Superseed, a new Ethereum Layer 2 network, has launched its mainnet with an ambitious pitch: it is the first L2 designed to help repay users’ loans. While most Layer 2s focus on scalability or lower fees, Superseed is taking a different route by building lending into the core of the chain itself.

Like many others in the space, Superseed is built on the OP Stack and fits into the broader Optimism ecosystem. But where it really stands out is its integrated Collateralized Debt Position (CDP) protocol—something that isn’t just an add-on, but a key part of the chain’s architecture.

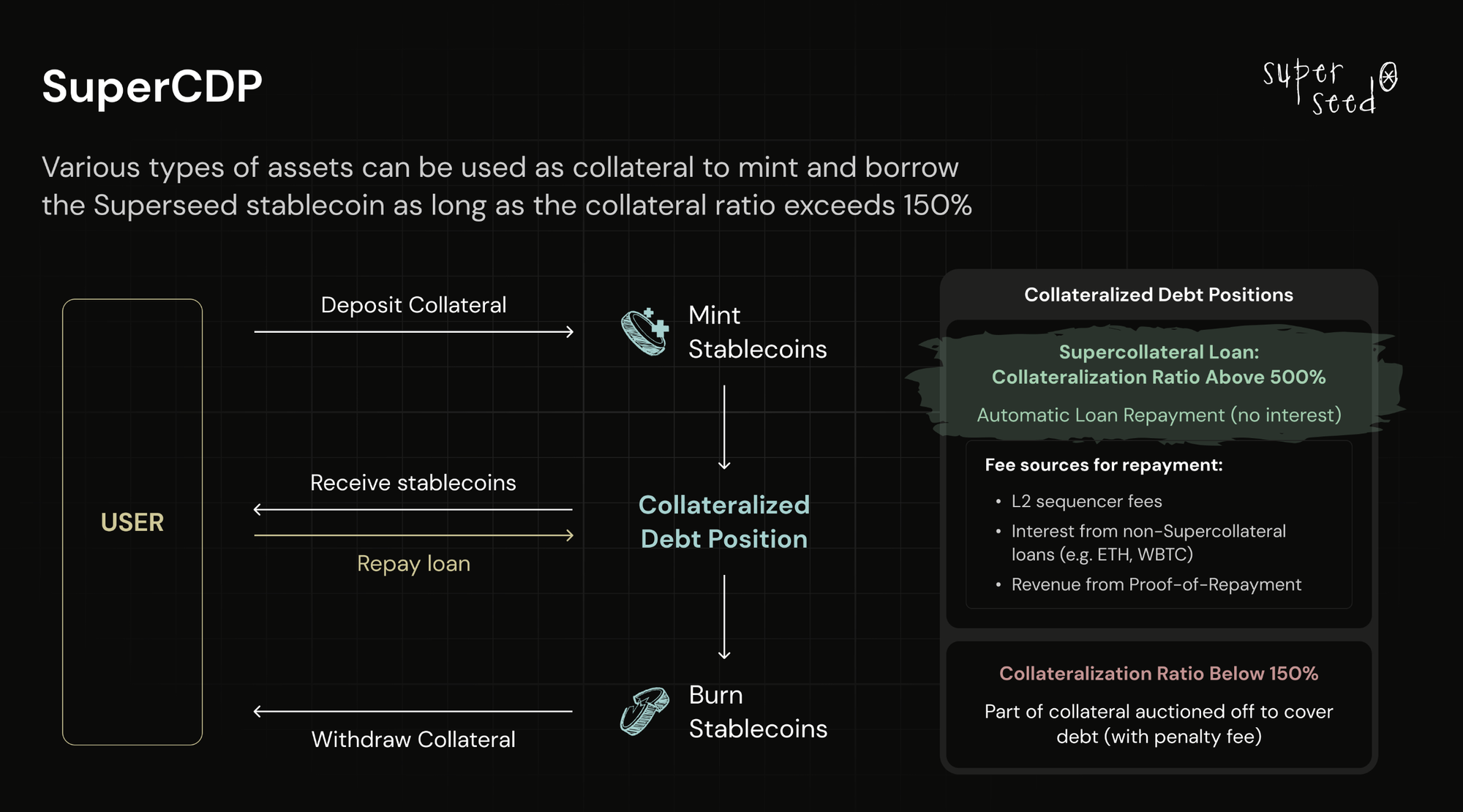

In a CDP system, users lock up assets as collateral and mint a stablecoin in return. This is a different approach compared to lending platforms like Aave or Morpho, where borrowers rely on pools of lender-supplied liquidity. With CDPs, users are effectively borrowing against their own assets. A good example of a CDP protocol is Sky (formerly MakerDAO).

Superseed follows a model similar to Sky and plans to support a range of collateral types for minting its stablecoin.

To open a position, users deposit collateral into the protocol. The value of that collateral needs to be at least 150% of the amount they are borrowing to ensure the system stays secure. Once the loan is repaid or liquidated, the corresponding stablecoins are burned.

One of the more interesting ideas Superseed introduces is “supercollateral.” If users provide the project’s native governance token, $SUPER, as collateral, and meet certain safety thresholds, they can borrow without paying interest. The protocol covers those costs using revenue generated across the ecosystem. That includes profits from the L2 sequencer, interest from regular loans, earnings from the native staking bridge, and other protocol fees.

