The SEC's recent approval of eight proposals to list and trade Ethereum ETFs has sparked not only a surge in Ether prices and optimism among investors but also some disputes over its true status. Polymarket users who lost money betting against the approval of spot Ether ETFs this month insist that the bet is still on.

Over this month, the ‘No’ option on the “Ethereum ETF approved by May 31?” market steadily prevailed (around 90/10%). Last Monday, the SEC reportedly asked the Nasdaq, the Chicago Board Options Exchange, and the New York Stock Exchange to update their 19b-4 filings, a step typically indicative of impending approval. After this information emerged, the bets rapidly changed, and ’Yes’ rose by over 550%. The overall market bet surpassed $13 million when the SEC approved 19b-4 form on May 23, and the market was resolved to ‘Yes’.

In market comments, those who disagree with the decision state that official registration forms S-1 are not approved yet and that 19b-4 alone doesn’t mean much. Others cite Delphi Labs general counsel Gabriel Shapiro, who outlined that the SEC’s approval was made by its Division of Trading and Markets unit on a “delegated authority,” and one of the five SEC Commissioners could challenge the decision within the next ten days.

“Agree with the outcome? The Ethereum ETF is not yet approved, who knows, might not even get approved till August, but they resolved every all ETH ETF markets to yes for no reason…Dispute this. form 19b-4 is just a amendement. Official registration form S-1 is not approved whats going on here...” - resent the market ‘losers’.

Indeed, Ether ETFs trading will not start immediately. Even with a favorable 19b-4 ruling, issuers must still secure approval for their S-1 applications, a process with no defined timeline that allegedly will take at least a couple of weeks.

“This market will resolve to "Yes" if any spot Ethereum ETF receives approval from the SEC by May 31, 2024,” - reads the platform’s market description. The vague wording can be explained in two ways: some say that approval doesn’t mean the start of trading, while others insist that ‘real’ approval includes both 19b-4 and S-1 greenlighted.

The logs show that even though the primary suggested yes-outcome was first disputed, the final outcome remains positive. Apparently, the decision has been made, and no user outrage, even supported by valid arguments and multiple expert opinions, can influence that. The most obvious reason is that if the outcome changes, the platform will have to roll back all the sales of winning ‘Yes’ shares and face criticism and probably a lack of liquidity.

Polymarket is a decentralized prediction market built on the Polygon blockchain where users can bet on the outcome of future events in a wide range of topics, including crypto. Being an expert (or having a great gut feeling) allows users to profit from trading based on their knowledge while improving the market’s accuracy. The platform claims that prediction markets are considerably more accurate than polls and pundits due to expert users’ contribution: the more savvy traders participate, the more accurately the price reflects the true, current odds.

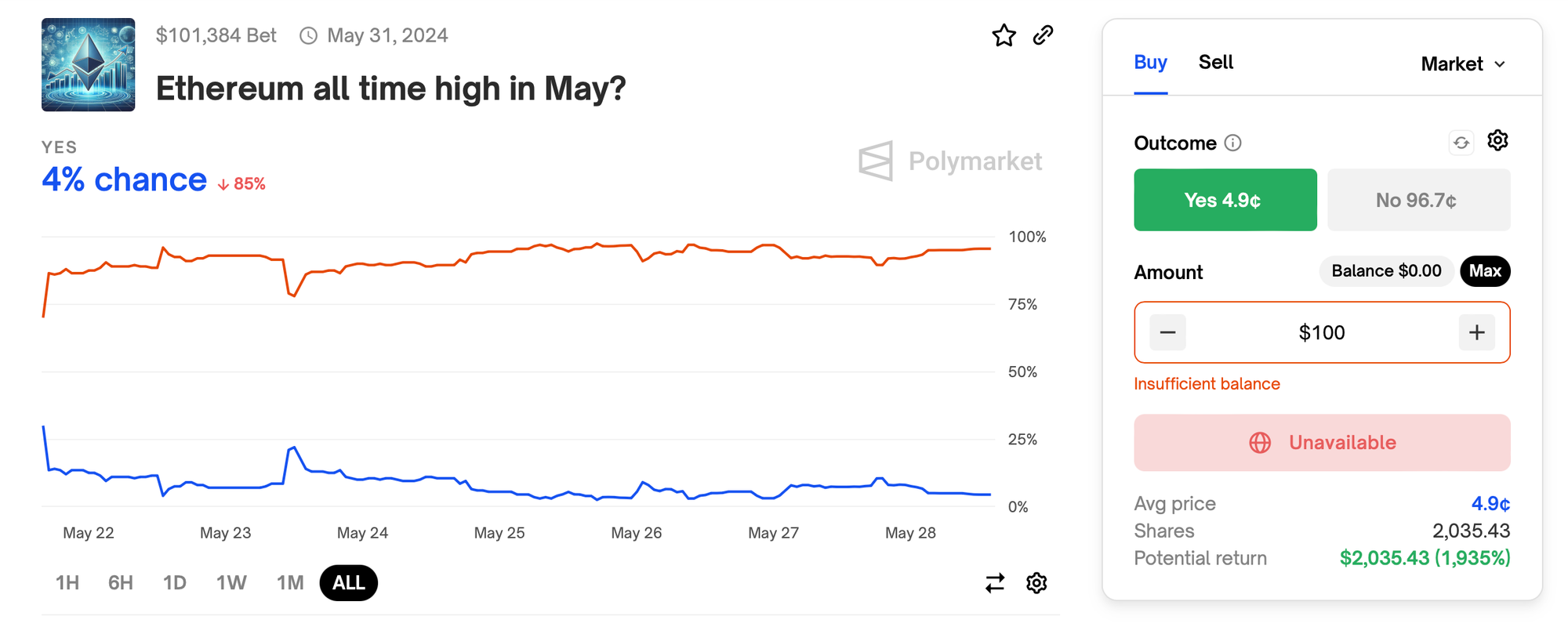

For example, one of the trending markets in the crypto section asked if Ethereum would reach a new all-time high in May. Current bets are 4% for ‘Yes’ and 96% for ‘No’. This means that if ETH had reached a price greater than 4,868, each ‘Yes’ share would be worth $1, so those who bought it for 4 cents would get 96 cents of profit. 'No’ shares would go to zero.

Polymarket supports UMA Optimistic Oracle (ОО) as a resolution source. The OO verifies data in stages: anyone can propose an answer to a data request along with a bond that acts as a bounty for anyone to dispute it if they have evidence to the contrary during the challenge period. The first dispute is ignored, and the request is repeated with the same parameters. However, if the answer is disputed twice, it will be voted on by UMA token holders. Thus, UMA token holders are an arbiter of the outcome for markets secured by Oracle. On the Ether ETF approval page, UMA is indicated as a resolver, meaning the decision was apparently taken via the OO algorithm.

Not all markets are secured by the OO. While Polymarket doesn’t directly provide such information, multiple sources state that in case of any dispute or ambiguity, the market will be resolved at the sole discretion of Polymarket’s Markets Integrity Committee, which consists of the company's employees.

While most users have already calmed down (allegedly, apart from the big no-holder @RevengeTour19B4, who recently popped up in all the related news), this was the most heated dispute over market resolution, and the platform resolved it in an authoritarian rather than decentralized way. Such a precedent might influence the level of users’ loyalty and trust.