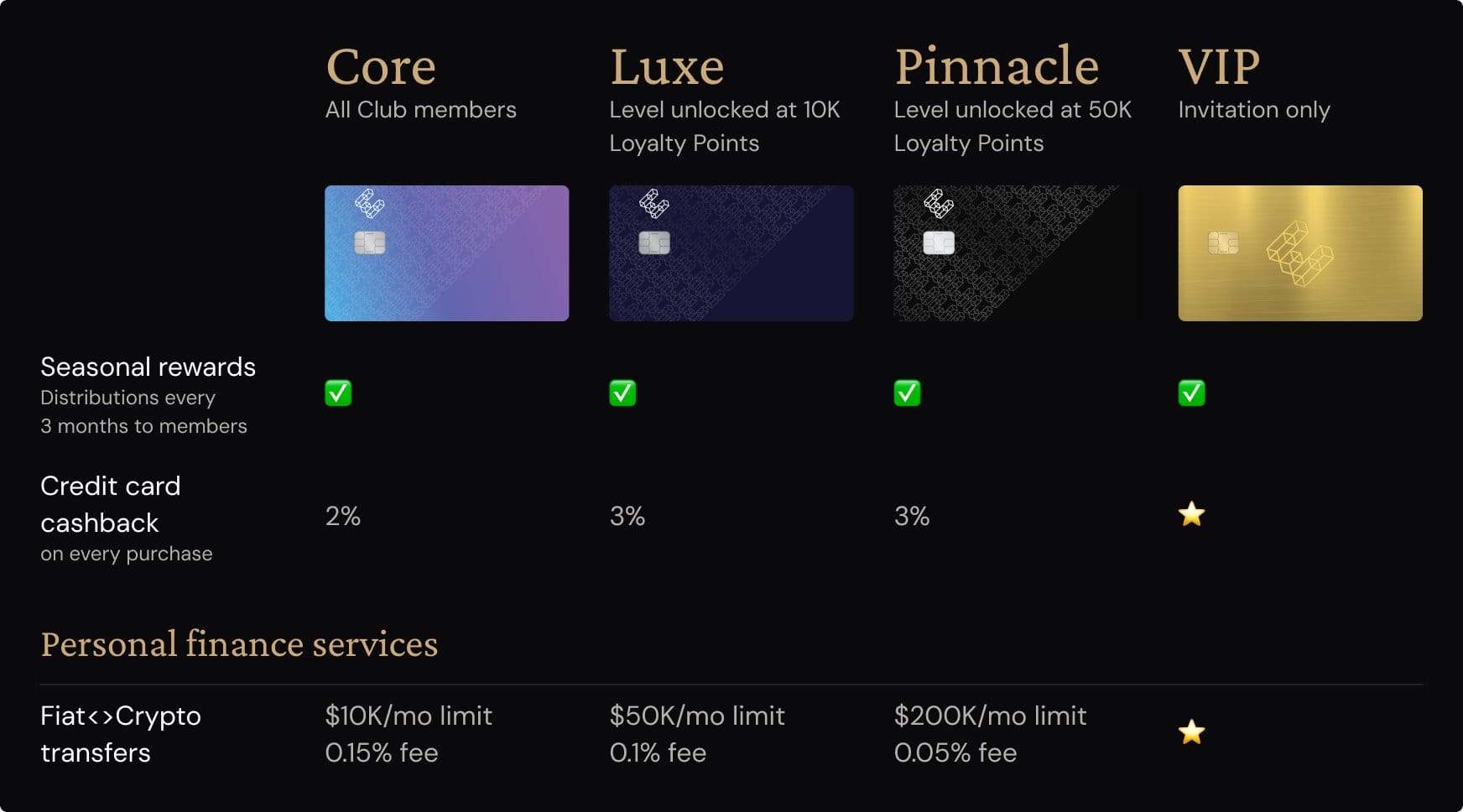

New users will be onboarded through “The Club,” a membership program modeled after popular loyalty programs like Air Miles and Amazon Prime. Depending on their membership tier, users will get different spending limits and cashback rewards on purchases. Higher-tier members can also unlock perks like lounge access at crypto events, tickets to sports games, and even early access to venture deals.

As with other DeFi projects, tokenomics is a big part of the Ether.fi development strategy. The project is looking to give $ETHFI a bigger role, tying it more closely to buybacks, staking rewards, and other parts of the ecosystem. The token’s still down about 93% from its all-time high, but with a market cap near $137 million, there is still a lot of upside potential if things go right.

Restaking Landscape

EigenLayer, with which Ether.fi is closely integrated, remains the foundational protocol for restaking. While EigenLayer itself focuses on providing a shared security layer for decentralized services, it has also begun expanding its ecosystem with direct staking services and partnerships, potentially overlapping with Ether.fi’s future roadmap.

Renzo Protocol is another rising competitor, offering liquid restaking services that allow users to access DeFi yields while simultaneously contributing to network security. Renzo emphasizes deep DeFi integrations and composability with other decentralized protocols, offering users flexible ways to deploy their restaked assets across multiple platforms.

KelpDAO is also emerging in the space, with a focus on modularity and cross-chain restaking solutions. Kelp aims to enable users to earn rewards across multiple chains simultaneously, a feature that could appeal to investors seeking greater diversification beyond Ethereum alone.

Each of these platforms brings strong technical capabilities, but Ether.fi is carving out a distinct niche by blending DeFi-native restaking with CeFi-style user experiences.

Right now, Ether.fi has about 200,000 crypto-native users. With its push into CeFi, the project sees a much larger opportunity — a market of 30 to 50 million users who are getting more involved in crypto but still rely on traditional banking.

By converging the smooth UX of CeFi with the core principles of DeFi — real yield, self-custody, borderless payments — Ether.fi is positioning itself to ride the next big wave of crypto adoption.