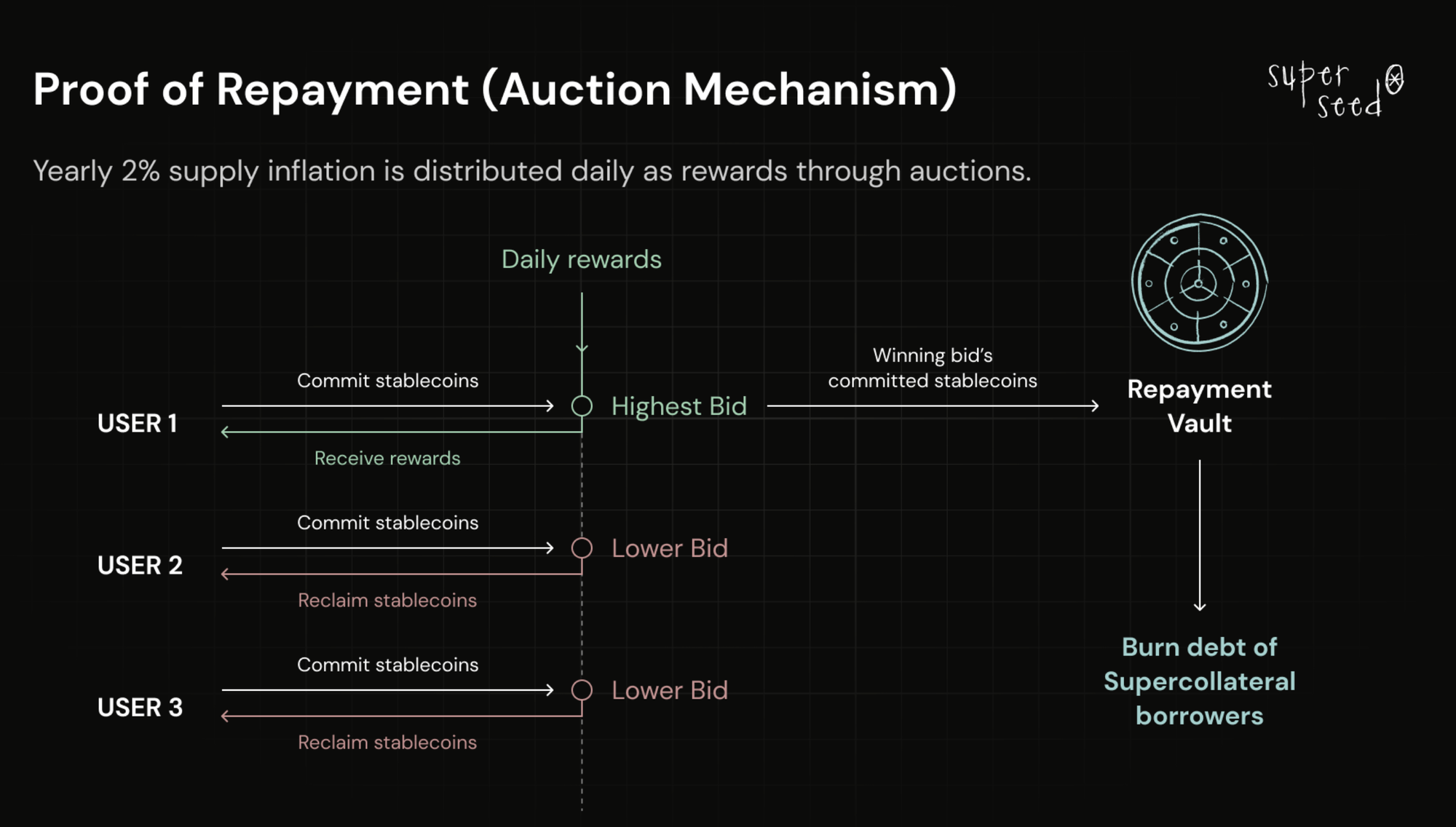

There’s also a mechanism called Proof-of-Repayment (PoR), which rewards anyone who helps pay down loans of Supercollateral users.

The $SUPER token inflates by 2% each year, and that new supply is given out daily through auctions. People join by bidding stablecoins, and the highest bidder wins that day’s $SUPER reward. Their stablecoins go into a vault that helps pay down Supercollateral debt. Everyone else can get their bids back after the auction ends. It’s a system that rewards participation while also helping reduce debt.

Token Price-Driven DeFi

CDP protocol is not live yet, but the Superseed network is fully operational. Users can already bridge assets to the chain and start using apps like Velodrome, BulletX, SeedFi, and others. According to the project’s own explorer, over $13 million worth of ETH has been bridged so far this month, and the network has logged more than 18,000 registered addresses.

There’s also a potential airdrop on the horizon. Users who explore the ecosystem ahead of the CDP launch and the release of the $SEED token may qualify.

With so many projects experimenting with decentralized finance and DeFi volumes increasing, the key driver of a project’s success remains its token price. In the case of Superseed, the main innovations appear to be designed to boost $SUPER and $SEED token prices rather than improve efficiency, user interface, or other features typical of legacy businesses.

This approach relies on the leveraged financial flows from token trading, which can be redirected to subsidize user costs and incentivize early adoption. However, in a highly competitive and sentiment-driven market, this strategy is short-term and adventurous. If the token fails to attract enough attention, the bet won’t work.